Request for Comments – Material Amendments to CDS Procedures – Elimination of ACV to Entitlement Processors for Maturing Securities – CDS Clearing and Depository Services Inc.

A. DESCRIPTION OF THE PROPOSED CDS PROCEDURE AMENDMENTS

The proposed amendment is to address the risks associated with providing aggregate collateral value (ACV) for maturing securities to Entitlement Processors when acting as paying agents in CDSX. As a result of this amendment, Entitlement Processors acting as paying agents in CDSX (Paying Agents) will not receive ACV for maturing securities in CDSX.

CDS currently provides collateral value for maturing securities held by Paying Agents in CDSX, with the exception of their own securities or securities issued by their family members, on the day of maturity.

Currently, Paying Agents receive ACV in CDSX for submitted maturing securities held in the CDS entitlement security account, The ACV is reduced when submitted entitlement securities are moved to their own segregated account intraday on payable date.

The following are the specific steps in CDSX for the processing of a maturity payment:

1. On maturity date, the Paying Agent triggers the online release of the maturity proceeds of the debt or money market security,

2. CDSX debits the Paying Agent's funds account for the amount of the maturity proceeds, subject to the application of both the ACV and funds edit

3. The maturity proceeds are credited to the funds account of the participants who held the maturing security.

4. The maturing holdings of each individual participant are collected and transferred to CDS's entitlement security account.

5. CDSX provides ACV to the Paying Agent for the maturing securities in CDS's entitlement security ledger, taking into account the appropriate haircut and sector limits.

In order for securities to provide collateral value in CDSX, there needs to be legal certainty with respect to the use of the collateral for its intended purpose and there needs to be certainty that the collateral can be used to provide the necessary liquidity on the day of default in order for CDS to complete payment exchange.

Continuing with the existing practice exposes surviving participants in the credit ring of a defaulting Paying Agent to significant liquidity and credit risk. In terms of liquidity risk, given that matured securities are not eligible collateral at the Bank of Canada for Standing Liquidity Facility (SLF) purposes, surviving participants may be required to replace the matured securities with other acceptable collateral. Given the timing of the default resolution process (i.e. likely after 5:00 p.m. on the day of the default) the availability of other acceptable collateral may be limited. In addition, the realization of value from matured securities is not certain and even if possible, it would likely require substantial time and legal expense to accomplish.

Based on the above, CDS is proposing to implement system and procedure changes to eliminate the practice of providing ACV to Paying Agents in CDSX on maturing securities on the date of the maturity.

B. NATURE AND PURPOSE OF THE PROPOSED CDS PROCEDURE AMENDMENTS

CDS will implement system and procedure changes so Paying Agents do not receive ACV for maturing securities in CDSX. Additionally CDS's external procedures are being amended to reflect this change. All affected participants will receive direct communication by e-mail and or by CDS bulletin to advise them of the change.

C. IMPACT OF THE PROPOSED CDS PROCEDURE AMENDMENTS

The elimination of ACV on maturing securities may require Paying Agents to collateralize maturity payments with other securities. Not receiving ACV for matured securities could cause Paying Agents to fail the ACV edit checks resulting in payments to participants holding the matured securities to fail. The settlement flow for the Paying Agent and participants that are depending on the proceeds from the matured securities could be slowed down until all ACV edit checks are satisfied.

CDS has conducted an analysis and consulted with the Paying Agents to determine the impact of this change. The analysis was conducted based on historic information in CDSX in order to determine the impact of not providing ACV for maturing securities during the daily settlement process. The results of the impact analysis showed that this change would not create a significant processing or financial impact to participants.

C.1 Competition

The change in process and procedures will not have a competitive impact on CDS, its participants or any other interested parties.

C.2 Risks and Compliance Costs

There is a potential increase in cost to Paying Agents in CDSX if they are required to provide additional ACV to ensure that the settlement process is not affected by this change. The cost is not expected to be material based on the analysis conducted.

There is no compliance costs associated with this change.

