Continuous disclosure

Companies that are reporting issuers in Ontario must regularly make certain information about their activities and financial status available to the public. This page highlights some of the main types of continuous disclosure for companies in Ontario other than investment funds, which have their own set of ongoing disclosure requirements.

Additionally, insiders are required to file regular reports with the Ontario Securities Commission (OSC). Learn more about insider reporting requirements.

Types of continuous disclosure required in Ontario

Reporting issuers are required to file annual and interim financial statements with the OSC. A reporting issuer that is not a venture issuer must file annual financial statements 90 days after the end of its most recently completed financial year and interim financial statements 45 days after the end of the interim period.

A venture issuer must file annual financial statements 120 days after the end of its most recently completed financial year and interim financial statements 60 days after the end of the interim period.

Part 4 of National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102) discusses:

- annual and interim financial statements required to be filed

- comparative financial statement requirements

- deadlines for filing

- requirements relating to auditor involvement

- approval and delivery of financial statements

- what to do in the case of a change in:

- year-end

- corporate structure

- auditor

Financial statements must be accompanied by the MD&A. The MD&A is a narrative explanation, through the eyes of management, of how a company performed during the period covered by the financial statements, and of the company's financial condition and future prospects. The MD&A supplements financial statements and is required to be filed at the same time as the financial statements.

Further details are outlined in:

Forward-looking information (FLI) is generally any disclosure by an issuer about possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action.

Companies are encouraged to provide FLI if they have a reasonable basis for doing so. The preparation of an MD&A necessarily involves some degree of prediction or projection, and might include some discussion of known trends or uncertainties that are reasonably likely to affect the company's business. As a consequence, FLI often forms part of the MD&A.

Whenever a company provides FLI in its financial statements, it must contain:

- a statement declaring that the information is a projection

- a description of the factors that may cause actual results to differ materially from the forward-looking information

- material assumptions

- appropriate risk disclosure and cautionary language

Detailed guidance can be found in Parts 4A and 4B of NI 51-102.

In addition to its financial statements, a reporting issuer is required to file copies of all material contracts it entered into within the last financial year. A material contract entered into in the ordinary course of business may not have to be filed, unless it falls into a category of contract specified in Part 12 of National Instrument 51-102 Continuous Disclosure Obligations.

A material contract is any contract that a company or any of its subsidiaries is a party to that is material to the issuer. For a discussion on making materiality determinations, see Part IV of National Policy 51-201 Disclosure Standards.

Certification improves the quality, reliability, and transparency of annual filings, interim filings, and other materials that companies file or submit under securities legislation.

Companies (other than investment funds) must provide certification of disclosure with their annual and interim filings. Each certifying officer—usually the CEO and CFO—must certify the annual and interim filings of the reporting company for which they work. The content of the certification and the related disclosure is different for venture issuers and non-venture issuers.

National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-102) sets out certification requirements for all reporting issuers, other than investment funds.

A company that is not a venture issuer must file an annual information form (AIF) every year, usually 90 days after the end of the company's most recent financial year. An AIF provides material information about a company and its business in the context of its historical and possible future development. It describes the company and its operations, prospects, risks and other factors that impact its business.

For further information, see:

Reporting issuers are required to publicly disclose any material changes to their affairs.

A material change (for a reporting issuer other than an investment fund) is either:

- a change in the business, operations, or capital of a company that would have a significant effect on the market price or value of its securities

- a decision to implement such a change made by the board of directors (or group acting in a similar capacity) or by senior management that would impact the market price of the company’s securities

When a material change occurs, the reporting issuer must:

- immediately issue and file a news release disclosing the substance of the change

- file a material change report on Form 51-102F3 Material Change Report within 10 days of the date of which the change occurs

Further details are available in Part 7 of NI 51-102.

Companies must file a business acquisition report (BAR) after completing a significant acquisition. The BAR describes the significant business(es) acquired and the effect of the acquisition on the company. The BAR must be filed within 75 days after the date of acquisition.

