Information continue

Les émetteurs assujettis en Ontario doivent rendre publics certains renseignements relatifs à leurs activités et à leur statut financier, et ce, de manière régulière. Cette page présente certains des principaux types d’information continue s’appliquant aux sociétés en Ontario autres que les fonds d’investissement qui ont leurs propres obligations en matière d’information continue.

De plus, les initiés sont tenus de déposer régulièrement des rapports auprès de la Commission des valeurs mobilières de l’Ontario (CVMO). Renseignez-vous sur les exigences relatives aux rapports d’initiés.

Exigences relatives aux types d’information continue en Ontario

Les émetteurs assujettis sont tenus de déposer des états financiers annuels et intermédiaires auprès de la CVMO. Un émetteur assujetti qui n’est pas un émetteur émergent doit déposer un état financier annuel 90 jours après la date de clôture du dernier exercice et un état financier intermédiaire 45 jours après la date de clôture de la période intermédiaire.

Un émetteur émergent doit déposer un état financier annuel 120 jours après la date de clôture du dernier exercice et un état financier intermédiaire 60 jours après la date de clôture de la période intermédiaire.

Dans la partie 4 du Règlement 51-102 Obligations d’information continue (en anglais seulement), les questions suivantes sont traitées :

- les exigences quant aux états financiers annuels et intermédiaires devant être déposés;

- les exigences en matière d’états financiers comparatifs;

- les dates limites de dépôt des états financiers;

- les exigences relatives à la participation d’un vérificateur;

- l’approbation et la transmission des états financiers;

- quoi faire lorsqu’un changement survient relativement à :

- la date de clôture de l’exercice;

- la structure de l’entreprise;

- le vérificateur.

Les états financiers doivent être accompagnés d’un rapport de gestion. Celui-ci explique, du point de vue de la direction, le rendement d’une société pendant la période couverte par les états financiers, la situation financière de la société et ses perspectives. Le rapport de gestion complète les états financiers et doit être déposé en même temps que ceux-ci.

Pour en apprendre davantage, consultez les documents suivants :

- Partie 5 du Règlement 51-102 (en anglais seulement)

- Annexe 51-102A1 Rapport de gestion (en anglais seulement)

Constitue généralement une information prospective toute information fournie par l’émetteur sur un événement, une situation ou un rendement financier possible, et établie sur le fondement d’hypothèses concernant les conditions économiques et les lignes de conduite futures.

On encourage les sociétés à communiquer l’information prospective si elles ont un fondement valable pour l’établir. La préparation d’un rapport de gestion implique forcément un certain degré de prévision ou de projection, et celui-ci peut inclure des discussions sur les tendances connues ou sur les incertitudes qui pourraient vraisemblablement avoir une incidence sur les activités de la société. Par conséquent, l’information prospective fait souvent partie du rapport de gestion.

Chaque fois qu’une société soumet de l’information prospective dans ses états financiers, celle-ci doit comprendre :

- une déclaration affirmant que l’information est une projection;

- une description des facteurs qui pourraient avoir une incidence importante sur les résultats réels par rapport à l’information prospective;

- des hypothèses;

- un exposé des risques et une mise en garde.

Vous trouverez des directives détaillées dans les Parties 4A et 4B du Règlement 51-102 (en anglais seulement).

En plus d’avoir à soumettre ses états financiers, un émetteur assujetti est tenu de déposer des copies de tous les contrats importants qu’il a conclus au cours du dernier exercice financier. Il est possible qu’un contrat important conclu dans le cours normal des affaires ne soit pas soumis à l’obligation de dépôt, à moins qu’il n’entre dans une catégorie de contrat énoncée dans la Partie 12 du Règlement 51-102 Obligations d’information continue (en anglais seulement).

Un contrat important représente tout contrat important pour l’émetteur et auquel une entreprise ou l’une de ses filiales sont parties. Consultez la partie IV du Règlement 51-201 Lignes directrices en matière de communication de l’information (en anglais seulement) pour obtenir davantage de renseignements au sujet de la détermination de l’importance.

L’attestation améliore la qualité, la fiabilité et la transparence des dépôts annuels et intermédiaires ainsi que de tout autre document déposé ou soumis par une société, en vertu de la Loi sur les valeurs mobilières.

Les sociétés (autres que les fonds d’investissement) doivent joindre une attestation de l’information présentée à leurs états financiers annuel et intermédiaire. Chacun des agents ordonnateurs, habituellement les chefs de la direction et des services financiers, doit attester les dépôts annuels et intermédiaires de la société déclarante pour laquelle il travaille. Le contenu de l’attestation et l’information présentée qui s’y rattache ne sont pas les mêmes pour les émetteurs émergents et non émergents.