C.3 Comparison to International Standards -- (a) Committee on Payment and Settlement Systems of the Bank for International Settlements, (b) Technical Committee of the International Organization of Securities Commissions, and (c) the Group of Thirty

This recommendation is consistent with "Recommendation 9" made by CPSS-IOSCO, regarding the risk controls of CSDs, to address participant's failure to settle.

The recommendation states that, CSDs that extend intraday credit to participants, including CSDs that operate net settlement systems, should institute risk controls that, at a minimum, ensure timely settlement in the event that the participant with the largest payment obligation is unable to settle. The most reliable set of controls is a combination of collateral requirements and limits.

D. DESCRIPTION OF THE PROCEDURE DRAFTING PROCESS

D.1 Development Context

The proposed amendments have been agreed to by the Risk Advisory Committee (RAC) to address the risks associated with providing ACV for maturing securities to Paying Agents in CDSX. Further details on the development context is documented in "Section A" of this notice.

D.2 Procedure Drafting Process

CDS Procedure Amendments are reviewed and approved by CDS's Strategic Development Review Committee ("SDRC"). The SDRC determines or reviews, prioritizes and oversees CDS-related systems development and other changes proposed by participants and CDS. The SDRC's membership includes representatives from the CDS Participant community and it meets on a monthly basis.

These amendments were reviewed and approved by the SDRC on December 3, 2010.

D.3 Issues Considered

CDS considered that the implementation of this change could impact the flow of settlements and possibly cause a settlement gridlock within CDSX. A settlement gridlock could occur if the lack of ACV prevented a Paying Agent from releasing maturity proceeds to CDS and downstream processing to participants holding the maturing securities. While a settlement gridlock is possible, the analysis based on historic data indicates that such a gridlock is unlikely as it relates to the amount of ACV currently provided to Paying Agents for maturing securities.

D.4 Consultation

A working group made up of Entitlement Processors/Paying Agents, the Bank of Canada and CDS was created to provide a solution to the issue. CDS also communicated the proposed change to all other Entitlement Processors/Paying Agents and invited them to provide their input. In addition, CDS plans to distribute a bulletin to all participants notifying them of the upcoming changes.

D.5 Alternatives Considered

No other alternatives were considered.

D.6 Implementation Plan

CDS is recognized as a clearing agency by the Ontario Securities Commission pursuant to section 21.2 of the Ontario Securities Act. The Autorité des marchés financiers has authorized CDS to carry on clearing activities in Québec pursuant to sections 169 and 170 of the Québec Securities Act. In addition CDS is deemed to be the clearing house for CDSX®, a clearing and settlement system designated by the Bank of Canada pursuant to section 4 of the Payment Clearing and Settlement Act. The Ontario Securities Commission, the Autorité des marchés financiers and the Bank of Canada will hereafter be collectively referred to as the "Recognizing Regulators".

The amendments to Participant Procedures may become effective upon approval of the amendments by the Recognizing Regulators following public notice and comment. Implementation of this change is planned for February 28, 2011.

E. TECHNOLOGICAL SYSTEMS CHANGES

E.1 CDS

CDS will need to implement a system change to eliminate the practice of providing ACV for matured or maturing securities in CDSX to Paying Agents that are participants of CDS.

E.2 CDS Participants

There are no anticipated system changes to be made by participants.

E.3 Other Market Participants

There is no anticipated impact to other market participants.

F. COMPARISON TO OTHER CLEARING AGENCIES

All CSDs are required to ensure that credit exposures are fully collateralized according to CPSS-IOSCO recommendation 9, point #5. There is no information available from other CSDs in order to conduct a further comparable analysis.

G. PUBLIC INTEREST ASSESSMENT

CDS has determined that the proposed amendments are not contrary to the public interest.

H. COMMENTS

Comments on the proposed amendments should be in writing and submitted within 30 calendar days following the date of publication of this notice in the Ontario Securities Commission Bulletin to:

Laura Ellick

Manager, Business Systems

CDS Clearing and Depository Services Inc.