For more details, refer to:

A proxy is a method by which a shareholder appoints a person or company to act on the shareholders’ behalf at a shareholder meeting. Subject to certain exemptions, when a company solicits proxies, it must also prepare an information circular.

An information circular includes information on how to exercise a proxy and provides details of the matters to be voted on at the shareholder meeting. The specific information required to be included in an information circular is set out in Form 51-102F5 Information Circular.

An information circular must also include prospectus-level disclosure if either of the following applies:

- shareholder approval is required in respect of a significant acquisition under which securities of the acquired business are being exchanged for the issuer's securities

- a restructuring transaction will result in securities being changed, exchanged, issued, or distributed

For details on proxies and circulars, refer to:

Information circulars prepared for an annual meeting of shareholders must also include detailed disclosure about the compensation paid to certain executive officers and directors. The disclosure requirements for executive compensation are outlined in Form 51-102F6 Statement of Executive Compensation.

Reporting Deadlines for Executive Compensation Disclosure

If a reporting issuer is required to send an information circular to security holders, the reporting issuer must disclose executive compensation information as required by section 9.3.1 of NI 51-102 and Item 8 of Form 51-102F5 Information Circular.

Non-venture Issuers must file this disclosure within 140 days after the reporting issuer’s most recently completed financial year and venture issuers must file this disclosure within 180 days after the reporting issuer’s most recently completed financial year.

A reporting issuer that is not required to send an information circular to security holders must comply with section 11.6 of NI 51-102, which requires the same executive compensation information to be disclosed within 140 days after the reporting issuer’s most recently completed financial year.

Restricted securities or securities convertible into or exchangeable for restricted securities require additional specified disclosure. For the purposes of disclosure requirements, a security is considered restricted if any of the following apply:

- the reporting issuer has another class of securities that carry a greater number of votes per security (relative to the equity security)

- the conditions attached to the equity security or contained in the reporting issuer's constating documents have provisions that appear to significantly restrict the voting rights of the equity securities

- the reporting issuer has issued another class of equity securities that appears to enable the owners of this class to participate in the earnings or assets of the reporting issuer to a greater extent, on a per security basis, than the owners of the first class of equity securities

Part 10 of NI 51-102 provides more detailed explanations of restricted security disclosure requirements.

Ongoing fees

All companies in Ontario that are required to make continuous disclosure filings must pay an annual participation fee. These fees are outlined in Part 2 and Appendix A and B of OSC Rule 13-502 Fees. Companies may also be subject to late fees, which are set out in Appendix G of OSC Rule 13-502.

Exemptions for foreign issuers

Foreign companies that are reporting issuers in Canada may be eligible for relief from certain continuous disclosure requirements on the condition that they comply with the continuous disclosure requirements of the SEC or a designated foreign jurisdiction. National Instrument 71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers (NI 71-102) identifies two main types of foreign issuers that may be exempt from disclosure in Ontario:

- SEC foreign issuers, who are incorporated outside of Canada and registered with the Securities and Exchange Commission (SEC) and meet certain additional criteria (outlined in NI 71-102)

- designated foreign issuers, who are incorporated outside of Canada and are regulated by one of 15 specified jurisdictions and have no more than 10% of its outstanding equity securities held by Canadian residents

Companies incorporated in the United States may also be eligible for relief from certain continuous disclosure requirements under National Instrument 71-101 The Multi Jurisdictional Disclosure System.

Venture issuers

The disclosure requirements for venture issuers differ from those of other issuers. The most significant difference is that venture issuers have longer filing deadlines, as outlined above. In addition, a venture issuer is not required to file an annual information form, and can file a basic certificate under NI 52-109.

NI 51-102 defines a venture issuer.

Continuous disclosure reviews

OSC staff conduct ongoing reviews of the disclosure documents filed by reporting issuers. A reporting issuer may be selected for a full, issue-oriented, or targeted review. The responsibility to ensure compliance with applicable securities legislation, policies, and practices rests with a company and its advisors. All companies may be subject to reviews and have a duty to remain compliant, regardless of whether or not they are selected for a review.

