OSC Staff Notice: 33-743 - Guidance on sales practices, expense allocation and other relevant areas developed from the results of the targeted review of large investment fund managers

OSC Staff Notice: 33-743 - Guidance on sales practices, expense allocation and other relevant areas developed from the results of the targeted review of large investment fund managers

OSC STAFF NOTICE 33-743

GUIDANCE ON SALES PRACTICES, EXPENSE ALLOCATION AND OTHER RELEVANT AREAS DEVELOPED FROM THE RESULTS OF THE TARGETED REVIEW OF LARGE INVESTMENT FUND MANAGERS

June 19, 2014

Purpose of this Notice

Staff of the Compliance and Registrant Regulation Branch (Staff or we) of the Ontario Securities Commission (OSC) recently conducted a targeted review or sweep of a sample of large investment fund managers (IFMs), based on assets under management. The reviews focused on the IFMs' compliance with Ontario securities law in key operational areas. This Notice provides a summary of our findings and related guidance.

We strongly encourage IFMs to use this Notice to improve their understanding of, and compliance with, applicable regulatory requirements. We also suggest that IFMs use this Notice as a self-assessment tool to strengthen their compliance with Ontario securities law and as appropriate, to make changes to enhance their systems of compliance, internal controls and supervision.

Background

In May 2013, we commenced targeted, on-site reviews of a sample of large IFMs to assess their compliance with securities law. The IFMs collectively had over $500 billion in assets under management at the time and manage a wide range of investment funds, including traditional mutual funds, pooled funds, exchange traded funds and closed end funds. As part of these reviews, we focused on key operational areas of the IFMs, such as:

• minimum working capital requirements and custody

• securityholder reporting/transfer agency

• trust accounting

• fund accounting

• oversight of service providers

• conflicts of interest

• sales practices

• overall compliance structure

In cases where the IFMs were dually registered or had an affiliated portfolio manager, we also performed testing of the portfolio management and trading activities in conjunction with the targeted review of large advisers being done at the same time.

Purposes of the sweep

The purposes of the sweep were to:

• use our oversight role to focus on IFMs who manage a significant portion of investment funds as a breakdown in their compliance structure or key operations could put investors and the capital markets at risk

• assess compliance of large IFMs with regulatory requirements and the adequacy of controls related to the key operations of their investment funds

• identify areas where additional guidance is needed

Major findings

Aside from the issuance of deficiency reports, the sweep did not result in further regulatory action on any of the IFMs reviewed. However, we identified areas where deficiencies were more prevalent and additional guidance is needed. These areas are discussed in dedicated parts below and include:

I. sales practices

II. allocation of expenses to investment funds

III. mutual fund borrowings

IV. prohibited cross trades

V. outsourcing and oversight of service providers

The guidance in large part is meant to assist IFMs in meeting their duty to act honestly, in good faith and in the best interests of their funds as required by section 116 of the Securities Act (Ontario). Many of the concepts related to some of the above topics, such as primary purpose and cost reasonableness, require judgment and can be interpreted differently within the existing legislation. We have tried to establish parameters around these concepts which best correlate with an IFM's standard of care.

We coordinated our review with staff in the Investment Funds branch to ensure consistent approaches in interpreting and applying the legislation.

We would also like to remind IFMs to review OSC Staff Notice 33-742 2013 Annual Summary Report for Dealers, Advisers and Investment Fund Managers and OSC Staff Notice 81-723 Summary Report for Investment Fund Issuers 2013 which contain information and guidance in other areas relevant to IFMs.

PART I -- Sales practices

Background

The purpose of Part 5 of National Instrument 81-105 Mutual Fund Sales Practices (NI 81-105) is to regulate the sales practices of industry participants in connection with the distribution of publicly offered securities of mutual funds to safeguard the interests of investors. As a result, NI 81-105 establishes a minimum standard of conduct to ensure that any compensation or benefits provided to participating dealers and their respective representatives are not in any way "excessive" or "extravagant" so as to improperly influence the selection of mutual funds for distribution by a representative to its clients.

In addition to the information contained in this Notice, IFMs should also refer to the guidance contained in OSC Staff Notice 11-760 Report on Mutual Fund Sales Practices Under Part 5 of National Instrument 81-105 (Staff Notice 11-760) which was based on the findings of a 2006 targeted review of sales practices and which continues to be relevant.

Scope and key findings

For the purposes of this sweep, we focused on the following areas of Part 5 of NI 81-105:

i) Section 5.1 -- Cooperative marketing practices

Section 5.1 permits IFMs to pay a portion of the costs of a sales communication, investor conference or investor seminar (collectively, cooperative marketing practices) that participating dealers organize and present to investors.

The major findings in this area, shown along with their incidence rate, were:

• cooperative marketing practices did not meet the primary purpose of promoting or providing educational information concerning a mutual fund, a mutual fund family or mutual funds generally in order to be eligible for support (25%)

• inadequate disclosure on cooperative marketing materials to indicate that the IFM paid for a portion of the costs of the cooperative marketing practice (25%)

• inconsistent application of the IFM's methodology to calculate primary purpose across all cooperative marketing practice requests (13%)

ii) Section 5.2 -- Mutual fund sponsored conferences

Section 5.2 outlines the conditions under which IFMs may provide a non-monetary benefit to a sales representative of a participating dealer to attend a conference or seminar organized and presented by the IFM.

The major findings in this area, shown along with their incidence rate, were:

• IFMs paid for expenses of the sales representatives, such as travel and accommodation, not permitted under section 5.2 (50%)

• the non-monetary benefits relating to the mutual fund sponsored conference, such as meals and entertainment, were excessive having regard to the purpose of the conference (25%)

iii) Section 5.5 -- Participating dealer sponsored events

Section 5.5 permits IFMs to pay a portion of the costs of conferences and seminars organized and presented by dealers (that are not investor conferences or seminars referred to in section 5.1), within certain parameters.

The major findings in this area, shown along with their incidence rate, were:

• IFMs provided support for dealer organized conferences which included amounts related to meals and entertainment that were excessive having regard to the purpose of the conference (25%)

• IFMs provided support for dealer organized conferences in excess of the 10% reimbursement limit of direct costs incurred by the dealer relating to the conference (25%)

iv) Policies and procedures related to sales practices

We also noted the following weaknesses with respect to IFMs' policies and procedures in this area:

• IFMs did not have adequate policies and procedures regarding sales practices (38%)

• IFMs did not adhere to their documented policies and procedures relating to sales practices (25%)

Guidance

Based on the above-noted findings, assessing primary purpose and the reasonability of costs associated with mutual fund sales practices are areas where IFMs can benefit from further guidance to encourage a more consistent application among industry participants to these otherwise subjective areas of Part 5 of NI 81-105.