85 Richmond Street West

Toronto, Ontario M5H 2C9

Phone: 416-365-3872

Fax: 416-365-0842

Email: [email protected]

Copies should also be provided to the Autorité des marchés financiers and the Ontario Securities Commission by forwarding a copy to each of the following individuals:

Me Anne-Marie Beaudoin Télécopieur: (514) 864-6381 Courrier électronique: | Manager, Market Regulation Fax: 416-595-8940 |

CDS will make available to the public, upon request, all comments received during the comment period.

I. PROPOSED CDS PROCEDURE AMENDMENTS

Access the proposed amendments to the CDS Procedures on the User documentation revisions web page (http://www.cds.ca/cdsclearinghome.nsf/Pages/-EN-blacklined?Open) and to the CDS Forms (if applicable) on Forms online (Click View by Form Category and in the Select a Form Category list, click External review) on the CDS Services web page (www.cdsservices.ca).

Appendix "A" contains text of CDS Procedures marked to reflect proposed amendments, as well as text of these procedures reflecting the adoption of the proposed amendments.

Appendix "A"

CHAPTER 2 PAYING AGENT PROCEDURES

Reconciling payments

2.5 Reconciling payments

On payable date, the paying agent can release payments using the Maintain Payment Release -- Paying Agent function. They can also monitor all events payable on that date and the status of each payment using the Inquire Payment Release function. The following reports allow the paying agent to do the following:

• Settled Transactions report -- Reconcile their entitlement payments once the payment has been made

• Unsettled Transactions report -- Reconcile their entitlement payments that have not yet been released.

For more information on these reports, refer to CDS Reporting Procedures.

2.5.1 Withdrawing submitted and tendered securities

After payment has been released, the Release/Hold Event Payment screen is available to the paying agent to initiate the movement of the submitted entitlement securities to their segregated account.

If the paying agent is a different family member than the issuing agent family, they receive the ACV for the submitted entitlement securities (with the exception of maturing securities) while the securities remain in the CDS entitlement account. Once the paying agent initiates the movement of the submitted entitlement securities to their segregated account, the ACV is reduced.

If the paying agent does not move the securities on payable date, the submitted entitlement securities are automatically moved to their segregated account in the next overnight process. Once these securities are moved, the ACV is reduced if ACV was granted upon payment.

Prior to the release of the submitted entitlement securities to the paying agent's segregated account, the system will complete an ACV edit check. For more information, refer to Participating in CDS Services. If the quantity of the submitted entitlement securities reduces the paying agent's ACV by more than their payment obligation, the release of those submitted entitlement securities will be left pending. For more information, see ACV edit on entitlement payments on page 44.

The paying agent has five business days to request a withdrawal to remove these securities from their segregated account. In the interim, they may not trade, pledge, deposit or complete an inter-account movement for the securities.

When a voluntary event involves the release of submitted securities, a movement occurs from the depositary agent's offer account to their segregated account. The depositary agent must create a manual withdrawal.

CHAPTER 4 ACV EDIT ON ENTITLEMENT PAYMENTS

Entitlement netting

2. The available ACV edit required to settle the entitlement payment is the net amount calculated as follows:

ACV for submitted entitlement securities

The paying agent receives ACV for the submitted entitlement securities (with the exception of maturing securities) in CDS's entitlement securities account. The agent's aggregate collateral value is updated if the following criteria is met:

• The entitlement has been successfully paid

• The submitted entitlement securities qualify for ACV.

Moving submitted entitlement securities from CDS's entitlement securities account

Upon payment of an entitlement, the paying agent may trigger an intraday movement of the submitted entitlement securities from CDS's entitlement securities account to their own segregated account. Their current and available ACV is then reduced by an amount equivalent to the value of the submitted entitlement securities.

If the movement of the submitted entitlement securities is not triggered intraday by the agent, CDS automatically moves the submitted entitlement securities from the CDS's entitlement securities account to the agent's segregated on the morning of payment date+1.