CSA Staff Notice 51-312 Harmonized Continuous Disclosure Review Program provides information on the types of reviews that a company can expect the OSC to undertake.

Pursuant to section 20.1(3) of Ontario’s Securities Act, information and documents obtained pursuant to a continuous disclosure review will be exempt from disclosure under the Freedom of Information and Protection of Privacy Act if the Commission determines that the information and documents should be maintained in confidence.

Continuous Disclosure Review (CDR) Program

The CSA published CSA Staff Notice 51-312 (Revised) Harmonized Continuous Disclosure Review Program to provide an overview of our CDR program. Below we have highlighted some of the key features of our program. Under Canadian securities law, a reporting issuer must provide timely and periodic continuous disclosure about its business and affairs. Continuous disclosure includes periodic filings as well as other event-driven disclosures:

| Periodic Filings | Event-Driven filings | Other |

|---|---|---|

|

|

|

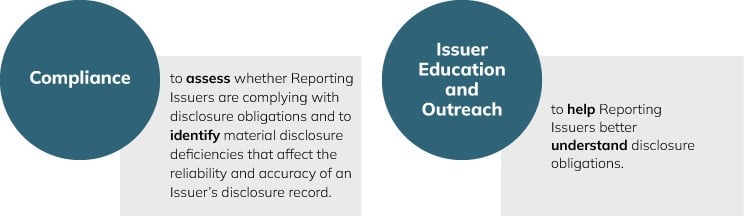

A) Objectives of the CDR program

The goal of the CDR program is to improve the completeness, quality and timeliness of continuous disclosure provided by reporting issuers. This program assesses compliance with continuous disclosure requirements through a review of a reporting issuer’s filed documents, its website and social media. This review function is critical to facilitating fair and efficient markets, investor protection, and informed investment decision making and trading. Disclosure about a reporting issuer and its business is important not only when a reporting issuer first enters the market, but also on an ongoing basis; for example, many reporting issuers raise funds through short form prospectuses which incorporate continuous disclosure documents by reference.

B) Types of continuous disclosure reviews

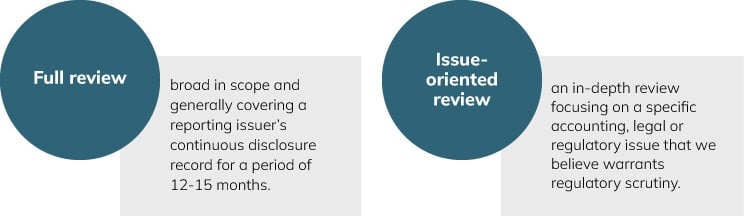

In general, we conduct either a full review or an issue-oriented review of a reporting issuer’s continuous disclosure.

In planning full reviews, we draw on our knowledge of reporting issuers and the industries in which they operate and use risk-based criteria to identify reporting issuers with a higher risk of deficient disclosure. The criteria are designed to identify reporting issuers whose disclosure is likely to be materially improved or brought into compliance with securities law or accounting standards as a result of our intervention. Our risk-based assessment incorporates both qualitative and quantitative factors that we review regularly to keep current with our evolving capital markets.1 We also monitor new or novel and high growth areas of financing activity when developing our review program and consider any complaints received regarding the Reporting Issuer.

Issue-oriented reviews are generally focused on a specific accounting, legal or regulatory issue, an emerging issue or industry or to assess compliance with a new or amended rule that recently came into force.

Conducting continuous disclosure reviews helps us to

- monitor compliance with continuous disclosure requirements by reporting issuers,

- communicate OSC interpretations and expectations on specific requirements, and identify areas of concern,

- address specific areas where there is heightened risk of investor harm,

- identify common deficiencies,

- provide industry-specific or topic-specific disclosure guidance that may assist preparers in complying with regulatory requirements, and

- assess compliance with new accounting standards and new or amended rules.