Le Règlement 52-109 Attestation de l’information présentée dans les documents annuels et intermédiaires des émetteurs (en anglais seulement) énonce les exigences relatives à l’attestation s’appliquant à tous les émetteurs assujettis, autres que les fonds d’investissement.

Une société qui n’est pas un émetteur émergent doit déposer chaque année une notice annuelle, généralement 90 jours après la date de clôture du dernier exercice de la société. Une notice annuelle fournit l’information importante au sujet d’une société et de ses activités, dans le contexte de ses développements antérieurs et futurs éventuels. Elle décrit la société, ses activités, ses perspectives, ainsi que les risques et autres facteurs qui ont une incidence sur ses activités.

Pour obtenir de plus amples renseignements, consultez les documents suivants :

- Partie 6 du Règlement 51-102 (en anglais seulement)

- Annexe 51-102A2 Notice annuelle (en anglais seulement)

Les émetteurs assujettis sont tenus de communiquer publiquement tout changement important touchant leurs affaires.

Un changement important (pour tout émetteur assujetti autre qu’un fonds d’investissement) consiste en l’un ou l’autre des scénarios suivants :

- un changement aux affaires, aux activités ou au capital d’une société qui pourrait avoir une incidence importante sur le prix du marché ou sur ses valeurs mobilières;

- une décision venant du conseil d’administration (ou autre groupe agissant de la sorte) ou des cadres supérieurs d’apporter un changement important qui aura une incidence sur le prix du marché des valeurs mobilières de la société.

Lorsqu’un changement important se produit, l’émetteur assujetti doit :

- publier et déposer immédiatement un communiqué de presse qui divulgue la substance du changement;

- déposer une déclaration de changement important à l’aide de l’Annexe 51-102A3 – Déclaration de changement important (en anglais seulement), au plus tard 10 jours après la date à laquelle survient le changement.

Pour obtenir de plus amples renseignements, consultez la Partie 7 du Règlement 51-102 (en anglais seulement).

Les sociétés doivent déposer une déclaration d’acquisition d’entreprise (DAE) lorsqu’elles effectuent d’importantes acquisitions. La DAE donne une description de l’entreprise ou des entreprises acquises et les effets qu’auront ces acquisitions sur la société. Cette déclaration doit être déposée dans un délai de 75 jours à compter de la date d’acquisition.

Pour obtenir de plus amples renseignements, veuillez consulter les documents suivants :

- Partie 8 du Règlement 51-102 (en anglais seulement)

- Annexe 51-102A4 Déclaration d’acquisition d’entreprise (en anglais seulement)

Une procuration est l’autorisation accordée par un actionnaire à une personne ou à une société d’agir au nom dudit actionnaire lors d’une assemblée d’actionnaires. Lorsqu’une société sollicite une procuration, elle doit également préparer une circulaire d’information, sous réserve de certaines exemptions.

Une circulaire d’information inclut des renseignements relatifs à l’exercice de la procuration et aux questions qui seront mises aux voix lors de l’assemblée d’actionnaires. Les renseignements précis qui doivent être inclus dans une circulaire d’information sont énoncés à l’Annexe 51-102A5 Circulaire de sollicitation de procurations (en anglais seulement).

Une circulaire doit également inclure l’information normalement communiquée dans un prospectus si l’une ou l’autre des situations suivantes s’applique :

une autorisation de l’actionnaire est requise dû à une acquisition importante, en vertu de laquelle des valeurs mobilières de l’entreprise acquise sont échangées contre des valeurs mobilières de l’émetteur;

une transaction de restructuration entraînera le changement, l’échange, le dépôt ou la distribution de valeurs mobilières.

Pour obtenir de plus amples informations sur les procurations et les circulaires, consultez :

- Partie 9 du Règlement 51-102 (en anglais seulement)

- Annexe 51-102A5 (en anglais seulement)

Les circulaires d’information préparées pour une assemblée annuelle des actionnaires doivent inclure l’information détaillée relative à la rémunération de certains cadres de direction et directeurs exécutifs. Les exigences en matière d’information relative à la rémunération sont énoncées à l’Annexe 51-102A6 Déclaration de la rémunération des membres de la haute direction (en anglais seulement).

Délais de déclaration pour la divulgation de la rémunération des dirigeants

Si un émetteur assujetti est tenu d’envoyer une circulaire d’information aux porteurs de titres, il doit divulguer des renseignements sur la rémunération des dirigeants, comme l’exigent la section 9.3.1 du Règlement 51-102 et la section 8 de l’Annexe 51-102A5 Circulaire de sollicitation de procurations (en anglais seulement).

