Notice of Proposed Change and Request for Comment - Amendment to Trading Fees - Canadian Securities Exchange

We are publishing this Notice of Proposed Changes and Request for Comment (Notice) in conjunction with a request for comment on a fee proposal related to the guaranteed minimum fill (GMF) functionality by CNSX Markets Inc. (CSE) (the Fee Proposal).

Staff request for specific comment

The CSE is proposing a change to the trading fee model applicable to passive marketplace participants (passive participants) trading in Designated Securities (as defined in the Notice). Under the Fee Proposal, the fees passive participants pay would be dependent on whether or not the active orders against which they trade are GMF eligible (GMF Orders).

In considering CSE's Fee Proposal, Staff is seeking comment on the whole proposal and on the following issues.

1) Fair Access -- Staff question whether the Fee Proposal would be unfair to passive participants because their fees are determined by the nature of an incoming order and not by their own actions or decisions.

2) Leakage of Information -- Staff are concerned that the Fee Proposal would allow for passive participants in the CSE to have an informational advantage over other marketplace participants, as they would know, based on the fee they pay, whether they are trading against GMF Orders (i.e. "agency" or "non-agency") orders. This information is not available to any other marketplace participant. We note CSE's assertions against the "real time" information leakage, but remain concerned that passive participants would have information that allows them to determine the type of counterparty to the trade.

Submissions of comments

Comments on the Notice should be in writing and submitted by August 2, 2016 to.

And to:

Mark FaulknerVice President, Listings and RegulationCNSX Markets Inc.220 Bay Street, 9th FloorToronto, ON, M5J 2W4M5J 2W4Email: Mark.Faulkner@thecse.com

Comments received will be made public on the OSC website. Upon completion of the review by OSC staff, and in the absence of any regulatory concerns, notice will be published to confirm the completion of Commission staff's review and to outline the intended implementation date of the changes.

Notice 2016-010 - Request for Comment - Amendment to Trading Fees

June 30, 2016

CANADIAN SECURITIES EXCHANGE

SIGNIFICANT CHANGE SUBJECT TO PUBLIC COMMENT

AMENDMENT TO TRADING FEES

NOTICE AND REQUEST FOR COMMENT

The Canadian Securities Exchange ("CSE" or the "Exchange") proposes to implement a significant change to trading fee schedule. The Exchange is publishing this Notice in accordance with the process for the Review and Approval of Rules and the Information Contained in Form 21-101F1 and the Exhibits Thereto attached as Appendix B to the Exchange's recognition order.

DESCRIPTION OF THE PROPOSED AMENDMENTS

Background

(i) Inverted Fee Model and Launch of the CSE Market Making Programme

In the autumn of 2015, the Canadian Securities Exchange ("CSE") received regulatory approval to implement a revised trading fee schedule that established an inverted maker-taker fee model for trading in a defined group of liquid TSX-listed securities ("Designated Securities").{1}

Under a traditional maker-taker fee model, liquidity providers are encouraged to place resting orders on a marketplace's book. The liquidity provider (i.e. the market making passive side) receives a rebate when an active order executes against them. For Designated Securities, there are no liquidity concerns for such securities. As such, the CSE determined that providing rebates for the liquidity providing market maker for Designated Securities was unnecessary and implemented an inverted maker-taker fee model.

Also at that time, the CSE appointed its first Market Maker and introduced a Guaranteed Fill Facility, whereby eligible agency orders ("GMF Orders") could automatically execute against a Market Maker's account up to a defined number of shares for each security.{2}

The CSE has since expanded its list of Designated Securities.

(ii) Proposed Amendments to the Fee Schedule for Eligible Agency Orders in Designated Securities in the continuous auction market

The CSE launched its market making programme in Designated Securities with a view to improving trading results for small agency order flow, which is directed through GMF Orders.

