Notice of Proposed Change and Request for Comment - Change to the MATCHNow Trading System - TriAct Canada Marketplace LP

TriAct Canada Marketplace LP (TriAct also known as MATCHNow) has announced plans to implement the change described below 90 days following approval by the Ontario Securities Commission (the OSC). MATCHNow is publishing this Notice of Proposed Change and Request for Comment in accordance with the "Process for the Review and Approval of Rules and the Information Contained in Form 21-101F2 and the Exhibits Thereto". Market participants are invited to provide the OSC with comments on the proposed change.

Feedback on the proposed change should be in writing and submitted by June 11, 2018 to:

Market Regulation Branch

Ontario Securities Commission

22nd Floor

20 Queen Street West

Toronto, Ontario M5H 3S8

Fax: (416) 595-8940

e-mail: [email protected]

And to:

Bryan Blake

Chief Executive Officer

MATCHNow

The Exchange Tower

130 King Street West, Suite 1050

Toronto, Ontario M5X 1B1

Fax: (416) 874-0690

e-mail: [email protected]

Feedback received will be made public on the OSC website. Upon completion of the review by OSC staff, and in the absence of any regulatory concerns, notice will be published to confirm the completion of OSC staff's review and to specify the intended implementation date of the change.

If you have any questions concerning the information below, please contact Bryan Blake, Chief Executive Officer of MATCHNow, at (416) 874-0919.

Conditional Orders

A. Detailed description of the proposed change to the MATCHNow trading system

Conditional orders or "Conditionals" will be a new way to interact with MATCHNow that will allow Subscribers to send a potential order that will sit uncommitted until the sender is invited -- and actually accepts -- to "firm up" that order. This invitation to "firm up" will only be transmitted to the Subscriber when contra liquidity is found in the Conditionals book or among orders that opt in to trade with Conditionals from the regular MATCHNow liquidity pool, and in that circumstance, invitations will be sent for all conditional orders that are tradeable (i.e. meeting price and "minimum quantity" criteria) in the book at that time, without regard to broker preferencing. The Subscriber will then have a defined, limited period of time (namely, 1 second{1}) to "firm up" the conditional order, after which the conditional order will automatically be cancelled where it has not been firmed up (what is known as a "fall down" of the conditional order); in the event that the conditional order is "firmed up" (i.e. where a "firm up" message has been sent back by the Subscriber in time), it will be executed in accordance with existing MATCHNow matching logic, which includes execution at the mid-point, with broker preferencing, and on a pro rata basis.

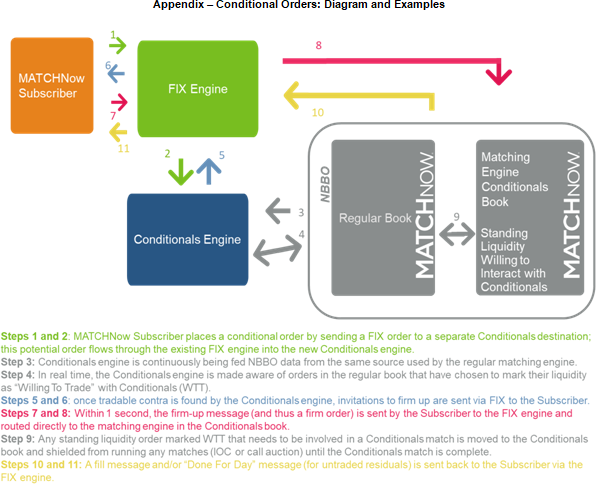

Conditional orders will be made available through the creation of a new Conditionals engine to handle invitations and firmed-up orders. Currently, MATCHNow operates through two main components: a "FIX" (or "Financial Information eXchange") server, which enables message routing; and a proprietary matching engine. The proposed Conditionals destination will be implemented by adding a Conditionals engine as a new layer between the existing FIX engine and matching engine, with a new Conditionals book set up within that matching engine, along with the optionality to allow standing MATCHNow liquidity to interact with Conditionals. See the attached Appendix. MATCHNow will ensure transparent reporting of all executed conditional orders (i.e. performance per Subscriber, and in relation to the pool).

