CSA Staff Notice 21-319 Data Fees Methodology

CSA Staff Notice 21-319 Data Fees Methodology

CSA Staff Notice 21-319

Data Fees Methodology

December 8, 2016

Introduction

On April 7, 2016, the Canadian Securities Administrators (the CSA or we) formalized a Data Fees Methodology to provide a transparent process for regulatory oversight of real-time professional market data fees.{1} The Data Fees Methodology estimates a fee range that reflects each marketplace's contribution to price discovery and trading activity.

The Data Fees Methodology had been used by Ontario Securities Commission Staff prior to its formal adoption by the CSA.

The text of this CSA Staff Notice is available on the websites of the CSA jurisdictions, including:

Purpose

The purpose of this notice is to provide marketplaces and marketplace participants with information about the scope, application, implementation and use of the Data Fees Methodology. The Data Fees Methodology is attached as an appendix to this CSA Staff Notice.

Regulation of Data Fees

The regulatory framework in Canada governs the manner in which exchanges and alternative trading systems (ATSs) conduct their business and set fees, and how marketplace participants access real-time market data.

The initial and ongoing regulatory filing requirements for the operation of marketplaces are found in sections 3.1 and 3.2 of National Instrument 21-101 Marketplace Operation (NI 21-101). Section 10.1 requires marketplaces, which includes exchanges and ATSs, to disclose the fees charged for their services, including their market data fees, in Appendix L to the exchange's or ATS's Form 21-101F1 Information Statement Exchange or Quotation and Trade Reporting System (F1) or Form 21-101F2 Information Statement -- Alternative Trading System (F2). Section 3.2 of NI 21-101 requires a marketplace to file an amendment to its F1 or F2 for any change in fees. Some form of regulatory review of fees occurs in most jurisdictions.

When reviewing fees, including market data fees, staff will also assess whether the proposed fees comply with other provisions of NI 21-101, including provisions preventing a marketplace from unreasonably prohibiting, conditioning or limiting access to its services, including by discriminating unreasonably among marketplace participants (subsections 5.1(1) & (3)).

In the context of the review of market data fees, the Data Fees Methodology will be applied to new fees and changes to existing fees. In addition, the methodology will be used in the annual review of market data fees. Subsection 3.2(5) of NI 21-101 requires each recognized exchange and ATS to file an updated and consolidated F1 or F2 within 30 days after the end of each calendar year. The consolidated F1s and F2s will be used in the review of a marketplace's market data fees to determine if these fees are higher than the range identified through the Data Fees Methodology.

Frequently Asked Questions on the Data Fees Methodology

The Data Fees Methodology was initially proposed in the CSA Staff Notice and Request for Comment Proposed Amendments to National Instrument 23-101 Trading Rules published on May 15, 2014. It was subsequently adjusted, based on the public comments and staff's experience in applying it. It was republished when formally adopted, on April 7, 2016. This section provides responses to frequently asked questions regarding the Data Fees Methodology.

Application and use of the methodology

1. How does the Data Fees Methodology work?

The Data Fees Methodology estimates a fee or fee range for top-of-book (Level 1) and depth-of-book (Level 2) market data for securities listed on the TSX and TSXV{2} for each marketplace based on their contribution to price discovery and trading activity. It has a three step approach that involves:

• the calculation of pre-- and post-trade metrics;

• a ranking of marketplaces on a relative basis; and

• an estimation of a fee range for the professional market data fees charged by each marketplace based on a domestic reference amount.

2. What is the reference or benchmark?

CSA staff recognize the importance of selecting an appropriate reference or benchmark for the Data Fees Methodology to allocate the aggregate Level 1 and/or Level 2 fees and determine an appropriate fee range for each marketplace. Initially, we are using a domestic reference that takes the data fees charged by each marketplace and aggregates them into a single pool, which is then re-allocated based on the ranking models described in the Appendix A. We intend to develop a process to determine the appropriate reference or benchmark to be used in the future to allocate the aggregate fees to each marketplace.