CHAPTER 7 PROCESSING ENTITLEMENTS

Moving submitted securities

To allocate an LVTS payment towards the payment of an event:

1. Ensure that the event is in a hold status.

Set the PAYMENT MODE field to LVTS to ensure that the event is held. See Holding an event for intraday payments on page 83 for more details. Payments that are pending due to lack of available funds may also be put on hold in preparation for an LVTS payment.

2. Initiate an LVTS payment (either Tranche One or Two) to CDS's account held at the Bank of Canada by no later than 2:30 p.m. ET (12:30 p.m. MT, 11:30 a.m. PT).

Note: CDS will not process partial entitlement payments.

The LVTS payment made for an entitlement is directed to the Bank of Canada (CDS's LVTS banker) for CDS's account. The LVTS payment should be made using a SWIFT message. To initiate the LVTS payment:

• Enter the ISIN (e.g., CA123456AA99) of the security involved in the entitlement into the RELATED REFERENCE field on the SWIFT message.

• Enter CDS's account number into the ACCOUNT field on the SWIFT message.

• Enter a payment amount that covers the entire value of the entitlement.

Verifying an LVTS payment

CDS notifies the entitlements processor upon completion of the payment release. To verify the event has been paid, use the Inquire Payment Release function to access the Release/Hold Event Payment screen on page 82.

7.6 Moving submitted securities

After payment has been released, the Release/Hold Event Payment screen on page 82 is available for entitlements processors to initiate the movement of submitted entitlement securities to their SA 000 account.

Entitlements processors receive the ACV for the paid securities (with the exception of maturing securities) if the securities remain in the CDS entitlement account. Once they initiate the movement of the paid securities to their SA 000, their ACV is reduced if the ACV edit permits and if ACV was granted upon payment.

If an entitlements processor elects not to move the securities on payable date, the paid securities will be automatically moved to their SA 000 during the next overnight payment event.

Once the event has been fully paid and the submitted securities have been moved to their SA 000, a withdrawal request will be automatically generated the next day to remove the submitted securities from their SA 000.

In the interim, entitlements processors may not trade, pledge, deposit or complete an inter-account movement for these securities.

7.6.1 Applying ACV rules to entitlement events

If an entitlements processor requests a release of submitted securities to their segregated account intraday on payable date, the system completes an ACV edit check to ensure that the ACV rule is maintained.

If an entitlements processor releases the submitted securities to their SA 000 and it results in a greater reduction of their ACV than their payment obligation, the securities release to their segregated account will become pending.

Note: Entitlements processors do not receive ACV for securities submitted if the payment is made intraday using LVTS funds.

The following sections describe the event groups, how the events are processed and how ACV affects the events.

Distribution (no submit items, receive funds)

For distribution events with no submit items and with a receive funds item, the funds are debited from the entitlements processor's account if there is sufficient available funds and ACV. If there is insufficient available funds or ACV, the transaction will become pending.

Mandatory events (submit security, receive funds)

For mandatory events and partial calls with a submit security item and a receive funds item, the following occurs:

1. Upon release of the payment, the Entitlement System checks for sufficient funds and sufficient ACV.

If there are sufficient funds and ACV, the funds are debited from the entitlements processor's account. If the entitlements processor does not belong to the same family as the issuer, they are credited for the ACV value of the securities submitted (with the exception of maturing securities) as long as the securities are in CDS's entitlement securities account.

If there are insufficient funds or ACV, a pending status is applied to the transaction.

CHAPTER 10

Aggregate collateral value

A participant's aggregate collateral value (ACV) is the dollar value CDS assigns to their holdings. This value becomes collateral if a participant defaults on their payment obligations. ACV collateral includes: all securities in a participant's risk accounts (general and restricted collateral accounts).

•

All securities in a participant's risk accounts (general and restricted collateral accounts)•

Paid-for maturities in the CDS entitlement security account.

ACV is monitored and updated in real time, and is maintained in Canadian dollars only. CDSX does not automatically transfer available ACV and sector limit amounts because participants can monitor and redistribute their ACV throughout the day.

