CORRA/Term CORRA-based OTC derivatives trend analysis

The Canadian Dollar Offered Rate (CDOR), an interest rate benchmark, ceased to be published after a final publication on June 28, 2024.

It is expected that market participants will use the Canadian Overnight Repo Rate Average (CORRA) as the alternative reference rate for most instruments that previously referenced CDOR.

- CORRA measures the cost of overnight general collateral funding in Canadian dollars using Government of Canada treasury bills and bonds as collateral for repurchase transactions.

- CORRA is an interest rate benchmark administered by the Bank of Canada.

Term CORRA is an interest rate benchmark that began publication on September 5, 2023 and is intended to replace CDOR for certain instruments or, when appropriate, for related derivatives.

- Term CORRA is a forward-looking measurement of CORRA for 1- and 3-month tenors, based on market-implied expectations from CORRA derivatives markets.

- The Ontario Securities Commission (OSC) has designated Term CORRA as a designated benchmark and CanDeal Benchmark Administration Services Inc. as its designated benchmark administrator.

- Term CORRA’s use is limited through its licensing agreements to (i) business loans, (ii) single currency derivatives for lenders, borrowers and guarantors hedging Term CORRA based loans, (iii) cross-currency derivatives for borrowers hedging Term CORRA based loans, and (iv) inter-dealer trading of CORRA-Term CORRA basis swaps, with certain limitations.

- For more information, see the Allowable Use Cases for Term CORRA developed by the Canadian Alternative Reference Rate Working Group.

Given the systemic importance of CORRA and Term CORRA as key interest rate benchmarks in Canada, it is important to monitor the trends and development of these reference rates.

The OSC receives data on OTC derivatives transactions referencing CORRA or Term CORRA where an Ontario-based entity is a counterparty. We plan to make the following graphs available monthly.