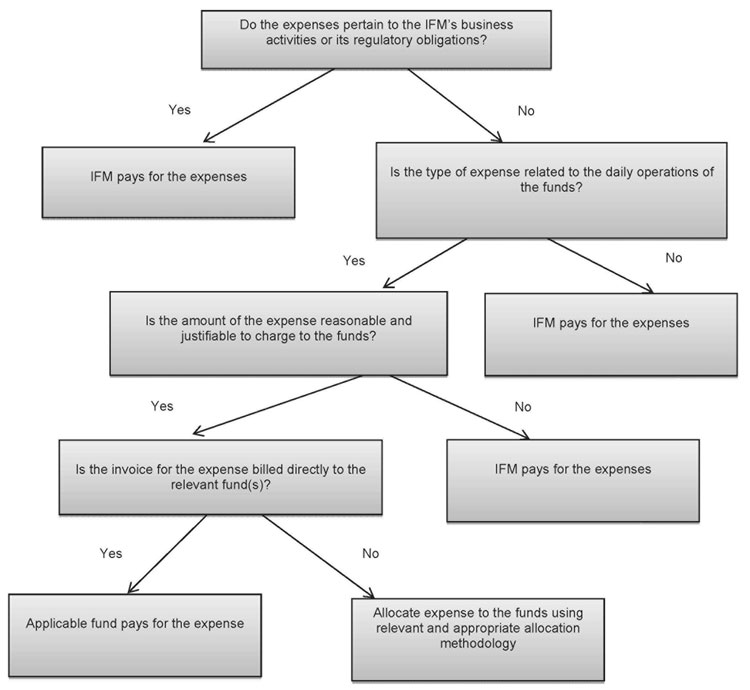

Please refer to Appendix A which provides a decision tree to assist in evaluating primary purpose and the reasonability of costs. These are also discussed separately in the sections below.

Assessing primary purpose

IFMs had challenges meeting the primary purpose test which is essential for deciding whether to accept or reject a cooperative marketing request, organize a mutual fund sponsored conference or provide monetary support for a dealer sponsored conference. Primary purpose also determines whether an IFM can pay for the cost of a sales representative to attend an industry association sponsored event or a third party sponsored educational event.

The main challenges for assessing primary purpose relate to the following:

• Content: The primary purpose test is based on specific topical content and is more restrictive in section 5.1 of NI 81-105 as compared to sections 5.2 to 5.5, which permit the primary purpose to include educational information on the broader topics of financial planning or investing in securities

• Time: NI 81-105 does not provide a prescribed percentage or bright line test to determine what amount of time must be allocated to appropriate content to meet primary purpose

Content and time are codependent in determining primary purpose as the content has to be evaluated not only on whether it is based on the provision of educational information, but also on the amount of time spent overall on appropriate content. Each is discussed in more detail below.

i) Content

The primary purpose of the sales practices in sections 5.1 to 5.5 must be the provision of educational information as set out in the table below (collectively, permitted topics):

| Section of NI 81-105 | Permitted topics |

| 5.1 - Cooperative marketing practices |

To promote or provide educational information concerning a mutual fund, a mutual fund family or mutual funds generally |

| 5.2 - IFM sponsored conferences |

To provide educational information about financial planning, investing in securities, mutual fund industry matters, a mutual fund, a mutual fund family or mutual funds generally |

| 5.5 - Dealer sponsored events |

|

| 5.3 - Third party sponsored events |

To provide educational information about financial planning, investing in securities, mutual fund industry matters, or mutual funds generally |

| 5.4 - Industry association sponsored events |

Since 2008, the OSC has granted relief, subject to several conditions, to IFMs who have made formal applications to expand the permitted topics set out in section 5.1 of NI 81-105. Initially, the relief permitted IFMs to sponsor the costs of cooperative marketing practices whose primary purpose is to provide educational information concerning tax and estate planning. More recently however, the OSC granted relief that further expanded the permitted topics to include the broader topic of financial planning.

To ensure compliance with the permitted topics and if applicable, any relief granted by the OSC, IFMs should review materials related to cooperative marketing practices, or other conferences and seminars for which their support is being sought under Part 5. This would include the final version of a sales communication and for conferences or seminars, the final agenda or program description and presentation materials. This will assist IFMs in ensuring that the content of the sales practice is consistent, in whole or in part, with the permitted topics.

The content of most sales communications under section 5.1 can likely be assessed for primary purpose from a quick visual review of the document breakdown. For seminars or conferences which also include non-permitted topics and recreational activities, an IFM should evaluate the amount of time spent on non-permitted topics and activities in relation to the event as a whole to determine whether the primary purpose test can still be met. This will be discussed in section ii) below.

Examples of non-permitted topics include, but are not limited to:

• business practice management sessions (selling mutual funds effectively, building/increasing book of business)

• motivational speakers

• award ceremonies

• sessions on general business operations

• time spent on recreational activities, such as golf, fishing or attending sporting events

ii) Time

We expect the time spent on permitted topics to be proportionate or exceed the amount of time spent on non-permitted topics and recreational activities. We encourage the use of a detailed and mathematical approach which objectively assesses the time spent on permitted topics in relation to the event as a whole because it can be applied consistently and is a verifiable method to determine whether the primary purpose test is met.

Although we recommend IFMs follow a mathematical approach, we acknowledge there are some areas in the time assessment where judgment is required, for example:

• Breakfasts, lunches and breaks during the conference may be excluded from the time assessment. However, if these are unusually long (i.e. a 3 hour lunch) or are incorporated as part of a wider non-permitted topic or recreational activity, these likely should be included as a non-permitted topic in the time assessment.

• The evaluation of time to determine primary purpose should focus on activities taking place during regular business hours. However, the totality of the event, including activities taking place after business hours, must still be considered when assessing the reasonableness of costs which is discussed in the next section.

Regardless of these guidelines, IFMs must still be mindful that if the dinner events or other forms of entertainment appear excessive in relation to the duration of the educational portion of the conference or seminar (for example, an entire day of golf during a two day event), or if the costs associated with these are excessive and unreasonable, this would not be consistent with meeting the primary purpose test.

For investor conferences or seminars under section 5.1 organized by a dealer for which an IFM is providing support, IFMs must confirm that the event is truly for educational purposes based on the amount of time spent on permitted topics. It may be difficult for IFMs to determine whether or not an investor seminar or conference crosses the line into a client appreciation event, which is not eligible for support, without obtaining adequate documentation from the dealer. IFMs must ensure that they receive sufficient information in order to evaluate whether the primary purpose test is met based on the amount of time spent on permitted topics.

Events which consist of only a short presentation related to mutual funds followed by a lengthy entertainment program would likely fall under the client appreciation category. Similarly, for IFM sponsored events under section 5.2, the overall objective of the event may be viewed as business promotion if the educational content is overshadowed by excessive recreational activities and free time.

Q&A

Q: A representative has requested cooperative marketing support for an investor conference. The details of the agenda submitted to the IFM include the following:

• 1 hour presentation by a portfolio manager on mutual funds

• Following the presentation, a sporting activity estimated to last a couple of hours where the portfolio manager will be available to speak with the dealing representatives on an informal basis.