Specifically, the CSE seeks to:

• reduce execution costs for investment dealers managing GMF Orders (by providing a rebate for active orders in the stocks that most commonly trade in Canada);

• lower dealer back office costs and reduce information leakage to the broader marketplace by employing larger guaranteed minimum fill ("GMF") commitments provided by the CSE's Market Makers to reduce the number of fills generated per agency order; and

• address the competitive imbalance between the "maker-taker" marketplaces and the US wholesale market and repatriating Canadian order flow to contribute to price discovery by inverting the fees for GMF Orders.

In order to accomplish these goals, the CSE proposes additional refinements to its market making programme by further amending the applicable fee model.

Under the current fee model:

• for incoming GMF Orders in Designated Securities (i.e. active orders), the passive side is assessed a fee of $.0018 per share and the GMF Order receives a rebate of $.0014 per share. If the passive side is provided by a designated Market Maker, the passive side is assessed a fee of $.0016 per share.

• for all non-GMF Orders, the passive side of the trade receives a rebate and the active incoming order will be assessed a fee based on the CSE's maker-taker fee model.

The CSE proposes to amend its fee schedule so the following applies:

• for incoming GMF Orders *not* in Designated Securities and that trade at or above $1.00 per share, the passive side will receive a rebate of $.0021 per share and the active order will be assessed a fee of $.0025 per share (for securities that trade below $1.00 per share, there are two tiers for fees on a take-take basis).

In substance, the change is that the existing inverted maker-taker fee model will no longer apply to all trades in Designated Securities; rather, the fee model will be narrowed to apply only to GMF Orders in Designated Securities.

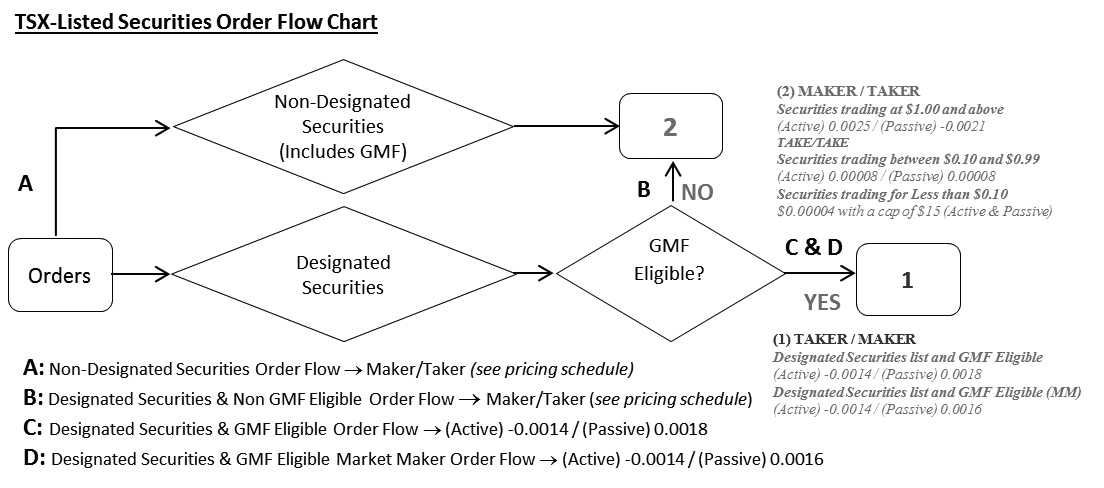

To assist in understanding the impact of the proposed fee change, the CSE has prepared the following flow chart and scenarios:

Glossary:

GMF Eligible -- Guaranteed Minimum Fill intended to provide trade executions for small agency orders. Not intended for systematic and/or repeated GMF access by proprietary accounts.

Designated Securities --TSX-listed securities that trade more than an average of 750,000 shares a day across all lit marketplaces

Scenario 1: Non-Designated Securities Order Flow

QUOTE

|

SYMBOL |

BID SIZE |

BID |

ASK |

ASK SIZE |

GMF SIZE |

|

|

|||||

|

ABC |

200 |

3.00 |

3.10 |

400 |

800 |

GMF eligible client puts in a market order to purchase 500 shares; he/she will receive 400 shares at the posted offer price of $3.10 and the balance 100 shares from the Market Maker.