For more detailed information on the reference or benchmark see question 21.

3. When will the Data Fees Methodology be used?

The Data Fees Methodology will be used in:

• the annual review of professional market data fees charged by each marketplace for both Level 1 and Level 2 data feeds; and

• ad-hoc reviews arising from the review and approval of any new fees and changes to existing fees.

4. Which marketplace fees will be subject to the Data Fees Methodology?

The Data Fees Methodology will apply to all marketplaces regardless of their protected or unprotected status. We think it is appropriate to maintain a level of oversight and ensure a consistent balance across all marketplaces between the values assessed using the Data Fees Methodology and the associated fees that are charged for the data. This is particularly important in the context of compliance with best execution requirements.

5. What will be the period used to review professional market data fees?

For both annual and ad-hoc reviews, we will apply the methodology to the prior 12 months of trading. The review covers a lengthy period of time, therefore short-term fluctuations in a marketplace's share of trading activity will not significantly impact the results of the review.

6. How will the results be communicated to marketplaces?

For both the annual and ad-hoc reviews, a marketplace will be notified only if its fees are above the range. Ranges will not be published or shared with other marketplaces.

7. If marketplaces are charging less than they could under the Data Fees Methodology will they be allowed to increase their fees?

No. We will not apply the Data Fees Methodology to allow fee increases until such time that an appropriate reference has been established. Any changes in the future to the reference may lead to different results.

8. When will the Data Fees Methodology be implemented?

The Data Fees Methodology has already been applied to most marketplaces' data fees and has (in some cases) resulted in an adjustment of those fees. It is currently used for any market data fees changes filed by marketplaces. It will also be applied to all marketplace data fees for the annual review in February 2017.

Data Provider and Pre-- and Post-Trade Metrics Inclusions and Exclusions

9. What is the CSA's source for raw data for the application of the Data Fees Methodology?

The Investment Industry Regulatory Organization of Canada (IIROC) provides the CSA with the underlying pre-- and post-trade metrics.

10. What quotes are included in the calculation of the underlying pre-trade metrics?

All quotes from all marketplaces during regular trading hours (9:30 a.m. to 4:00 p.m.) are included in the calculation of the underlying pre-trade metrics.

11. Are there any quotes excluded from the calculation of the underlying pre-trade metrics?

Odd-lot quotes are excluded from the calculation of the underlying pre-trade metrics.

12. Is a listed security that has no quote on any marketplace for the period under consideration included in the pre-trade metrics calculation?

If a listed security does not have any quotes on any marketplace for the period under consideration (e.g. a trading day), that security would be not be included in the pre-trade metrics calculation for that period.

13. What trades will be included in the calculation of the underlying post-trade metrics?

• Regular open market trades

• Crosses (intentional and unintentional)

• Special terms trades

• After-hours trades

14. What trades will be excluded from the calculation of the underlying post-trade metrics?

Odd-lot trades will be excluded.

15. How will cancelled trades be handled for the purpose of the calculation of the underlying post-trade metrics?

Cancelled trades will be removed from the calculation and corrections will be added.

16. Is there a different approach in terms of the calculation of the pre-- and post-trade metrics for days with early closes?

There are no changes to the pre-- and post-trade formulas to accommodate days when the markets close early. Due to the lengthy period of time considered for the review, we do not think there will be any material impact on the final results.

17. Is there a different approach in terms of the calculation of the pre-- and post-trade metrics for days when trading in certain securities is halted or opening is delayed?

No, for the same reason given in the answer to question 16.

18. Is there a different approach in terms of the calculation of the pre-- and post-trade metrics for days when marketplaces may declare self-help?

No, for the same reason given in the answer to question 16.