Would this investor conference meet the primary purpose of providing educational information about mutual funds?

A: No. The duration of the recreational activity exceeds the one hour presentation provided by the portfolio manager. The portfolio manager's mere presence at the sporting event is not sufficient to conclude that the purpose of the entire event is for the provision of educational information. As a result, the time spent on non-permitted topics and activities exceeds the time spent on permitted topics. This event would be considered a client appreciation event which is not eligible for support under section 5.1 of NI 81-105.

Staff Notice 11-760 provides in-depth guidance on issues related to sales practices. The following guidance is meant to complement that notice based on the issues we identified during this sweep for evaluating whether an event contemplated in Part 5 of NI 81-105 meets the primary purpose test:

Suggested practices

We expect:

• IFMs to develop guidelines and internal percentage thresholds that are consistent and verifiable when evaluating the content of a sales communication, seminar, conference or other event to assess if it meets the primary purpose of providing educational information on the permitted topics prescribed in sections 5.1 to 5.5 of NI 81-105, as applicable

• IFMs to request sufficient and appropriate documentation to confirm that any sales communication, conference or seminar is sufficiently focused on permitted topics based on the allotted time and their internal guidelines and percentage thresholds. This should include:

• a copy of the final version of the sales communication or the final agenda for the investor conference or seminar (section 5.1)

• the agendas or program descriptions for events sponsored by third parties, industry associations or participating dealers (sections 5.3 to 5.5, respectively)

• For cooperative marketing practices, IFMs must ensure their full legal name appears in the sales communication or conference/seminar agenda and that clear language indicates that the IFM has paid for a portion of the cooperative marketing practice

• Documentation related to determining primary purpose must be maintained, with sufficient evidence of review and approval prior to the support being granted

• IFMs, at a minimum, to develop written policies and procedures which include

• the definition of primary purpose for each type of sales practice

• guidelines and internal thresholds that have been established

• procedures to review the costs, time and content of an event or sales communication prior to granting approval to determine if the primary purpose test is met, including the types of documentation that must be obtained for the review, the individuals that will provide approval and the type of evidence that should be maintained

(refer also to Appendix A of Staff Notice 11-760 for a more detailed listing of policies and procedures)

Reasonability of costs

The main issues identified during the sweep in this area related to:

• inadequate processes to ensure that the non-monetary benefits provided to investors or sales representatives attending a seminar or conference, whether organized by the IFM or a participating dealer, were not extravagant and were consistent with the spirit of NI 81-105

• the payment of prohibited expenses, such as travel and accommodation, of representatives attending an IFM sponsored event

Each of these issues will be discussed in sections i) and ii) which follow below.

The financial limitations of Part 5 of NI 81-105 are set out in the table below and serve as a starting point in assessing what costs are permitted and reasonable:

| Section of NI 81-105 | Financial limitation |

| 5.1 - Cooperative marketing practices |

All IFMs, in aggregate, cannot pay more than 50% of the total direct costs incurred by the dealer (for sales communication, investor conference/seminar) |

| 5.2 - IFM sponsored conferences |

IFMs cannot pay any travel, accommodation or personal incidental expenses for the attendee, and the costs must be reasonable having regard to the purpose of the conference |

| 5.3 - Third party sponsored events |

IFMs can pay the registration fees for attendees |

| 5.4 – Industry association sponsored events |

The IFMs in a mutual fund family in aggregate cannot pay more than 10% of the total direct costs incurred by the prescribed industry associations or their affiliates |

| 5.5 – Dealer sponsored events |

The IFMs in a mutual fund family in aggregate cannot pay more than 10% of the total direct costs incurred by the dealer and All IFMs, in aggregate, cannot pay more than 66% of the total direct costs incurred by the dealer |

Direct costs (as defined in section 1.1 of NI 81-105) may include:

• reasonable food and beverage costs

• reasonable entertainment costs

• conference room rental fees

• conference or seminar materials

• audio visual equipment costs

• printing costs

• advertising costs of the seminar or conference

• speaker fees and expenses

• event planning fees

but do not include costs such as:

• salary and overhead of the dealer

• travel, accommodation or personal incidental expenses of the dealer's sales representatives

• prizes or gifts, unless they are of nominal value

i) Reasonability of costs

Assessing the reasonableness of costs requires judgment. NI 81-105 does not provide a range or measure for firms to assess the reasonability of costs "having regard to the purpose of the conference or seminar." During our reviews, we looked at the totality of the costs associated with conferences or seminars and noted that the majority of the costs related to meals and entertainment and in particular, to costs that occurred after regular business hours. While this practice is not contrary to NI 81-105, staff was concerned that some IFMs lacked guidelines in terms of what an acceptable expenditure amount would be in these areas, particularly since this is where the majority of the money is being spent. Further, we found the costs of these meals and entertainment to be extravagant in some cases. For example, the cost per day for dinner and entertainment that we calculated in our sample of conferences and seminars ranged from less than $100 to well over $700 per person. While the latter seems completely extravagant and the former seems reasonable, we acknowledge that finding a balance is challenging.

IFMs must develop internal guidelines to assess and review whether the costs of meals and entertainment provided at conferences or seminars sponsored by them are reasonable having regard to the purpose of these events. Similarly, IFMs must also develop guidelines to use when reviewing the costs incurred by a participating dealer to organize an event under section 5.5 in which their monetary support is provided.

In developing these guidelines, IFMs need to look at these expenditures objectively and consider whether:

• the expenditures are necessary to achieve the objective of the conference or seminar,

• an outsider or an independent party such as the Independent Review Committee (IRC) of the funds would consider these costs excessive based on the venue selected or the type of entertainment being offered,

• there are alternatives that would be more reasonable and achieve the same purpose and outcome,

• investors would perceive the meals and entertainment or other non-monetary benefits being offered as excessive and not in line with the educational purpose of the event.

With respect to specific expenditures, the following should be considered by IFMs in establishing their internal guidelines on reasonability:

Food and beverages

• Develop an acceptable upper limit or range for

• the cost per meal per attending representative

• the daily average meal cost per representative

• the total food and beverage cost over the duration of the conference or seminar, as a percentage of the total event costs

• Criteria for the selection of venue that are consistent with cost reasonability

• The reasonableness of ancillary costs, such as decorations and table linens, associated with providing the meal above and beyond the cost of the food and beverages (Note: ancillary costs such as decorations and flowers must be included when assessing the cost of food and beverages)

Entertainment and promotional activities

• Develop an acceptable upper limit or range for

• the cost of the activity or entertainment per attending representative

• the cost of an activity in total for all representatives participating over the duration of the conference or seminar

• the total cost for all entertainment and activities over the duration of the conference or seminar, as a percentage of the total event costs

• Criteria to assess alternatives for entertainment and activities to ensure costs are reasonable and in line with the educational purpose of the event, taking into account factors such as the perception of excessiveness, the location of the activities and the ease of access to these events. For example, hiring a local performer rather than a well-known celebrity or providing tickets to a regular season sporting event rather than a play-off game would be valid alternatives that can be evaluated based on established criteria.