To prevent the concentration of ACV in a few securities, it is subject to limits. For more information, see Sector limits on page 110.

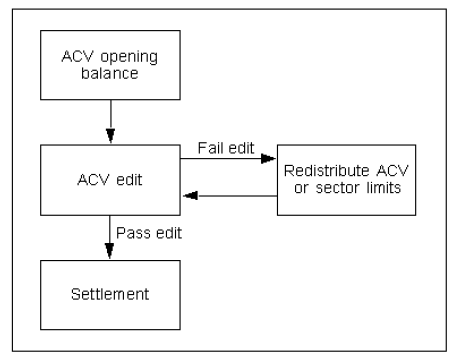

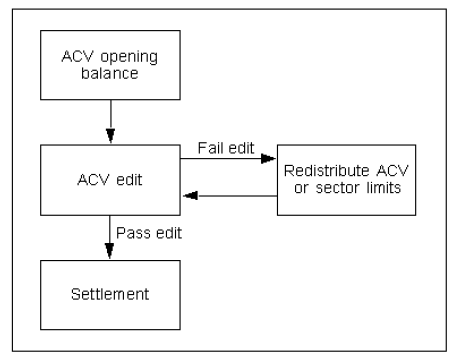

The following diagram illustrates the ACV process:

This process involves:

• Calculating the opening balance -- At the start of each business day, CDSX calculates ACV opening balances for all ledgers. The opening balance is equal to initial ACV (allocated by CDS or the family administrator), plus any value of securities held in that ledger's risk accounts.

CHAPTER 10 AGGREGATE COLLATERAL VALUE

ACV edit during payment exchange

Meeting payment obligations

A participant's payment obligation is the negative balance in their funds account in a specific ledger and does not include any:

• Unused lines of credit granted by an extender of credit

• Unused cap

• Outstanding mark-to-market amounts (CNS or FINet).

If a participant's ACV or sector limit amount is insufficient to meet their payment obligation, see Handling insufficient ledger ACV and sector limit amounts on page 125.

10.2 ACV edit during payment exchange

During the payment exchange period when transactions are settled between CDS and its participants, securities are subject to a modified ACV edit to ensure that participants can:

• Pledge all L-type positions (for more information, refer to Pledge and Settlement Procedures) in their risk accounts to the Bank of Canada without restrictions.

• Trade all positions in their risk accounts with the Bank of Canada without restrictions.

Once payment exchange is complete, the ACV edit is not applied.

10.3 Account movements affecting ACV

During the day, participants can move securities from their segregated accounts into their general account to increase their ACV. Securities that are moved to the participant's segregated account overnight are paid-for securities belonging to their clients, and can no longer be used to increase ACV. Any securities that are not segregated overnight will form part of the participant's initial ACV the next day.

CDS entitlement security account

The paying agent will receive ACV for the submitted entitlement securities held in the CDS entitlement security account with the exception of securities which are issued by them or their family members and maturing securities. The ACV is reduced when submitted entitlement securities move to the segregated account or RSP account as follows:

• Paying agent initiates the movement

• Automatically moved in overnight processing after payment date.

CHAPTER 2 PAYING AGENT PROCEDURES

Reconciling payments

2.5 Reconciling payments

On payable date, the paying agent can release payments using the Maintain Payment Release -- Paying Agent function. They can also monitor all events payable on that date and the status of each payment using the Inquire Payment Release function. The following reports allow the paying agent to do the following:

• Settled Transactions report -- Reconcile their entitlement payments once the payment has been made

• Unsettled Transactions report -- Reconcile their entitlement payments that have not yet been released.

For more information on these reports, refer to CDS Reporting Procedures.

2.5.1 Withdrawing submitted and tendered securities

After payment has been released, the Release/Hold Event Payment screen is available to the paying agent to initiate the movement of the submitted entitlement securities to their segregated account.

If the paying agent is a different family member than the issuing agent family, they receive the ACV for the submitted entitlement securities (with the exception of maturing securities) while the securities remain in the CDS entitlement account. Once the paying agent initiates the movement of the submitted entitlement securities to their segregated account, the ACV is reduced.