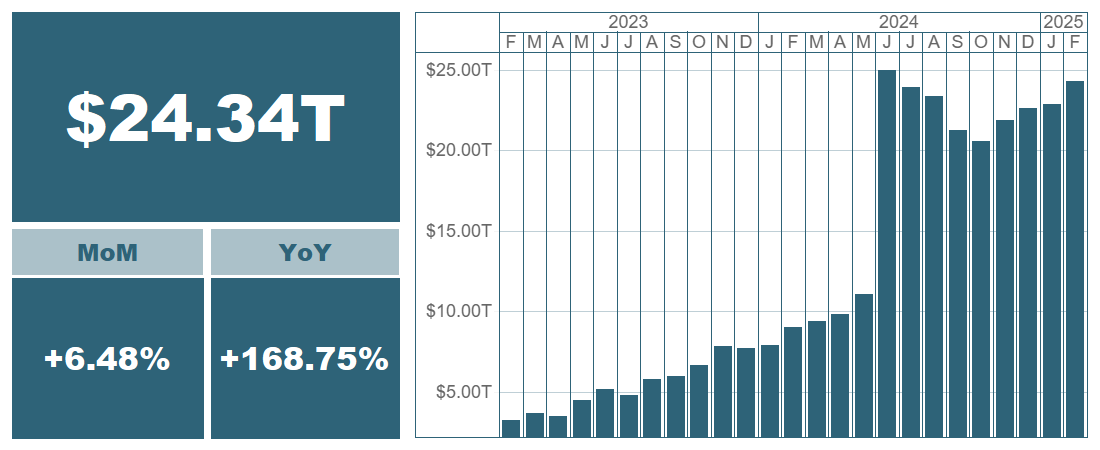

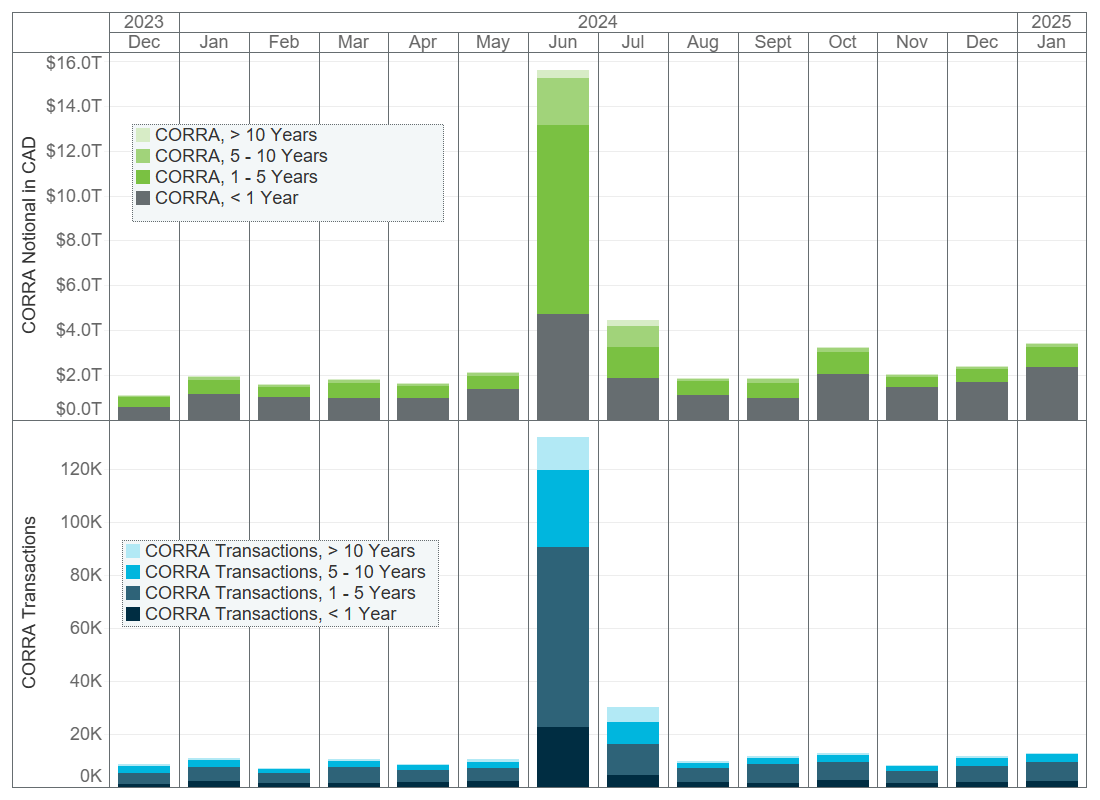

The graphs below depict the outstanding notional amounts for OTC derivatives transactions referencing CORRA or Term CORRA where an Ontario-based entity is a counterparty. The graphs include:

- the current month-over-month (MoM) and year-over-year (YoY) percentage change,

- a breakdown of the outstanding notional amounts by month,

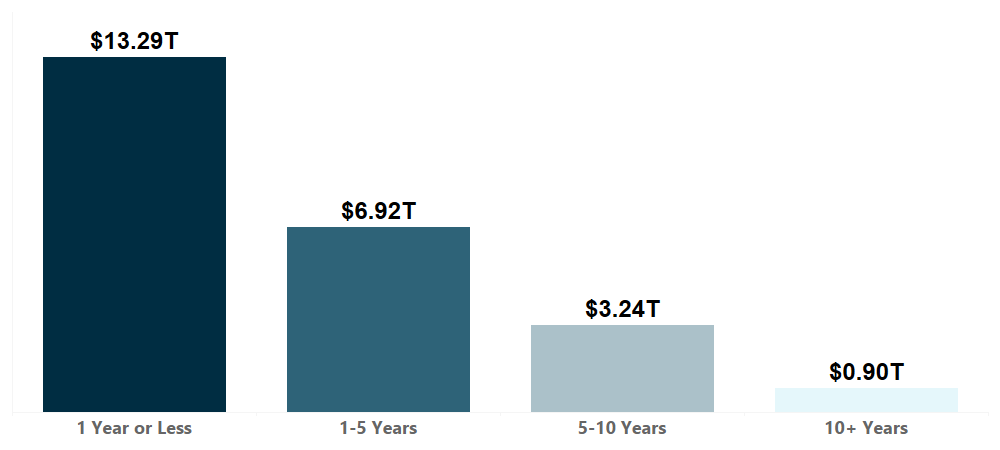

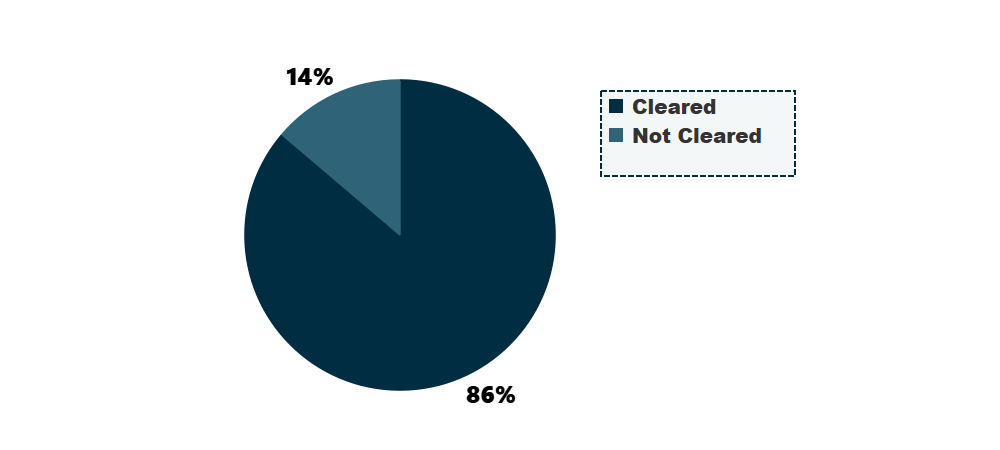

- a breakdown by duration (e.g., 1 year or less, 1-5 years, 5-10 years and greater than 10 years), proportion cleared (in the case of CORRA), and product category, and