Gifts

• Dollar limit on the value of a gift per representative and the amount that may be spent on a representative on an annual basis

• Is the limit consistent with the gift being of nominal value and promotional in nature?

• Is the gift required for the effective and efficient execution of the conference or seminar?

Q&A

Q: As a door prize at our IFM sponsored conference, we would like to offer prepaid Visa gift cards of a nominal value. Would this be contrary to NI 81-105?

A: Although the value is nominal, these prepaid cards are not promotional in nature and are in substance, a cash gift to the recipient which is inconsistent with the requirement that the items be non-monetary in nature. Other gifts that are equivalent to a cash gift should also not be offered to sales representatives, such as other types of gift certificates and casino chips.

If these prizes are offered as part of an investor conference or seminar of a participating dealer, IFMs must scrutinize the expenses submitted by the participating dealer to ensure such costs are not included as part of the direct costs of the seminar or conference for which support is being sought.

We would also like to highlight the guidance found in subsection 7.3(1) of Companion Policy 81-105CP Mutual Fund Sales Practices (81-105CP) in relation to the provision of entertainment and gifts to representatives during IFM sponsored conferences which states:

The term "reasonable" costs would not include gifts or entertainment provided to attendees other than as permitted by section 5.6 of the Instrument.

IFMs can provide gifts and entertainment to representatives attending IFM sponsored conferences provided that the value of the gifts and entertainment are in compliance with section 5.6 of NI 81-105. As a result, the provision of gifts and entertainment must not be so extensive so as to cause a reasonable person to question whether the provision of the gifts and entertainment would improperly influence the advice provided by the representative to its clients.

A number of IFM firms set a limit per representative that can be spent on gifts and entertainment on an annual basis under section 5.6 of NI 81-105.

Q&A

Q: As an IFM, we have an annual limit of $1,500 per representative to be spent on promotional items and business promotion activities. We would like to take a group of representatives to a play-off sporting event. Based on the cost, the entire limit per representative would be spent on this one time sporting event for the cost of the ticket and a limousine ride to the arena. Would this be contrary to NI 81-105?

A: Yes, the spending of the entire limit on a representative at one time would be considered excessive and therefore unreasonable under section 5.6 of NI 81-105. You should establish dollar limits per year, and per event, that may be spent on promotional items and business promotion activities for dealing representatives. Furthermore, the provision of a limousine ride to the event is considered to be a travel expense that is strictly prohibited under paragraph (b) of section 5.6 of NI 81-105.

The following guidance is suggested for assessing the reasonability of direct costs:

Suggested practices

We expect:

• IFMs to develop internal policies and procedures to determine the reasonability of the cost of food, beverages, gifts, entertainment and promotional activities provided to representatives during mutual fund sponsored conferences, or to be paid to dealers for conferences or seminars which they sponsor and for which support is being sought. The policies and procedures should include, at a minimum:

• Internal parameters on what is considered a reasonable amount for each type of non-monetary benefit

• Factors to consider when determining reasonability, such as the location of the event, whether it's a specialty event or a routine event or time of year the event is held and how these factors should be addressed

• The type of documentation required to assess reasonability, including detailed invoices, receipts and budgets

• The individual(s) responsible for assessing reasonability and providing documented approval of expenses

• The involvement of the IRC in evaluating sales practices for reasonability

• IFMs to maintain evidence of their reasonability assessment and the review and approval of the non-monetary benefit, including how the choice to provide one non-monetary benefit over another was determined

• Prior to providing monetary support, IFMs to exercise reasonable diligence to confirm that costs indicated on invoices or receipts received from participating dealers represent direct costs that are reasonable under the circumstances

ii) Prohibited expenses

Section 5.2 of NI 81-105 explicitly prohibits an IFM to pay any travel, accommodation or personal incidental expenses for sales representatives attending its sponsored conferences. Furthermore, an IFM cannot indirectly pay for prohibited expenses by subsidizing a portion of these costs and/or applying savings in a permissible area to cover a prohibited expense. For example, an IFM cannot pay for bus transportation from the airport to the hotel and then charge the attending representatives a reduced rate on that transportation. Similarly, an IFM cannot pay the hotel for room upgrades for each attending representative and then recover the cost through a discount offered on hotel catering services.

Further guidance on prohibited expenses is provided in subsection 7.1(1) of 81-105CP and these expenses are also outlined below. We noted that some IFMs were paying prohibited expenses on behalf of attending sales representatives.

Travel

The following expenses are not acceptable for the IFM to pay:

• Airfare or the payment of any other form of transportation

• Transportation to and from the airport to the hotel

• The payment of a car rental fee, parking expenses, gas, or mileage in relation to a car used by a representative during the conference

• Transportation from the location of the conference and/or the representative's hotel (if not the same location as the conference) to dinners during the conference

Q&A

Q: As an IFM, our conference will include a dinner where there will be alcoholic drinks available with dinner. Can we cover the travel expenses of the sales representatives of participating dealers incurred to travel from dinner back to the hotel and remain in compliance with NI 81-105?

A: Yes. Although the payment of costs associated with travel to dinner is not permissible, the payment of travel from dinner back to the hotel is allowed in light of the risk associated with the consumption of alcohol. While it would be prudent for a concerned IFM to mitigate these risks by serving limited or no alcohol, or advising those dealing representatives that they must pay out of pocket for alcohol, we acknowledge that IFMs may be exposed to a potential liability as a result of sponsoring an event where alcohol is permitted and no mode of transportation is offered to ensure safe arrival back at their hotel or home. As a result, we consider this travel cost to be permissible, as long as the cost is reasonable. For example, providing a multi-passenger vehicle or taxi chits to attendees would be considered reasonable while the use of a luxury limousine would be excessive.

Accommodation

The accommodation costs of a representative attending an IFM sponsored conference are not an expense that can be paid for by an IFM. This includes hotel expenses of the attending representative and any guests of the attending representative during the conference. In addition, an IFM cannot pay for an upgrade for the accommodation of the representatives. Any upgrade must be paid for by the representative directly or the representative's participating dealer.