For greater certainty, we note that the proposed Conditionals engine will be separate from the existing standard MATCHNow matching engine; however, the two engines will communicate with each other. As a result, a regular standing order that opts in to trade with conditional orders will be shielded or "locked in" for the amount of time (i.e. milliseconds, but up to 1 second maximum) necessary to communicate with tradeable conditional orders on the book. As such, there is a small risk that a standard order that opts to trade with conditional orders could miss out on matching with a contra order in the standard matching engine during that small amount of time (1 second or less) necessary to carry out the conditional matching process. This is because any given standard order cannot run in two separate pools at one time.

This new Conditionals destination will be electronic only, i.e. it will function without any human interaction, and it will be subject to minimum size requirements (i.e. greater than 50 standard trading units or greater than $100,000 in value, in accordance with the "large order" parameters derived from IIROC's Universal Market Integrity Rules). Size corrections will be supported. Conditional orders, which will be an optional feature, will only be available through MATCHNow to MATCHNow Subscribers.

As part of this proposed change, we will be adopting a compliance mechanism, which is intended to combat information leakage by ensuring that conditional firm-up rates remain at or above an appropriate level. This compliance mechanism will be based on a temporary restriction on a Subscriber's ability to send new conditional orders for the duration of the day in the event that the Subscriber's firm-up rate drops below 70% for the day, provided that no less than 10 conditional orders have been sent. The restriction will be imposed manually, following an automated notice that the firm-up rate has dropped below the 70% threshold. At the start of each trading day, the restriction will be lifted, and thus a Subscriber's ability to place new conditional orders will be restored, unless and until its firm-up rate drops below 70% for the day once again. The restriction will therefore either be on or off at any point in time; there will be no tiering of Subscribers based on firm-up rates. MATCHNow will track each Subscriber's firm-up rate and deliver periodic reports of that rate to the Subscriber. In addition, MATCHNow will track fall-down rates, including the reason for each fall-down, such as where the quote moved during the firm-up process; we will include this information in the above-mentioned Subscriber reports. Fall-downs related to a quote change during the permitted firm-up time period will not be viewed as negative behavior by a Subscriber for the purposes of determining whether a Conditionals restriction should be imposed. Even if a Subscriber's Conditionals privileges are restricted, it will continue to have the ability to trade with new conditional orders as contra liquidity in the standard MATCHNow liquidity pool. We believe this compliance mechanism is specific, transparent, and reasonable, as it strikes an appropriate balance by encouraging higher firm-up rates, and thus greater liquidity, without undermining fair access to the Conditionals destination (as explained in greater detail in Section E below).

At this time, MATCHNow has not determined what new fee(s), if any, will be applicable to conditional orders. If, in the future, one or more new fees are determined to be appropriate, we will file a Fee Change amendment to our Form F2 at such future time.

B. Expected implementation date

The proposed change is expected to be implemented 90 days after approval by the OSC.

C. Rationale for the proposed change and any relevant supporting analysis

The proposed change will allow MATCHNow to add liquidity and value to the street by improving MATCHNow's current order offerings within the existing MATCHNow FIX system, namely, by allowing algorithms to search for liquidity in multiple venues without the risk of overcommitting the order.

This type of conditional order is already in use on marketplaces in the United States and Europe, where conditional trading represents approximately 3% and 2.5% of market share, respectively, and where it is expected to continue growing due to the continued need to source block liquidity.

For a diagram and examples of how conditional orders will function, please see the attached Appendix.

D. The expected impact of the proposed change on market structure, subscribers, and, if applicable, investors and capital markets

This change is not expected to have any adverse impact on market structure, Subscribers, other market participants, or the capital markets more generally.