Les émetteurs non émergents doivent déposer cette divulgation dans les 140 jours suivant le dernier exercice financier terminé de l’émetteur assujetti et les émetteurs émergents doivent déposer cette divulgation dans les 180 jours suivant le dernier exercice financier terminé de l’émetteur assujetti.

Un émetteur assujetti qui n’est pas tenu d’envoyer une circulaire d’information aux porteurs de titres doit se conformer à la section 11.6 du Règlement 51-102, qui exige que les mêmes renseignements sur la rémunération des dirigeants soient divulgués dans les 140 jours suivant le dernier exercice financier terminé de l’émetteur assujetti.

Les titres subalternes ou les titres permettant d’obtenir, par voie de conversion ou d’échange, des titres subalternes exigent la communication d’information additionnelle. Lorsqu’il est question d’exigences liées à l’information, une valeur mobilière est considérée comme restreinte si l’une des situations suivantes s’applique :

- l’émetteur assujetti possède une catégorie de valeurs qui comporte plus de droits de vote par titre qu’un titre de capitaux propres;

- les conditions rattachées à l’action ordinaire ou comprises dans les documents constitutifs de l’émetteur assujetti semblent restreindre de façon significative les droits de vote des titres de capitaux propres;

- l’émetteur assujetti a émis une autre catégorie de titres de capitaux propres qui semble conférer à leurs propriétaires un droit de participer davantage, par titre, au résultat ou au partage de l’actif de l’émetteur assujetti que les porteurs de la première catégorie de titres de capitaux propres.

La Partie 10 du Règlement 51-102 (en anglais seulement) fournit de plus amples renseignements sur les exigences qui s’appliquent aux obligations d’information relatives aux titres subalternes.

Frais courants

En Ontario, les sociétés qui sont tenues de communiquer l’information continue doivent payer des frais annuels de participation. Ces frais sont décrits dans la partie 2 et les annexes A et B de la Règle 13-502 de la CVMO Frais (en anglais seulement). Les sociétés pourraient également être assujetties à des frais de retard, lesquels sont décrits à l’annexe G de la règle 13-502 de la CVMO.

Dispenses pour émetteurs étrangers

Toute société étrangère qui est un émetteur assujetti au Canada peut avoir droit à un allègement de certaines des exigences en matière d’information continue à condition qu’elle se plie aux exigences de la Securities and Exchange Commission (SEC) ou d’un territoire de compétence étranger désigné en matière d’information continue. Le Règlement 71-102 Dispenses en matière d’information continue et autres dispenses en faveur des émetteurs étrangers (en anglais seulement) identifie deux types principaux d’émetteurs étrangers qui pourraient être dispensés de l’exigence en matière d’information continue en Ontario :

- les émetteurs étrangers inscrits auprès de la Securities and Exchange Commission (SEC) et constitués en société au Canada qui satisfont à certains critères supplémentaires (tels que décrits dans le Règlement 71-102);

- les émetteurs étrangers visés constitués en société à l’extérieur du Canada qui sont régis par l’un des 15 territoires donnés et dont un maximum de 10 % de leurs titres en actions en circulation est détenu par des résidents du Canada.

Les sociétés constituées aux États-Unis peuvent aussi avoir droit à un allègement de certaines exigences en matière d’information continue en vertu du Règlement 71-101 Régime d’information multinational (en anglais seulement).

Émetteurs émergents

Les exigences en matière d’information continue pour les émetteurs émergents diffèrent de celles d’autres émetteurs. La différence majeure est la durée du délai de dépôt; celui-ci est plus long pour les émetteurs émergents tel que mentionné plus haut. De plus, un émetteur émergent n’est pas tenu de déposer un formulaire d’information continue et il a la possibilité de déposer une attestation de base en vertu du Règlement 52-109.

Le Règlement 51-102 (en anglais seulement) explique en quoi consiste un émetteur émergent.

Examens portant sur les obligations d’information continue

Le personnel de la CVMO passe continuellement en revue les documents portant sur l’information continue déposés par des émetteurs assujettis. Un émetteur assujetti peut faire l’objet d’une enquête ciblée concernant une question précise. Il appartient aux sociétés et à leurs conseillers d’assurer le respect des lois, des politiques et des pratiques pertinentes aux valeurs mobilières. Aucune société n’est à l’abri d’une enquête et chacune d’entre elles a le devoir de se conformer à toutes les exigences, qu’elle fasse l’objet d’une enquête ou non.