Personal incidental expenses

The payment of personal incidental expenses incurred by a representative during the course of a conference is not allowed to be covered by the IFM. Examples of personal incidental expenses include:

• Car rental

• Parking fees, including valet parking

• Costs related to room service charges or other hotel services

• Costs incurred by a guest accompanying an attending representative related to any of the above

Suggested practices

For events that are sponsored by a dealer under section 5.1 or section 5.5, the IFM should, prior to providing monetary support:

• Obtain invoices with sufficient detail of the costs for which reimbursement has been requested and assess if the actual expenses represent direct costs as defined in section 1.1 of NI 81-105, rather than prohibited costs listed in subsection 7.1(1) of the 81-105CP

• A dealer requesting financial support for a sales practice under NI 81-105 must provide an IFM with enough information to enable the IFM to determine eligibility and compliance with NI 81-105

For all types of events contemplated under Part 5, we expect the IFM to

• Develop internal guidelines as part of the IFM's policies and procedures manual that outline permissible costs and develop a list of expenses that cannot be covered for sales representatives under any circumstance

PART II -- Allocation of expenses to investment funds

Our review of fund expenses during the sweep did not indicate any significant issues in this area. However, some IFMs expressed that additional guidance in this area would be helpful to assist them in enhancing their fund expense allocation methodology. IFMs have a duty to act honestly, in good faith, and in the best interest of the investment funds. IFMs should be able to demonstrate that the allocation of expenses is not inconsistent with their duty of care and that they are not putting their own interests ahead of those of the fund and its securityholders. The amount of the expenses charged to the funds has a direct impact on the management expense ratio (MER). IFMs monitor the funds' MERs closely to ensure the funds remain competitive.

There is an inherent conflict of interest in fund expense allocation. IFMs must bring conflicts of interest matters to the IRC. Materials provided to the IRC should contain sufficient details for the IRC to review and assess the matters thoroughly prior to making any recommendation. With respect to the fund expense allocation policy, an IFM should provide the IRC with a detailed list that itemizes all types of expenses to be allocated to its investment funds. In the discussion with the IRC, IFMs should also highlight expense items that are considered contentious in relation to their necessity for the daily operation of the funds, that are payable to a related party service provider or are unique to their business operations. Ultimately, any expenses allocated to the funds should relate to the daily operation of the funds and be reasonable and justifiable.

Allocation models

Accumulating the appropriate expenses and allocating them to the investment funds using a sound methodology is a time consuming and challenging task depending on the expense model that is chosen by the IFMs. Some expense models are relatively easy to apply, for example, the fixed rate administration fee{1} or the operating expense subject to a cap{2} model. Other models require the IFMs to exercise judgment to determine:

• the appropriate types of expenses that may be eligible for allocation

• the appropriate method to equitably allocate these expenses to the investment funds, ensuring that the amount of expenses allocated to each fund is in proportion to the services provided to the fund

Types of expenses

i) Expenses of an IFM

Expenses related to the operations and conduct of an IFM should be borne by the IFM and should not be allocated to the funds. An IFM directs the business, operations or affairs of an investment fund. Its major roles and responsibilities include:

• maintaining proper registration for the firm, the ultimate designated person (UDP) and the chief compliance officer (CCO)

• developing a system of compliance and controls, along with on-going monitoring and supervision, that covers all relevant areas of the IFM's business operations whether the functions are done in-house or by third-party service providers

• ensuring compliance with securities law and meeting all regulatory obligations

• establishing the firm's infrastructure and hiring qualified personnel

• entering into agreements with portfolio managers, custodians or third-party service providers

• establishing a distribution network for the investment funds by entering into distribution agreements with registered dealers and providing them with adequate and appropriate information

• promoting the investment funds

Expenses incurred by the IFM to fulfill its roles and responsibilities and to ensure the proper conduct of the firm and the investment funds with regulatory obligations should be paid for by the IFM. Further, the IFM earns a management fee paid by the investment funds to carry out its roles and responsibilities. The purpose of the management fee is to cover expenses related to the IFM's business activities.

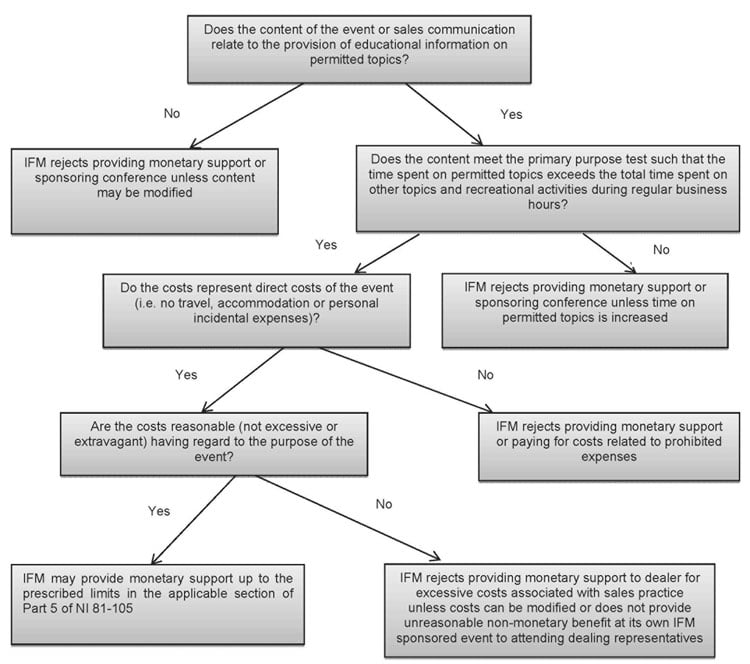

Please refer to Appendix B of this Notice for a decision tree that assists in determining whether an expense item should be paid for by the IFM or allocated to its investment fund(s).

Q&A

Q: As an IFM, I will need to make system changes to produce the information required under CRM2 Amendments by July 15, 2016. How should I treat the costs incurred to make these system changes?

A: Providing the necessary information to registered dealers who distribute your investment funds is an obligation of the IFM. You should account for the costs associated with the system changes as part of your operating expenses and you should not allocate these expenses to the funds.

Q&A

Q: Our firm is currently going through the process of hiring an employee for our fund accounting group. We have engaged a search firm to assist us in this process. Can we charge the hiring expenses associated with this employee to the funds that we manage?

A: No. IFMs have a responsibility to establish the infrastructure for the daily operation of their funds to ensure compliance with securities law, including the hiring of staff. As a result, any expenses incurred for the hiring of this employee, such as the use of a recruiting firm, should be borne by the IFM and not the funds. Until this employee has commenced work at the IFM, there is no involvement with the daily operation of the funds.

However, a fund can be allocated salary and benefit costs that are part of a reasonable compensation package for employees whose jobs are directly related to the daily operation of the fund.

Q&A

Q: How do we treat the costs associated with our compliance department? While the compliance personnel ensure our IFM business is compliant with the requirements under securities laws, including NI 31-103, they also spend time on product-related compliance, such as dealing with certain requirements in NI 81-102. It would seem appropriate that some of these compliance costs be allocated to the investment funds.

A: The wide range of expenses incurred in managing investment funds, as well as the lack of specific disclosure regarding expense allocation provisions in the funds' offering documents, often result in varying interpretations by IFMs on which types of expenses should be allocated to the funds. IFMs should consider all expense allocation decisions in conjunction with their duty to act in the best interests of their funds and any excessive or unreasonable allocations to their funds may constitute a breach of this duty.