If the paying agent does not move the securities on payable date, the submitted entitlement securities are automatically moved to their segregated account in the next overnight process. Once these securities are moved, the ACV is reduced if ACV was granted upon payment.

Prior to the release of the submitted entitlement securities to the paying agent's segregated account, the system will complete an ACV edit check. For more information, refer to Participating in CDS Services. If the quantity of the submitted entitlement securities reduces the paying agent's ACV by more than their payment obligation, the release of those submitted entitlement securities will be left pending. For more information, see ACV edit on entitlement payments on page 44.

The paying agent has five business days to request a withdrawal to remove these securities from their segregated account. In the interim, they may not trade, pledge, deposit or complete an inter-account movement for the securities.

When a voluntary event involves the release of submitted securities, a movement occurs from the depositary agent's offer account to their segregated account. The depositary agent must create a manual withdrawal.

CHAPTER 4 ACV EDIT ON ENTITLEMENT PAYMENTS

Entitlement netting

2. The available ACV edit required to settle the entitlement payment is the net amount calculated as follows:

ACV for submitted entitlement securities

The paying agent receives ACV for the submitted entitlement securities (with the exception of maturing securities) in CDS's entitlement securities account. The agent's aggregate collateral value is updated if the following criteria is met:

• The entitlement has been successfully paid

• The submitted entitlement securities qualify for ACV.

Moving submitted entitlement securities from CDS's entitlement securities account

Upon payment of an entitlement, the paying agent may trigger an intraday movement of the submitted entitlement securities from CDS's entitlement securities account to their own segregated account. Their current and available ACV is then reduced by an amount equivalent to the value of the submitted entitlement securities.

If the movement of the submitted entitlement securities is not triggered intraday by the agent, CDS automatically moves the submitted entitlement securities from the CDS's entitlement securities account to the agent's segregated on the morning of payment date+1.

CHAPTER 7 PROCESSING ENTITLEMENTS

Moving submitted securities

To allocate an LVTS payment towards the payment of an event:

1. Ensure that the event is in a hold status.

Set the PAYMENT MODE field to LVTS to ensure that the event is held. See Holding an event for intraday payments on page 83 for more details. Payments that are pending due to lack of available funds may also be put on hold in preparation for an LVTS payment.

2. Initiate an LVTS payment (either Tranche One or Two) to CDS's account held at the Bank of Canada by no later than 2:30 p.m. ET (12:30 p.m. MT, 11:30 a.m. PT).

Note: CDS will not process partial entitlement payments.

The LVTS payment made for an entitlement is directed to the Bank of Canada (CDS's LVTS banker) for CDS's account. The LVTS payment should be made using a SWIFT message. To initiate the LVTS payment:

• Enter the ISIN (e.g., CA123456AA99) of the security involved in the entitlement into the RELATED REFERENCE field on the SWIFT message.

• Enter CDS's account number into the ACCOUNT field on the SWIFT message.

• Enter a payment amount that covers the entire value of the entitlement.

Verifying an LVTS payment

CDS notifies the entitlements processor upon completion of the payment release. To verify the event has been paid, use the Inquire Payment Release function to access the Release/Hold Event Payment screen on page 82.

7.6 Moving submitted securities

After payment has been released, the Release/Hold Event Payment screen on page 82 is available for entitlements processors to initiate the movement of submitted entitlement securities to their SA 000 account.

Entitlements processors receive the ACV for the paid securities (with the exception of maturing securities) if the securities remain in the CDS entitlement account. Once they initiate the movement of the paid securities to their SA 000, their ACV is reduced if the ACV edit permits and if ACV was granted upon payment.

If an entitlements processor elects not to move the securities on payable date, the paid securities will be automatically moved to their SA 000 during the next overnight payment event.

Once the event has been fully paid and the submitted securities have been moved to their SA 000, a withdrawal request will be automatically generated the next day to remove the submitted securities from their SA 000.