1 A full review generally includes a review of the Issuer’s most recent annual and interim financial statements and MD&As, AIF, annual reports, information circulars, news releases, material change reports, website, social media disclosure, investor presentations, and SEDI filings.

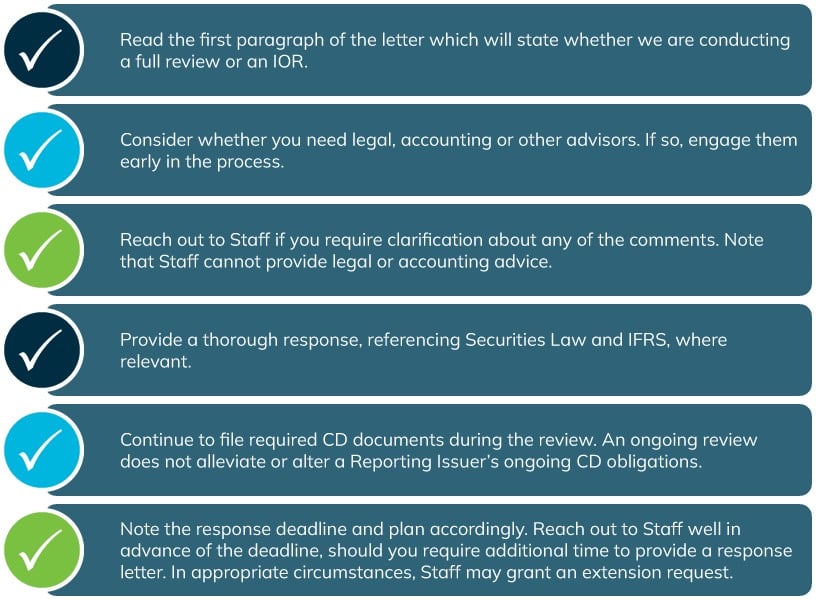

C) Tips for reporting issuers that are selected for a continuous disclosure review

Below are tips on what to do if you receive a comment letter from the OSC in connection with a continuous disclosure review:

- National Instrument 51-102 Continuous Disclosure Obligations

- National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings

- National Instrument 43-101 Standards of Disclosures for Mineral Projects

- National Instrument 51-101 Standards of Disclosure for Oil and Gas Activities

- National Instrument 71-101 The Multi Jurisdictional Disclosure System

- National Instrument 71-102 Continuous Disclosure and Other Exemptions Relating to Foreign Issuers

- CSA Staff Notice 51-312 Harmonized Continuous Disclosure Review Program

Timing

For more information on the OSC’s service standard timing to complete full continuous disclosure reviews, see the OSC Service Commitment.

Continuous Disclosure for Non-Reporting Issuers

Non-reporting issuers distributing securities in Ontario pursuant to prospectus exemptions will be subject to certain continuous disclosure obligations. Some of the more common issues regarding continuous disclosure obligations for non-reporting issuers are outlined below.

Annual Financial Statements for Non-reporting Issuers

OSC staff would like to remind non-reporting issuers that as a result of relying on s.2.9 (the Offering Memorandum exemption) of National Instrument 45-106 Prospectus Exemptions (NI 45-106), Issuers are subject to ongoing obligations., Generally, pursuant to subsection 2.9(17.5) of NI 45-106, an sisuer must, within 120 days after the end of each of its financial years, deliver annual financial statements to the securities regulatory authority. The financial statements must be accompanied by a notice disclosing the issuer's use of the proceeds raised under the exemption in accordance with Form 45-106F6.

Both annual financial statements and notices of use of proceeds must be filed via SEDAR+ using the Exempt Market Offerings filing category under the appropriate filing sub-types:

- Annual financial statements for non-reporting issuers

- Notice of use of proceeds

Late document fees may apply in accordance with Appendix G of OSC Rule 13-502 Fees.