With that principle in mind, costs associated with ensuring compliance with securities law and meeting regulatory obligations, such as the salaries of dedicated compliance staff and any overhead allocated to that department, should generally be considered an expense of the IFM. We acknowledge that the compliance structures at IFMs vary greatly in size and nature, may include multiple layers and that there may be overlap across other departments in performing compliance-related duties. Accordingly, IFMs should consider their contractual agreements with the funds, the advice of the IRC and its disclosure in the offering documents if considering the allocation of certain compliance costs to their funds.

Compliance costs related to NI 31-103 clearly belong with the IFM. NI 31-103 deals primarily with firm conduct and a firm's regulatory roles and responsibilities and these are obligations that can only be met by the IFM. NI 31-103 requires each registrant to establish a system of compliance and controls, along with on-going monitoring and supervision, over all relevant areas of its business operations. This would include its fund operations and the related compliance costs of complying with product-specific legislation. The investment funds are already paying a management fee to the IFM that arguably covers these compliance and oversight expenses.

Using NI 81-102 as an example, many of the compliance-related costs are already linked to the management fee being paid by the fund. The revenue of an IFM is dependent on the proper operation of its mutual funds in compliance with applicable product regulation. Failure to do so would result in the inability to offer the product to the public. Mutual fund sales communications that are effective and compliant with legislation assist in growing the funds' assets under management which in turn, impact management fee revenues. Also, the product-related investment restrictions in NI 81-102 are managed by the portfolio manager (PM) who is being compensated out of the management fee to ensure that the funds are managed in accordance with their stated investment objectives and regulatory restrictions. A PM firm would not invoice an advisory client an additional amount for ensuring compliance with its PM mandate and the same logic would apply to an IFM in relation to its investment fund product. In addition, where the IFM and PM are not the same entity, the IFM has an obligation to oversee the PM as part of its oversight of service providers and should bear this cost.

ii) Expenses of an investment fund

Only expenses that are related to the daily operations of the investment funds should be allocated to the investment funds. Expenses that investment funds incur on a daily basis can be grouped into three main categories as follows:

Direct expenses

We consider direct expenses to be expenses that can be directly linked to the investment funds. Examples of direct expenses may include expenses related to prospectus or other continuous disclosure filings, audit, legal, securityholder reporting, trading and brokerage, IRC and custodial fees. In most cases, these expenses are supported by invoices that provide a breakdown of the expenses on a fund-by-fund basis.

Fees paid to service providers for outsourced functions

IFMs may outsource certain functions to third-party or related service providers, such as the net asset value calculation or securityholder record keeping. These functions pertain to the daily operations of the investment funds and may be paid for by the investment funds. Unlike direct expenses, invoices submitted by third-party service providers may not include a breakdown of the fees associated with each fund. Accordingly, the IFM will need to allocate these costs to the funds using an appropriate cost driver -- see discussion on Allocation of fund expenses.

Expenses incurred for functions performed in-house

IFMs that choose to administer the key business activities of their investment funds internally must develop a method to determine how to allocate the correct amount of these expenses to their funds. Some IFMs establish departments or cost centres for each function to clearly identify the expenses that are associated with the employees who are fully or partially dedicated to providing services to the funds. Similarly, the portion of expenses such as rent, office supplies, photocopier fees and telephone and internet charges that can be allocated to that department must be determined.

IFMs must critically assess and determine which expense items from the department should be included in the pool of expenses for allocation to the various funds. The expenses allocated must be directly related to the operations of the fund.

IFMs are responsible for ensuring that they obtain the best commercially available prices for the services used by their funds. If the provision of certain fund functions in-house is more cost favorable to a fund than outsourcing these functions, the difference in cost cannot be charged to the fund and retained by the IFM in addition to the management fees charged. This type of practice is contrary to an IFM's duty and responsibilities.

Q&A

Q: Our firm currently performs the fund accounting, trust accounting and securityholder recordkeeping internally. As a result, we have saved our funds a total of $100,000 which would have been the additional cost to the funds to hire a third party service provider to provide these services. What amount should we charge the funds for these services? The internal cost or the cost that we would have paid the service provider and then retain the difference as another fee paid to us as the IFM of our funds?

A: As the IFM of the funds, you have a responsibility to act in the best interest of the funds and secure the best commercially viable arrangements for the funds you manage. You determined that the best arrangement for your funds was to provide these services in-house and chose to do so. Therefore, the cost charged to the funds should be the cost of providing these services internally. It would be contrary to your duty as an IFM to charge your funds the third party rate and keep the difference as an extra fee for your services.

Furthermore, allocating and charging the funds for the costs associated with providing these services in-house is a conflict of interest matter that needs to be referred to the IRC.

Q&A

Q: We organized a party for an employee in the fund accounting department. Would it be appropriate to include this cost as part of the fund accounting department expenses that are allocated to the funds?

A: No, these expenses are to be paid for by the IFM, not the funds. As a guideline, expenses that do not in any way impact the operation of the funds, such as the social event described above, costs related to landscaping, design or general maintenance of the office and gifts to staff need to be paid for by the IFM and not be allocated to the funds.

Q&A

Q: Our firm is both the IFM and the PM of our investment funds. We subscribe to a number of research materials to assist us in our research and analysis which is part of the investment decision making process. Can we charge the subscription fees to the investment funds?

A: No. A PM manages the investment portfolios of the funds in return for an advisory fee as specified in the advisory agreement. Expenses incurred for the PM's research and analysis, or other costs associated with managing the funds' investment portfolios, are paid for by the PM because they are part of the costs of operating the PM's business. The answer may be less obvious when the firm has more than one role, i.e. being the IFM and PM. An IFM should consider whether it would pay for the subscription fees if the PM was a separate, unrelated entity. Since the PM is already compensated through its advisory fee which in turn, is paid out of the management fee collected from the funds, the IFM would not pay for the subscription fees.

Q&A

Q: Our firm is solely registered as an IFM and manages investment funds on a daily basis. The key operating activities for the funds, including fund accounting, trust accounting and securityholder recordkeeping, are performed in house. Can we charge the entire amount of the office rent expense and telephone and internet charges to the investment funds that we manage?

A: No, it would not be appropriate to charge 100% of the rent, telephone and internet charges or other common expenses to the funds that the firm manages. In addition to managing the funds on a daily basis, the IFM also conducts other duties that are not necessarily related to running the funds on a daily basis. For example, staff from the wholesale and compliance teams of the IFM also occupy office space and use the shared services such as the telephone and internet on a daily basis. As a result, the IFM should be charging a portion of the rent and telephone and internet charges to the funds and the IFM, respectively, based on a reasonable allocation methodology that appropriately reflects the usage of these shared costs.

Q&A

Q: We have a number of employees who divide their time between the IFM business and the investment funds as follows:

1) UDP -- reviews financial statements and management reports of fund performance of the investment funds; meets with the CCO regarding compliance updates and compliance issues; sits on the Board of Directors of the IFM.