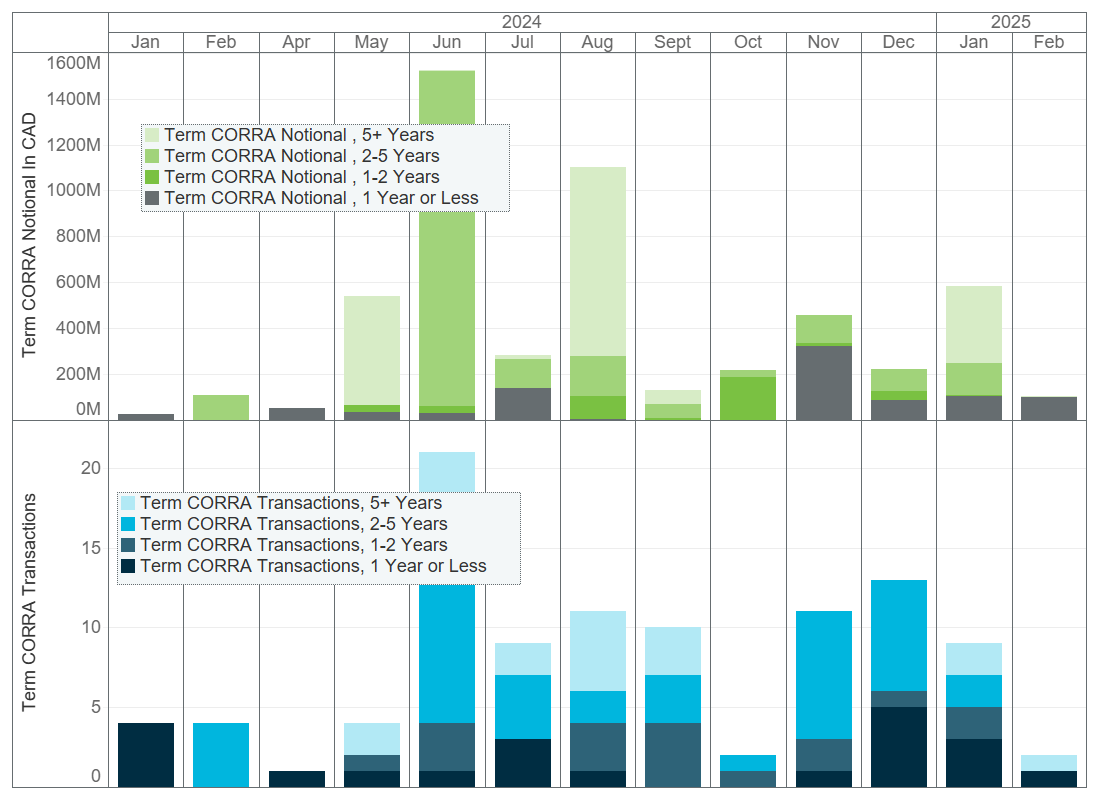

- a breakdown of the monthly volume in terms of notional amount and number of transactions by duration (e.g., 1 year or less, 1-5 years, 5-10 years and greater than 10 years) for both CORRA-based and Term CORRA-based OTC derivatives transactions.

CORRA/Term CORRA Position Monitor

Report date: February 28, 2025

Notional values in Canadian dollars (CAD).

CORRA

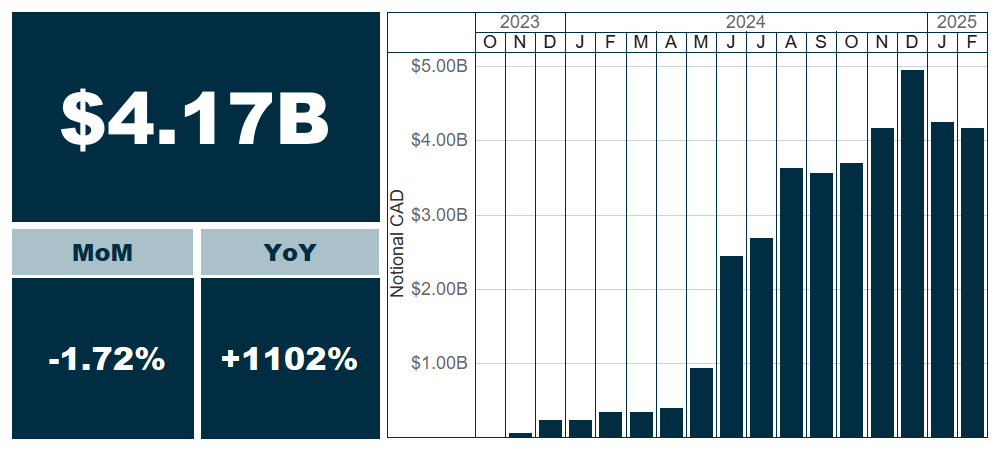

Outstanding notional of OTC derivatives and month-over-month and year-over-year changes (%)

Outstanding notional by maturity

Outstanding notional by proportion cleared (%)