E. Expected impact of the proposed change on MATCHNow's compliance with Ontario securities law and, in particular, the requirements of fair access and the maintenance of fair and orderly markets

The impact of the proposed change will be to maintain MATCHNow's compliance with Ontario securities law, including fair access and the maintenance of fair and orderly markets. In particular, the proposed Conditionals feature will be optional, and once approved and implemented, it will be made available on an equal basis to all MATCHNow Subscribers, in accordance with the "fair access" requirements set out in section 5.1 of National Instrument 21-101 (Marketplace Operation) (NI 21-101).

We also note that the Conditionals engine is separate from the standard MATCHNow engine, which reduces the risk of any undue informational advantage for Subscribers that utilize the Conditionals destination. In theory, a Subscriber that sends a conditional order that is not immediately filled may infer information from that, which information would not be available to a Subscriber sending a standard (firm) order. However, it is arguable that Immediate-or-Cancel (IOC) orders, which are an approved MATCHNow order type, may present the same potential informational advantage, insofar as they allow a Subscriber to infer something about the standard MATCHNow book whenever an IOC order is entered and not filled. In any event, to the extent that Conditionals do create a risk of information leakage, we have proposed a compliance mechanism to combat this, as noted above in Section A. This compliance mechanism will prevent informational advantages derived from fall-down abuse by restricting the conditional order privileges of Subscribers whose firm-up rates fall below the specified threshold (70% after at least 10 conditional orders sent). We believe this mechanism ensures compliance with the "fair access" requirements, in particular, because it establishes "reasonable standards for access" to the Conditionals destination and does not "unreasonably create barriers to access to the services" of MATCHNow. (See s. 7.1 of 21-101CP.)

More generally, MATCHNow will take reasonable steps to monitor order entry and trading activity through the proposed Conditionals destination for compliance with MATCHNow's operational policies and procedures, as well as to encourage compliance with securities laws and the rules of MATCHNow's regulatory services provider (IIROC), just as it does for all order types, in accordance with the "fair and orderly markets" requirements set out in section 5.7 of NI 21-101 and subsections 7.6(2) and (3) of 21-101CP.

Lastly, it bears noting that the pre-trade transparency requirements set forth in Part 7 of NI 21-101 are not applicable to Conditionals. In fact, a conditional order is not an "order" for the purposes of section 1.1 of NI 21-101, as interpreted in the light of section 5.1 of 21-101CP, because a conditional order it is not "actionable," i.e. it cannot be "executed without further discussion between the person or company entering [it] ... and the counterparty". (See s. 5.1(2) of 21-101CP.) By design, a conditional order only becomes capable of execution when a Subscriber takes the additional step of sending a firm-up message, following an invitation to do so from the Conditionals engine, which only occurs when contra liquidity is available. Thus, by definition, a conditional order is not an "order" under NI 21-101 and, therefore, it is not subject to the pre-trade transparency requirements which, pursuant to Part 7 of NI 21-101, only apply to orders.

F. Details of any consultations undertaken in formulating the proposed change

With respect to the proposed new feature, MATCHNow consulted with its User Advisory Committee on two occasions and, in addition, met one-on-one with numerous Subscribers on multiple occasions. We received a generally positive response from all Subscribers, including several that said they were certain that they would use the new feature. The consensus was that a new MATCHNow conditional order type would not take away from Subscribers' existing cash desk blocks; instead, it will simply provide another way to source liquidity. The following considerations were raised in our consultations:

• Compliance: to ensure that conditional firm-up rates remain at an appropriate level, some Subscribers were in favor of a scoring or compliance mechanism, while others were not, and those that supported a scoring or compliance mechanism also supported liquidity segregation based on that mechanism;

• Cancellation: some Subscribers suggested that conditional orders should be canceled back if an indication is ignored;

• Size corrections: some Subscribers requested the ability to do size corrections so that a cancel/re-submit feature is not necessary;

• Quote change: some Subscribers were concerned about quote change during firm-up.