2) Controller -- responsible for entries and the review of the general ledger and the preparation of the financial statements of both the investment funds and the IFM.

3) Financial analyst -- responsible for calculating management fees and MERs of the funds; aids the controller in compiling the financial statements of the funds and the IFM.

Can we charge the entire salaries and bonuses for these individuals to our funds?

A: No. If you would like to charge a portion of these salaries to the funds, you need to make an assessment of how much time is spent by these individuals on performing tasks related to the funds as compared to time spent on IFM matters, and allocate the salaries accordingly.

Time that is spent on the business of the IFM and ensuring its investment funds comply with applicable legislation is more appropriately allocated to the IFM. In the examples noted above, this would include the UDP's time spent on compliance matters and sitting on the Board. Similarly, the amount of time spent by the controller and the financial analyst on the financial statements and general ledger of the IFM can be charged to the IFM.

Where the duties of these employees are related to calculating management fees and MERs of the funds and preparing the funds' continuous disclosure documents, these costs may appropriately be charged to the funds.

Allocation of fund expenses

Once it is determined which expenses are attributable to the daily operation of the funds, an IFM must establish a process to determine the allocation of these expenses to the various funds. The allocation is straightforward when invoices provide a breakdown of the expenses on a fund-by-fund basis. Expenses that relate to multiple funds that cannot be directly linked to a particular fund based on an invoice should be accumulated and allocated to funds using relevant and appropriate factors. We have noted that IFMs use one or more factors to determine the expense allocation, including but not limited to:

• assets under management

• the number of securityholders

• the fund's mandate

• the number of classes/series in a fund

The decision on how to allocate an expense to a fund should be linked to how the expense is being charged (i.e. the cost driver), which in most cases will have a direct relationship with the time and effort spent on each fund by the external party providing the service or by the in-house department. IFMs should inquire of the service provider how the fees are being determined when negotiating the agreement with them. For in-house departments, IFMs generally keep track of the number of hours or the percentage of time spent on the funds per department, or use one of the above factors as a proxy to divide the time spent among the various funds. The allocation of the departmental expenses to each fund is then based mainly on the level of usage by the fund of that department's services.

Q&A

Q: Our firm is considering streamlining our fund expense allocation methodology to use only one factor to allocate all types of expenses to our funds instead of our current approach of using different factors. Is this change appropriate?

A: No. While it may be easier to allocate expenses to the funds using only one allocation factor, it is unlikely that this is an appropriate method to allocate fund expenses. There are many types of fund expenses that can be allocated to the funds and they usually do not correlate with one common factor. For example, securityholder reporting expenses tie closely with the number of securityholders, whereas the costs of calculating the net asset values (NAV) of the funds would have no direct relationship with the number of securityholders. As such, it is not appropriate to allocate both securityholder reporting expenses and expenses relating to the NAV calculation by using the number of securityholders as a common factor. Ultimately, your firm must determine the appropriate allocation factor(s) based on your knowledge of the cost driver of each expense item.

Disclosure in offering documents

Disclosure made in the funds' offering documents on fees and expenses should be clear and contain an appropriate level of detail to allow securityholders to fully understand the types of fees and expenses that are charged to the investment funds. IFMs should avoid using general or collective terms such as "administration costs" or "operating costs" to describe a group of expenses. The disclosure could be enhanced by providing a further breakdown to indicate what these expenses are, resulting in better and more meaningful disclosure.

For further guidance on disclosure, please refer to OSC Staff Notice 81-724 Report on Staff's Continuous Disclosure Review of the Fees and Expenses Disclosure by Investment Funds issued by the Investment Funds branch.

Documentation and periodic assessment

IFMs must maintain adequate documentation to demonstrate their rationale and the analysis performed in the development of their fund expense allocation policy. The documentation needs to support the methodology chosen, and demonstrate that the expenses allocated to the funds are reasonable, fair, and in the best interests of the funds. The policy should be reviewed at least on an annual basis or more frequently whenever there are changes in the IFMs' business activities or operations.

Suggested practices

We expect IFMs to establish and enforce written policies and procedures that include, at a minimum, the following:

• procedures to develop internal criteria and processes to identify and assess which expense items are related to the daily operations of the funds

• procedures to independently review expenses charged to the funds for appropriateness and accuracy, keeping in mind the internal criteria

• procedures to ensure that adequate controls are in place to review and approve invoices before they are processed for payment

• procedures to ensure that only those expenses disclosed in the offering documents are charged to the funds

• procedures to ensure that policies on fund expenses are up-to-date and where established, approved by the funds' IRC

IFMs should also develop and document procedures used to budget and accrue for expenses in the funds, for example:

• procedures to prepare and approve the funds' budgets at the beginning of each fiscal year to ensure that only reasonable and appropriate expenses will be charged to the funds

• procedures to monitor accrued amounts versus actual amounts on a periodic basis and guidelines on when an adjustment to the accruals should be made

When allocating expenses to the funds, we expect IFMs to:

• document the method used and maintain documentation on the rationale and analysis performed to support the chosen method

• determine the appropriate factors to be used for the allocation and how they are applied for each type of expense

• confirm the allocation method is fair and reasonable to all funds

PART III -- Mutual fund borrowings

Sub-paragraph 2.6(a)(i) of National Instrument 81-102 Mutual Funds (NI 81-102) states that a mutual fund shall not borrow cash or provide a security interest over any of its portfolio assets unless the transaction is a temporary measure to meet redemption requests, or to permit the mutual fund to settle portfolio transactions, and the outstanding amount of all borrowings of the mutual fund does not exceed five percent of its NAV at the time of the borrowing.

We noted two issues in this area:

i) Interpretation of the term "all borrowings"

During our reviews, we noted that some IFMs were calculating "all borrowings" in a mutual fund as the total of all its borrowings netted against its available cash balances for all the bank accounts of the mutual fund, rather than the sum of all borrowings of the mutual fund.

Under NI 81-102, mutual funds are not allowed to borrow except under the very limited circumstances outlined in the instrument. Consequently a strict and plain meaning interpretation to the borrowing provision should be applied. Accordingly, in the absence of any reference to "net borrowings" in NI 81-102, it is inappropriate to use excess cash in the bank accounts of the mutual fund to offset the total amount of a mutual fund's borrowing in account(s) where there is a balance owing. Until borrowed monies are actually repaid, those amounts are still outstanding and must factor into the "outstanding amount of all borrowings" as described in NI 81-102. Accordingly, the absolute sum of all borrowings of the mutual fund must be used when monitoring compliance with the borrowing provision.

ii) Mutual funds borrowed in excess of 5% of their NAV

We identified IFMs with overdraft positions in their mutual funds' bank accounts in excess of the prescribed 5% of NAV limit in NI 81-102. This was also noted in some IFMs that were incorrectly netting the borrowings in the accounts of a mutual fund against cash balances in other bank accounts of the mutual fund which in effect, reduced the amount of the borrowings that should have been used to monitor the 5% limit.