L’Avis 51-312 du personnel des ACVM Programme d’examen harmonisé de l’information continue (en anglais seulement) fournit des renseignements sur les types d’examens qu’une société peut s’attendre à ce que la CVMO entreprenne.

Conformément à l’article 20.1(3) de la Loi sur les valeurs mobilières de l’Ontario, les renseignements et les documents obtenus conformément à un examen portant sur l’information continue sont dispensés de l’obligation d’être divulgués aux termes de la Loi sur l’accès à l’information et la protection de la vie privée si la Commission détermine qu’ils devraient conserver leur caractère confidentiel.

Programme d’examen de l’information continue

Les ACVM ont publié l’Avis 51-312 du personnel des ACVM (révisé) Programme d’examen harmonisé de l’information continue (en anglais seulement) pour donner un aperçu de notre programme d’examen de l’information continue. Nous avons souligné ci-dessous quelques-unes des principales caractéristiques de notre programme. En vertu de la législation canadienne sur les valeurs mobilières, un émetteur assujetti doit fournir une information continue, ponctuelle et périodique sur ses activités et ses affaires. L’information continue comprend les dépôts périodiques ainsi que d’autres divulgations liées à des événements :

| Dépôts périodiques | Dépôts de déclarations événementielles | Autre |

|---|---|---|

|

|

|

A) Objectifs du programme d’examen de l’information continue

L’objectif du programme est d’améliorer l’exhaustivité, la qualité et la rapidité de l’information continue fournie par les émetteurs assujettis. Ce programme évalue la conformité aux exigences d’information continue au moyen d’un examen des documents déposés par un émetteur assujetti, de son site Web et de ses médias sociaux. Cette fonction d’examen est essentielle pour faciliter des marchés justes et efficaces, la protection des investisseurs et une prise de décision d’investissement et des transactions éclairées. La divulgation d’informations sur un émetteur assujetti et ses activités est importante non seulement lors de son entrée sur le marché, mais également de façon continue. Par exemple, de nombreux émetteurs assujettis lèvent des fonds au moyen de prospectus simplifiés qui intègrent par référence des documents d’information continue.

B) Types d’examens de l’information continue

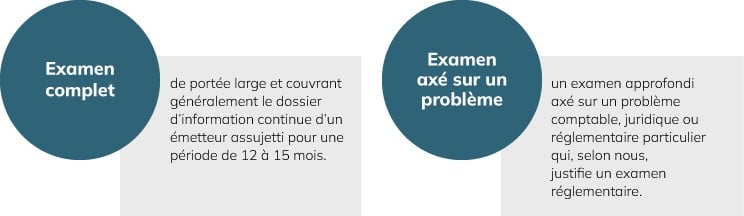

En général, nous effectuons soit un examen complet, soit un examen axé sur les problèmes de l’information continue d’un émetteur assujetti.

Lors de la planification d’examens complets, nous nous appuyons sur notre connaissance des émetteurs assujettis et des secteurs dans lesquels ils opèrent et utilisons des critères fondés sur le risque pour déterminer les émetteurs assujettis présentant un risque plus élevé de divulgation déficiente. Les critères visent à identifier les émetteurs assujettis dont la divulgation est susceptible d’être sensiblement améliorée ou mise en conformité avec la législation sur les valeurs mobilières ou les normes comptables à la suite de notre intervention. Notre évaluation fondée sur les risques intègre des facteurs qualitatifs et quantitatifs que nous examinons régulièrement afin de nous tenir au courant de l’évolution de nos marchés financiers{1}. Nous surveillons également les domaines d’activité de financement nouveaux ou inédits et à forte croissance lors de l’élaboration de notre programme d’examen et examinons toute plainte reçue concernant l’émetteur assujetti.

Les examens axés sur des problèmes particuliers sont généralement axés sur un problème comptable, juridique ou réglementaire particulier, sur un problème ou un secteur émergent ou sur l’évaluation de la conformité à une règle nouvelle ou modifiée récemment entrée en vigueur.

La réalisation d’examens de l’information continue nous aide à :

- surveiller le respect des exigences d’information continue par les émetteurs assujettis,

- communiquer les interprétations et les attentes de la CMVO sur des exigences particulières et déterminer les domaines de préoccupation,

- aborder des domaines particuliers où un risque accru de préjudice pour les investisseurs existe,

- identifier les déficiences courantes,

- fournir des indications sur les informations à fournir, propres à un secteur ou à un sujet particulier, qui peuvent aider les préparateurs à se conformer aux exigences réglementaires,

- évaluer la conformité aux nouvelles normes comptables et aux règles nouvelles ou modifiées.