As reflected in Section A above, with respect to each of these considerations, we have incorporated into our proposal the solution favoured by a majority of those consulted.

In addition, some Subscribers were in favour of an option for non-Conditional day orders and Immediate-or-Cancel (IOC) orders to interact with Conditionals on an opt-in basis. As explained in Section A above, we have determined to incorporate day order (standing liquidity) optionality in the proposal, but not IOC order optionality; this is because holding an IOC order for any period of time is at odds with the very nature of that order type.

G. If the proposed change will require subscribers or service vendors to modify their systems after implementation of the change, the expected impact of the change on the systems of subscribers and service vendors together with a reasonable estimate of the amount of time needed to perform the necessary work, or an explanation as to why a reasonable estimate was not provided

This proposed change will require some work by Subscribers or vendors to modify their own systems, but only insofar as they wish to utilize the new conditional order functionality. We will provide a spec a minimum of 90 days prior to launch to enable Subscribers or vendors to do the necessary work to test this new functionality, should they wish to have the option of sending conditional orders to MATCHNow. A reasonable estimate of the amount of time needed to complete this work is 30 days.

H. If applicable, whether the proposed change would introduce a feature that currently exists in other markets or jurisdictions

This feature is not novel. It is similar to a conditional order type for Canadian equities available through Liquidnet Canada to certain IIROC-approved securities dealers (as explained in Liquidnet Canada's Notice, published on April 6, 2017, see proposed change #2, "Expansion of conditional order functionality for Canadian equities"), which was given final approval on June 23, 2017.

Moreover, as noted above, marketplaces in the United States and Europe have already implemented conditional order functionalities similar to the one that MATCHNow is proposing.

{1} The limited time period for firming up a conditional order (1 second) is configurable by MATCHNow. As a result, that time period could be changed pursuant to a future amendment to MATCHNow's Form 21-101F2 (Form F2) if our Subscribers' user experiences warrant such a change.

Appendix -- Conditional Orders: Diagram and Examples

Example 1(a): no fall down, no changes in quantity

|

Order |

Quantity |

Side |

Time |

Broker |

|

|

||||

|

Order 1, Conditional |

50,000 |

SELL |

10:00 AM |

Broker A |

|

|

||||

|

Order 2, Conditional |

100,000 |

SELL |

11:00 AM |

Broker B |

|

|

||||

|

Order 3, Conditional |

75,000 |

BUY |

11:15 AM |

Broker C |

Result, step i:

Orders 1 and 2 obtain invitations/firm-up messages to sell

Order 3 obtains an invitation/firm-up message to buy

Result, step ii:

Order 1 sends a committed order back to sell 50,000 shares

Order 2 sends a committed order back to sell 100,000 shares

Order 3 sends a committed order back to buy 75,000 shares

Result, step iii:

Orders 1, 2, and 3 go to MATCHNow and follow our regular matching logic as follows:

Order 1 gets a partial fill for 25,000 shares at mid-point

Order 2 gets a partial fill for 50,000 shares at mid-point

Order 3 gets fully filled for 75,000 shares at mid-point

Orders 1 and 2 receive "Done For Day" messages{2} for untraded residuals

Example 1(b): no fall down, no changes in quantity, smaller contra liquidity

|

Order |

Quantity |

Side |

Time |

Broker |

|

|

||||

|

Order 1, Conditional |

50,000 |

SELL |

10:00 AM |

Broker A |

|

|

||||

|

Order 2, Conditional |

100,000 |

SELL |

11:00 AM |

Broker B |

|

|

||||

|

Order 3, Conditional |

45,000 |

BUY |

11:15 AM |

Broker C |

Result, step i:

Orders 1 and 2 obtain invitations/firm-up messages to sell

Order 3 obtains an invitation/firm-up message to buy

Result, step ii:

Order 1 sends a committed order back to sell 50,000 shares

Order 2 sends a committed order back to sell 100,000 shares

Order 3 sends a committed order back to buy 45,000 shares

Result, step iii:

Orders 1, 2, and 3 go to MATCHNow and follow our regular matching logic as follows:

Order 1 gets a partial fill for 15,000 shares at mid-point

Order 2 gets a partial fill for 30,000 shares at mid-point

Order 3 gets fully filled for 45,000 shares at mid-point

Orders 1 and 2 receive "Done For Day" messages for untraded residuals

Example 1(c): fall down and change in quantity

|

Order |

Quantity |

Side |

Time |

Broker |

|

|

||||

|

Order 1, Conditional |

50,000 |

SELL |

10:00 AM |

Broker A |

|

|

||||

|

Order 2, Conditional |

100,000 |

SELL |

11:00 AM |

Broker B |

|

|

||||

|

Order 3, Conditional |

75,000 |

BUY |

11:15 AM |

Broker C |

Result, step i:

Orders 1 and 2 obtain invitations/firm-up messages to sell

Order 3 obtains an invitation/firm-up message to buy

Result, step ii:

Order 1 sends a committed order back to sell 20,000 shares

Order 2 does not send back an order

Order 3 sends a committed order back to buy 45,000 shares

Result, step iii:

Orders 1 and 3 go to MATCHNow and follow our regular matching logic as follows:

Order 1 gets fully filled for 20,000 shares at mid-point

Order 3 gets a partial fill for 20,000 shares at mid-point

Order 3 receives "Done For Day" message for untraded residuals

Example 2: Invitations with minimum quantity (MinQty)

|

Order |

Quantity |

Side |

Time |

Broker |

MinQty (tag 110) |

|

|

|||||

|

Order 1, Conditional |

20,000 |

SELL |

10:00 AM |

Broker A |

None |

|

|

|||||

|

Order 2, Conditional |

10,000 |

SELL |

11:00 AM |

Broker B |

None |

|

|

|||||

|

Order 3, Conditional |

100,000 |

BUY |

12:10 PM |

Broker E |

MinQty 50,000 |

Result:

No invitation sent to Order 1, 2, or 3 because combined sell quantity (30,000 shares) does not meet Order 3 MinQty restriction (50,000 shares)

Example 3: Invitations and standing liquidity

|

Order |

Quantity |

Side |

Time |

Broker |

MinQty (tag 110) |

|

|

|||||

|

Order 1, Conditional |

50,000 |

SELL |

10:00 AM |

Broker A |

None |

|

|

|||||

|

Order 2, Conditional |

50,000 |

SELL |

11:00 AM |

Broker C |

None |

|

|

|||||

|

Order 3, Standing liquidity in MATCHNow pool |

100,000 |

BUY |

9:40 AM |

Broker B |

MinQty 100,000 |

Result, step i:

Orders 1 and 2 obtain invitations/firm-up messages to sell

Result, step ii:

Order 1 sends a committed order back to sell 50,000 shares

Order 2 sends a committed order back to sell 50,000 shares

Order 3 has standing liquidity in the MATCHNow pool which has been marked as "willing to trade'" with Conditionals -- no invitation required (but this order is shielded from matching with other orders in the standard liquidity pool for 1 second or less -- i.e. the time it takes for the Conditionals matching process to be carried out -- because it cannot run in two separate pools at once)

Result, step iii:

Order 1 gets fully filled for 50,000 shares at mid-point

Order 2 gets fully filled for 50,000 shares at mid-point

Order 3 gets fully filled for 100,000 shares at mid-point

{2} In this example and those that follow, a "Done For Day" FIX message indicates that the unfilled portion of the order has effectively been cancelled, thereby returning the residual shares to the Subscriber that placed the order. In that circumstance, the Subscriber would need to send a new conditional order to trade the residual.