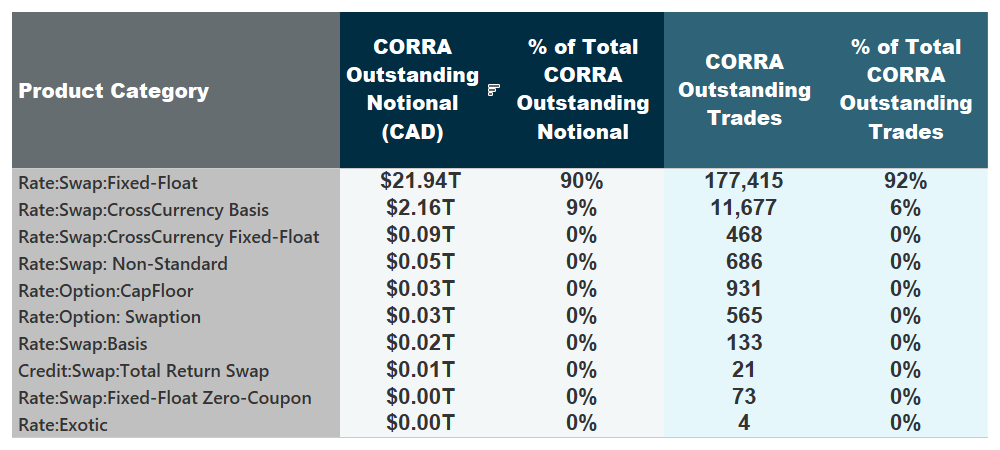

Outstanding notional and number of outstanding trades by product type

Term CORRA

Outstanding notional of OTC derivatives and month-over-month and year-over-year changes (%)

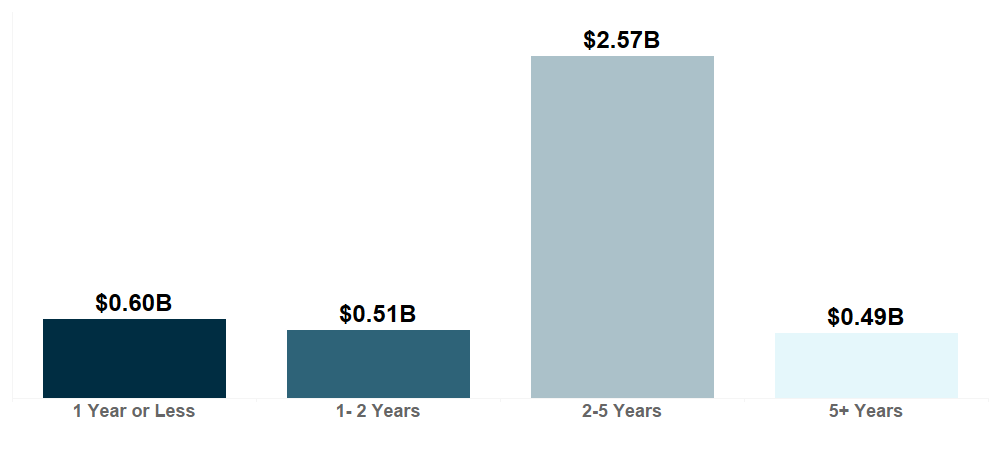

Outstanding notional by maturity

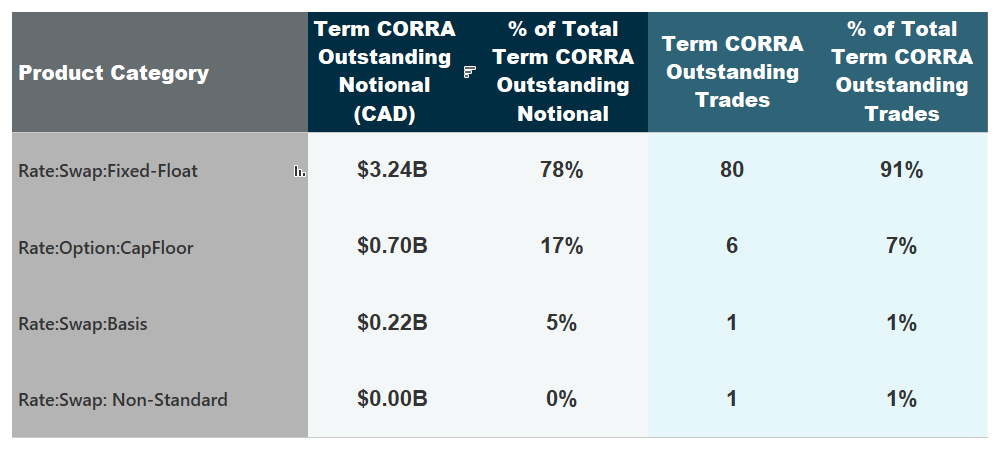

Outstanding notional and number of outstanding trades by product type

CORRA and Term CORRA Volume

CORRA monthly volume traded by outstanding notional and number of trades broken down by maturity

Term CORRA monthly volume traded by outstanding notional and number of trades broken down by maturity