ABC is not on the CSE Designated Securities list. A maker/taker fee model applies.

GMF eligible client: Bought 500 shares at $3.10, active order fee $0.0025

Agency poster: Sold 400 shares at $3.10, passive order rebate --$0.0021

Market Maker: Sold 100 shares at $3.10, passive order rebate --$0.0021

Scenario 2: Designated Securities & Non-GMF Eligible Order Flow

QUOTE

|

SYMBOL |

BID SIZE |

BID |

ASK |

ASK SIZE |

GMF SIZE |

|

|

|||||

|

XYZ |

300 |

5.95 |

6.00 |

200 |

500 |

Proprietary trader client enters a non-GMF eligible market order to purchase 200 shares; he/she will receive 200 shares at the posted offer price of $6.00.

XYZ is on the CSE Designated Securities list but the order is not GMF eligible. The maker/taker fee model applies.

Proprietary trader client: Bought 200 shares at $6.00, active order fee $0.0025

Agency poster: Sold 200 shares at $6.00, passive order rebate --$0.0021

Market Maker: no interaction, non-GMF eligible order

Scenario 3: Designated Securities & GMF Eligible Order Flow (with & without Market Maker)

QUOTE

|

SYMBOL |

BID SIZE |

BID |

ASK |

ASK SIZE |

GMF SIZE |

|

|

|||||

|

XYZ |

300 |

5.95 |

6.00 |

200 |

500 |

GMF eligible client puts in a market order to purchase 300 shares, he/she will receive 200 shares at the posted offer price of $6.00 and the balance 100 shares from the market maker

XYZ is on the CSE Designated Securities list and GMF eligible. A taker/maker fee model applies.

GMF eligible client: Bought 300 shares at $6.00, active order rebate --$0.0014

Agency poster: Sold 200 shares at $6.00, passive order fee $0.0018

Market Maker: Sold 100 shares at $6.00, passive order fee $0.0016

Expected Implementation Date

The new fees are expected to be implemented at the beginning of the first month following the receipt of regulatory approval.

Rationale and Supporting Analysis

The additional change to the market making programme has been informed with the benefit of several months' experience and extensive consultation with liquidity providers and consumers.

The CSE has received concerns on the proposed enhancement to the Market Making programme from some quarters of the industry. The concerns can be summarized as follows:

• the variable fee will provide information to the liquidity provider not otherwise available to the broader marketplace. This information could result in increased adverse selection for agency clients executing trades in Designated Securities through the CSE; and

• the variable fee will be difficult for individual investors to understand; it represents another layer of complexity in an already challenging marketplace landscape.

Counterparty Identity

Some observers have expressed concerns that the counterparty identity would be known to the passive side of the trade in "real time" or otherwise during the trading session.

There will be no "real time" information leakage. In order to learn whether a counterparty on a particular trade was for a GMF Order or not, the liquidity provider would need to collate its daily fill report with their daily billing report (each being available in the evening at approximately 6:30 p.m. each trading day). The resulting collation would provide the house number for the agent on the passive side of the trade and an indication as to whether the contra side of the trade was for a GMF Order or not. This "information" would not cause either party to the trade to materially alter their strategies. However, one possibility is that the Market Maker might determine that it is missing out on trading opportunities by having a GMF commitment that is too small. The consequence would be to increase the size of the GMF, a benefit to all market participants.

Variable Fee

Concerns have also been expressed that the variable fee outcomes would add further complexity to a crowded and increasingly fragmented Canadian equity trading landscape. In particular, the CSE has been asked to consider the impact on retail market participants who cannot be expected to stay current with all of the various fee models and order types employed by lit, dark, protected and unprotected marketplaces.