Q&A

Q: One of our funds had a series of net redemptions this month which rendered the fund's bank account in an overdraft position for the entire month. Each overdraft was temporary in nature and it was corrected either in the following day or the day after. A new overdraft occurred due to redemption requests received in the following day. Are we in compliance with sub-paragraph 2.6(a)(i) of NI 81-102?

A: No. Sub-paragraph 2.6(a)(i) of NI 81-102 states that a mutual fund shall not borrow cash unless the transaction is a temporary measure to meet redemption requests. It is not a temporary measure when the fund was in a continuous overdraft position over a prolonged period of time. The IFM, together with the PM of the fund, should review and re-evaluate the cash position of the fund to ensure that it is adequate to meet redemption requests going forward.

Suggested practices

• IFMs need to establish an appropriate cash management process, including:

• procedures over the settlement of securityholder trades to ensure that these are communicated to portfolio managers in a timely manner

• procedures to sell investments in the fund's portfolio in the most favorable manner and minimize the likelihood of the fund going into an overdraft position

• IFMs must regularly monitor their mutual funds to ensure there is no overdraft position and to make certain that overdrafts, if they occur, are temporary and quickly resolved

• Overdraft positions should be reported to senior management, including the CCO, along with a description of the cause of the overdraft, impact of the overdraft (e.g. interest expense) and corrective actions to be taken to prevent an overdraft from recurring

PART IV -- Prohibited cross trades

As part of our IFM reviews, we do not typically review trading activities relating to the funds' investment portfolios. However, during this sweep, if the IFM or one of its affiliates was also a registered adviser, we reviewed certain trading activities.

During our reviews, we noted that prohibited trades occurred between the investment funds advised by the firm ("inter-fund trades") or between investment funds and other managed accounts of the firm, collectively referred to as cross trades.

Clause 13.5(2)(b)(iii) of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations (NI 31-103) prohibits an adviser from knowingly causing any investment portfolio it manages, including an investment fund, to purchase or sell a security from or to the investment portfolio of another investment fund for which a responsible person acts as an adviser.

Section 6.1 of National Instrument 81-107 Independent Review Committee for Investment Funds (NI 81-107) permits inter-fund trades that would otherwise be prohibited under NI 31-103 if certain conditions are met, including the approval or standing instruction by the funds' IRC. In the cases noted during our reviews, the inter-fund trades were not permissible under either NI 81-107 or NI 31-103.

Suggested practices

We expect IFMs to

• be aware of conflict of interest matters and refer them to the IRC where the funds are reporting issuers

• perform oversight of the funds' trading activities, whether performed in-house or outsourced

• confirm all inter-fund trades are permitted under NI 81-107 and have met all the conditions in section 6.1

• seek regulatory exemptive relief to permit the execution of cross trades between investment funds that are otherwise prohibited

IFMs should also refer to section 13.5 of the Companion Policy 31-103CP Registration Requirements, Exemptions and Ongoing Registrant Obligations (31-103CP), under the heading "Restrictions on trades with certain investment portfolios", for guidance on prohibited inter-fund trades.

PART V -- Outsourcing and oversight of service providers

During our reviews, some IFMs expressed that additional guidance in the area of outsourcing would be helpful to assist them in enhancing their oversight procedures. Many IFMs outsource certain aspects of their IFM operations (such as fund accounting, trust accounting and transfer agency) to service providers.

During the reviews, we noted that the service provider typically used by an IFM is either a third party service provider or a related legal entity within the IFM's overall corporate group. It is our expectation that at least the same level of oversight should be performed on a related service provider by the IFM as that performed on a third party service provider. The IFM should also compare the fees charged by a related service provider to those charged by a third party to ensure the selection of a service provider is in the best interests of the funds, with referral of the matter to the IRC for consideration.

In addition, some firms which operate globally centralize certain functions of their IFM operations in order to achieve cost effectiveness and efficiency. Although we do not have issues with this business practice, we do expect that the Canadian compliance department of the IFM oversees the centralized function, as it would any service provider, and confirms that there is a robust process in place to obtain assurance that all requirements under Canadian securities laws are being adhered to.

Section 11.1 of NI 31-103 requires IFMs to establish a system of controls and supervision to ensure compliance with securities legislation and to manage their business risks in accordance with prudent business practices. Part 11 of 31-103CP, under the heading General business practices -- outsourcing, states that registrants that outsource aspects of their business operations to third-party service providers are responsible and accountable for all functions that have been outsourced. An IFM is required to oversee its service providers in order to meet its obligation of being responsible and accountable for the work performed by the service providers.

Please refer to the suggested practices that were included in OSC Staff Notice 33-742 2013 Annual summary Report for Dealers, Advisers and Investment Fund Managers to provide IFMs with additional guidance regarding the monitoring of service providers.

Conclusion

This sweep enabled staff to focus on IFMs who are responsible for directing the business, operations and affairs of a significant segment of the industry's investment funds. This was an important step in evaluating the compliance systems of registrants who have a major impact on the capital markets. In addition, the results of the sweep highlighted areas where further guidance is needed. We hope that the guidance in this Notice, as well as other guidance referred to in this Notice, are helpful to registrants in meeting their regulatory obligations. Registrants should use this Notice as a self-assessment tool to assess their practices in the highlighted areas and to determine if changes are required.

Questions

If you have any questions regarding the content of this Notice, please refer them to any of the following:

Noulla Antoniou, Senior AccountantCompliance and Registrant RegulationTel: (416) 595-8920Email: [email protected]Jessica Leung, Senior AccountantCompliance and Registrant RegulationTel: (416) 593-8143Email: [email protected]Merzana Martinakis, Senior AccountantCompliance and Registrant RegulationTel: (416) 593-2398Email: [email protected]Estella Tong, Senior AccountantCompliance and Registrant RegulationTel: (416) 593-8219Email: [email protected]

{1} The IFM is responsible for most of the expenses of the fund in return for an annual administration fee calculated by applying a fixed percentage to the fund's assets under management. The rate is disclosed in the fund's offering documents.

{2} The IFM applies a fixed basis point rate, a cap, to cover the fund's actual operating expenses instead of accumulating and allocating the expenses to the fund. It is called a cap because the rate is typically lower than what the IFM would have charged if actual operating expenses were allocated. IFMs should review and assess the cap periodically to ensure the cap rate is not higher than the actual expenses. The cap is done at the discretion of the IFM, who has no obligation to cap the operating expenses of the funds.

APPENDIX A

Decision Tree -- Part 5{3} of NI 81-105

{3} The decision tree applies to parts 5.1 (cooperative marketing practices), 5.2 (IFM sponsored conferences) and 5.5 (dealer sponsored conferences) of NI 81-105 as these areas were the scope of our review.

APPENDIX B

Decision Tree -- Expense allocation