{1} Un examen complet comprend généralement un examen des états financiers annuels et intermédiaires les plus récents de l’émetteur, ainsi que des rapports de gestion, de la notice annuelle, des rapports annuels, des circulaires d’information, des communiqués de presse, des déclarations de changement important, du site Web, de la divulgation sur les médias sociaux, des présentations aux investisseurs et des dépôts sur SEDI.

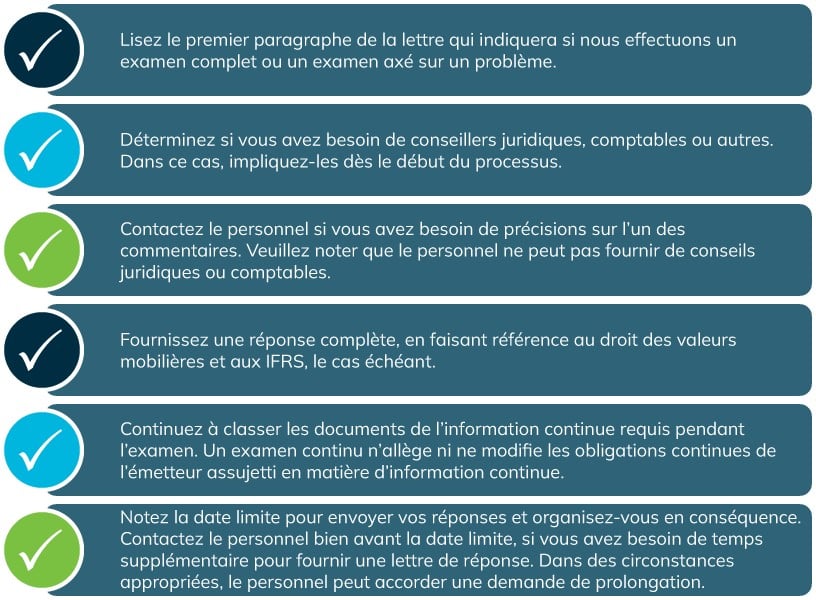

C) Conseils aux émetteurs assujettis sélectionnés pour un examen de l’information continue

Vous trouverez ci-dessous des conseils sur la marche à suivre si vous recevez une lettre de commentaires de la CVMO dans le cadre d’un examen de l’information continue :

(Tous en anglais seulement)

- Règlement 51-102 Obligations d’information continue

- Règlement 52-109 Attestation de l’information présentée dans les documents annuels et intermédiaires des émetteurs

- Règlement 43-101 Information concernant les projets miniers

- Règlement 51-101 Information concernant les activités pétrolières et gazières

- Règlement 71-101 Régime d’information multinational

- Règlement 71-102 Dispenses en matière d’information continue et autres dispenses en faveur des émetteurs étrangers

- Avis 51-312 du personnel des ACVM Programme d’examen harmonisé de l’information continue

Calendrier

Pour obtenir davantage de renseignements sur le calendrier de la norme de service de la CVMO afin d’effectuer des examens complets de l’information continue, consultez l’Engagement de la CVMO en matière de service.

Information continue pour les émetteurs non assujettis

Les émetteurs non assujettis qui distribuent des valeurs mobilières en Ontario en vertu de dispenses de prospectus seront assujettis à certaines obligations d’information continue. Certains des problèmes les plus courants concernant les obligations d’information continue pour les émetteurs non assujettis sont décrits ci-dessous.

États financiers annuels des émetteurs non assujettis

Le personnel de la CVMO souhaite rappeler aux émetteurs non assujettis qu’en raison du recours à l’article 2.9 (la dispense relative à la notice d’offre) du Règlement 45-106 sur les dispenses de prospectus, les émetteurs sont assujettis à des obligations continues. En règle générale, conformément au paragraphe 2.9(17.5) du Règlement 45-106, un émetteur doit, dans les 120 jours suivant la fin de chacun de ses exercices, remettre ses états financiers annuels à l’autorité en valeurs mobilières. Les états financiers doivent être accompagnés d’un avis divulguant l’utilisation par l’émetteur du produit levé en vertu de l’exemption conformément à l’Annexe 45-106A6.

Les états financiers annuels et les avis d’utilisation du produit doivent être déposés via SEDAR+ en utilisant la catégorie de dépôt « Offres sur le marché non réglementé » sous les sous-types de dépôt appropriés :

- États financiers annuels des émetteurs non assujettis

- Avis d’utilisation du produit

Des frais de retard peuvent être appliqués conformément à l’annexe G de la Règle 13-502 de la CVMO Frais (en anglais seulement).