The CSE does not believe that retail market participants would be harmed by the proposed fee amendment. All agency orders received by the CSE are entered by a CSE Dealer with a best execution responsibility to their client. It can be assumed that the order has been presented to the CSE once the dealer has discharged its responsibility to determine that, having regard to all of the circumstances, the CSE presents the most favourable opportunity for best execution. Sophisticated clients may well wish to better understand their dealer's means of determining best execution and that is a conversation between the dealer and its client. The CSE also does not believe that the variable fee outcome affects the trading economics for the client: whether the trade receives a rebate or is charged a fee, we are unaware of any circumstances where the impact of the fee or the benefit of the rebate is reflected on the client's trading outcome. Simply put, the client is employing the dealer to master the complexities of the system and achieve the best result on their behalf. Individual investors do not have to be intimately "up to speed" on the pricing or functionality nuances.

Resting Orders

The CSE has also been asked to consider the impact of the amendment to the fee model on resting orders. From the advent of multiple marketplaces in Canada, one fact is abundantly clear: resting agency orders are almost invariably posted to the listing exchange. In the case of the CSE, all orders in TSX and TSX-V-listed securities come from proprietary sources. These accounts, many of whom are amongst the most sophisticated proprietary trading firms in the world are capable of modelling the impact of the variable fee model and adjusting their posting strategies accordingly.

Order Preferencing

The CSE has also examined the question of the different treatment accorded to orders with the proposed fee amendment. There is no shortage of examples of situations where exchanges have accorded "preferences" to particular kinds of orders, according to their character. In this regard we point to a number of examples of rules, order types, and facilities that introduce levels of uncertainty into fees or fill priority in providing advantages to "client" or "natural" orders:

• The broker preference rule. Liquidity providers are accustomed to a situation where top of book orders by price and time priority are by-passed by client orders from the same firm that are assigned an unintentional cross by the trading system. Canadian market structure has long accepted that client orders may be given fill preference over other booked orders in determining execution priority.

• Speed bumps. Speed bumps introduced by markets in Canada and the U.S. are said, by their advocates, to increase the opportunity for "natural" orders to interact with market maker (either officially designated or not) supplied liquidity, while reducing the opportunity for "predatory" traders to use their speed and informational advantages (by seeing signals given off from firms executing orders across multiple markets) to trade against these orders to the detriment of the client orders.

• Order types. The "long life" order type is an attempt to provide a different outcome for a liquidity provider depending on the intended duration of the order.

• Segregated books. The CSE is attempting to provide, within the context of a single book, services which are provided by other marketplace operators in Canada using multiple books. NASDAQ Canada, Omega, TMX Group and Aequitas all operate multiple books with different fee outcomes in an attempt to service different customer needs. There is no support from the customer base to see additional marketplace facilities launched in Canada. The impact on trading systems, compliance, risk, routing facilities and market data administration is considerable. In order to provide an innovative service without the necessity of opening an additional marketplace, the CSE has no alternative other than to support multiple fee outcomes within the context of a single marketplace.

• Minimum Guaranteed Fill on the TSX. The active side of an order is subject to multiple fee outcomes depending on the nature of the order. The TSX fee schedule includes a maker-taker structure with rates for securities priced over $1.00 and two tiers for security prices below $1.00. Additionally, there are different fees if the order is filled through the MGF facility.{3}

• Variable pricing models. The CSE is aware of a number of international examples of variable pricing models. The NASDAQ BX market employs inverted pricing for continuous auction market trades and also offers a mid-point peg order type. In-bound active orders have no price certainty when entered: if they encounter a marketable peg order, they receive no rebate on the execution. If they execute against a booked order, the rebate may be from $0.0006 to $0.0017 depending on the amount of liquidity being removed by the firm. The more liquidity removed by the firm, the higher the rebate.

The end result of all of these fees, order types and marketplace features is to accomplish two goals: improve the execution of agency order flow and provide officially designated market makers with an optimal environment to provide liquidity to retail investors.