In the interim, entitlements processors may not trade, pledge, deposit or complete an inter-account movement for these securities.

7.6.1 Applying ACV rules to entitlement events

If an entitlements processor requests a release of submitted securities to their segregated account intraday on payable date, the system completes an ACV edit check to ensure that the ACV rule is maintained.

If an entitlements processor releases the submitted securities to their SA 000 and it results in a greater reduction of their ACV than their payment obligation, the securities release to their segregated account will become pending.

Note: Entitlements processors do not receive ACV for securities submitted if the payment is made intraday using LVTS funds.

The following sections describe the event groups, how the events are processed and how ACV affects the events.

Distribution (no submit items, receive funds)

For distribution events with no submit items and with a receive funds item, the funds are debited from the entitlements processor's account if there is sufficient available funds and ACV. If there is insufficient available funds or ACV, the transaction will become pending.

Mandatory events (submit security, receive funds)

For mandatory events and partial calls with a submit security item and a receive funds item, the following occurs:

1. Upon release of the payment, the Entitlement System checks for sufficient funds and sufficient ACV.

If there are sufficient funds and ACV, the funds are debited from the entitlements processor's account. If the entitlements processor does not belong to the same family as the issuer, they are credited for the ACV value of the securities submitted (with the exception of maturing securities) as long as the securities are in CDS's entitlement securities account.

If there are insufficient funds or ACV, a pending status is applied to the transaction.

CHAPTER 10

Aggregate collateral value

A participant's aggregate collateral value (ACV) is the dollar value CDS assigns to their holdings. This value becomes collateral if a participant defaults on their payment obligations. ACV collateral includes all securities in a participant's risk accounts general and restricted collateral accounts.

ACV is monitored and updated in real time, and is maintained in Canadian dollars only. CDSX does not automatically transfer available ACV and sector limit amounts because participants can monitor and redistribute their ACV throughout the day.

To prevent the concentration of ACV in a few securities, it is subject to limits. For more information, see Sector limits on page 110.

The following diagram illustrates the ACV process:

This process involves:

• Calculating the opening balance -- At the start of each business day, CDSX calculates ACV opening balances for all ledgers. The opening balance is equal to initial ACV (allocated by CDS or the family administrator), plus any value of securities held in that ledger's risk accounts.

• Editing ACV -- Before each transaction is processed, CDSX checks to ensure that a participant's accumulated ACV remains greater than or equal to their payment obligation after settlement (see ACV edit on page 107).

CHAPTER 10 AGGREGATE COLLATERAL VALUE

ACV edit during payment exchange

Meeting payment obligations

A participant's payment obligation is the negative balance in their funds account in a specific ledger and does not include any:

• Unused lines of credit granted by an extender of credit

• Unused cap

• Outstanding mark-to-market amounts (CNS or FINet).

If a participant's ACV or sector limit amount is insufficient to meet their payment obligation, see Handling insufficient ledger ACV and sector limit amounts on page 125.

10.2 ACV edit during payment exchange

During the payment exchange period when transactions are settled between CDS and its participants, securities are subject to a modified ACV edit to ensure that participants can:

• Pledge all L-type positions (for more information, refer to Pledge and Settlement Procedures) in their risk accounts to the Bank of Canada without restrictions.

• Trade all positions in their risk accounts with the Bank of Canada without restrictions.

Once payment exchange is complete, the ACV edit is not applied.

10.3 Account movements affecting ACV

During the day, participants can move securities from their segregated accounts into their general account to increase their ACV. Securities that are moved to the participant's segregated account overnight are paid-for securities belonging to their clients, and can no longer be used to increase ACV. Any securities that are not segregated overnight will form part of the participant's initial ACV the next day.

CDS entitlement security account

The paying agent will receive ACV for the submitted entitlement securities held in the CDS entitlement security account with the exception of securities which are issued by them or their family members and maturing securities. The ACV is reduced when submitted entitlement securities move to the segregated account or RSP account as follows:

• Paying agent initiates the movement

• Automatically moved in overnight processing after payment date.