Expected Impact

The CSE anticipates the following outcomes if the proposal is adopted:

• by improving the economics of GMF Orders in Designated Securities; the CSE expects to see an increase in the number of firms willing to participate as Market Makers on the CSE;

• meaningful GMF commitments on Designated Securities, the most actively traded stocks in Canada, resulting in fewer executions to satisfy each client order, less information leakage to the market place and less opportunity for quote fade;

• by using standard maker-taker pricing for resting orders trading against proprietary orders (i.e. non-GMF Orders) in Designated Securities, protection of the providers of liquidity against predatory proprietary trading strategies. This measure should encourage third party liquidity providers to layer the CSE book with resting orders in the Designated Securities, and encourage the Market Maker to increase the size of their GMF commitment;

• No "fair access" concerns. As discussed above, liquidity provision on the CSE for TMX Group-listed securities is entirely the role of proprietary traders. For a number of reasons, resting "natural" client orders tend to be posted on the listing exchange's book. The pricing proposed by the CSE does not limit any qualified dealer from applying for a market making assignments, nor does it prevent or discourage any firm from determining that they wish to access the liquidity projected by the CSE's auction facility in providing execution services to their clients. The pricing advantages afforded the Market Maker under the proposal is an accepted means of encouraging larger guaranteed fill size and broader coverage of eligible stocks. These goals have been supported across a number of markets over the years with various advantages conferred on the firm providing the market making service. The CSE's approach is transparent, and can be managed by the sophisticated firms supplying liquidity to the alternative marketplaces operating in Canada.

Compliance with Ontario Securities Law

There will be no impact on the CSE's compliance with Ontario securities law. The changes do not alter any of the requirements for fair access or the maintenance of fair and orderly markets.

Consultation

The CSE has consulted extensively, including with current and prospective Market Makers and investment dealers executing agency order flow. Most dealers support the goal of assisting in the execution of agency orders in ways that encourage larger average trade size and overall improved execution quality, while limiting information leakage and potential "quote fade". The dealers also support the notion of achieving these goals through the use of price incentives, instead of through the introduction of complicated order types, speed bumps or separate and segregated books.

Technology Changes

The proposed pricing changes do not introduce any new technology changes. Dealers and vendors are capable of making the necessary change to either route to the CSE or route away based on routing preferences as they pertain to best execution requirements or a particular dealer's fee sensitivity.

Alternatives

As discussed under "Rationale and Analysis" and "Expected Impact", other Canadian marketplaces have sought to achieve the same goals through the introduction of separate books (with distinct fee structures). There has been little support in Canada from disinterested dealers for the introduction of new marketplaces where often, innovation is not enough and financial incentives must be provided. Furthermore, other exchanges and marketplaces have introduced new order types and features (like speed bumps) that require updates to specifications and considerable testing and expense for dealers and vendors. By using price methods to achieve similar goals, the expense of such technical change is obviated.

Other Markets or Jurisdictions

Both quote and order driven systems around the world have struggled to find ways to encourage market makers to increase their quoted size, while broadening the range of stocks covered by their liquidity provision efforts. The CSE has cited several examples, and is prepared to provide additional examples upon request. To summarize, these efforts have typically involved one or more of the following models:

• Participation preference for market makers on incoming marketable orders

• Pricing advantages or incentives over other resting orders in a book

• Protection against interaction with proprietary or other "non-natural" order flow

COMMENTS

Submit comments on the proposed amendments no later than August 2, 2016 to:

{1} Designated Securities must be priced $1.00 or higher per share and trade more than 750,000 shares per day on average over a six-month period. The list of Designated Securities is amended by the CSE as necessary and published and distributed on the CSE website.

{2} "Eligible agency orders" are client orders that are less than or equal to the Guaranteed Fill volume and are: not multiple orders for the same client on the same day, not entered by a DEA client (unless the DEA client is a broker acting as an agent for retail order flow), not entered for a U.S. dealer (unless it is confirmed it is for the U.S. dealer's client), and not from day traders. See Rule 4 -- 107 of the CSE's Trading Rules: http://www.thecse.com/cmsAssets/docs/Trading%20Rules/CSE%20RULE%204%20%E2%80%93%20Trading%20of%20Securities.pdf.

{3} http://www.tsx.com/trading/toronto-stock-exchange/fee-schedule.