19. Are there any changes/corrections to the Data Fees Methodology compared to the methodology that was published?

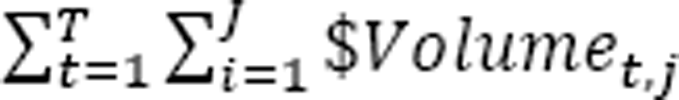

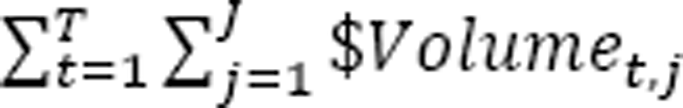

We noted an error in the weighting formula of the pre-trade metric $Time(value) and corrected it in Appendix A, section 3 attached to this notice. Specifically, in the denominator of the wj formula we replaced

Application of the domestic reference to allocate fees

20. How will the domestic reference be determined?

Generally, marketplaces offer at least two levels of market data:

• Level 1, consisting of information on the last sale of a security, the best bid and offer, and the aggregate volume available for purchase or sale at those prices;

• Level 2, consisting of information on all visible orders in the marketplace (price and volume) and all trades.

Level 2 data is generally more expensive than Level 1 data, but some marketplaces offer both Level 1 and Level 2 data for one fee.

Because there are two types of data products being offered, for the purpose of the application of the Data Fees Methodology, we consider two domestic references, one for the Level 1 data and one for the Level 2 data. Furthermore, because most marketplaces charge different data fees for TSX-- and TSXV-listed securities, the domestic reference for each level will reflect this fee segregation.

For example, if we are assessing the Level 1 fees charged by marketplaces for TSX-listed securities, we will aggregate the Level 1 fees charged by each marketplace. The result will be the domestic reference for Level 1 fees for TSX-listed securities. A similar approach is taken to determine the domestic reference for Level 1 fees for TSXV-listed securities.

Because certain marketplaces condition the purchase of Level 2 data on acquiring Level 1 data, when we determine the domestic reference for Level 2 fees we take into consideration the approach taken by marketplaces when charging Level 2 fees. For example, for those marketplaces that require purchasing Level 1 data to obtain Level 2 data, we consider the Level 2 fee to be the aggregate of Level 1 and Level 2 fees. For those marketplaces that include Level 1 fees in Level 2 fees, we consider the Level 2 fee to be the actual Level 2 fee charged.

Another issue that we consider in determining the domestic reference is that some marketplaces charge one fee for both TSX-- and TSXV-listed securities. For such marketplaces, we look at their volume, value and number of trades, equally weighted, and calculate the percentage of trading that takes place on those marketplaces in TSX-- versus TSXV-listed securities. We then allocate the fee charged to each data feed based on those percentages.

21. Will the domestic reference remain the same or it will change over time?

The domestic reference may potentially change over time to reflect changes in fees charged by marketplaces. However, it is the CSA's intention to maintain the domestic reference as close as possible to the existing level until an appropriate benchmark is determined.

Questions

Please refer your questions to any of the following:

{1} See Annex F to CSA Notice of Approval[:] Amendments to National Instrument 23-101 Trading Rules and Companion Policy 23-101CP to National Instrument 23-101 Trading Rules (2016), 39 O.S.C.B. 3237.

{2} The Data Fees Methodology only applies to securities listed on the TSX and TSXV. The CSA will review and consider the information from the Data Fees Methodology when approving fees for data from other marketplaces.

APPENDIX A

Data Fees Methodology

The Data Fee Methodology described below will be used to determine each marketplace's relative contribution to pre-- and post-trade activities. The scope of the methodology is to determine whether the professional market data fees charged by the marketplaces in Canada reflect each marketplace's share of trading activity.

The methodology consists of three steps:

1. Calculation of pre-- and post-trade metrics

2. Ranking of marketplaces based on the pre-- and post-trade metrics calculated in step 1

3. Assigning an estimated fee range to each marketplace.

The methodology uses the following notations for the pre-- and post-trade metrics and the ranking methods:

Notation

Description

i

A transparent marketplace

m

Total number of transparent marketplaces

j

Securities traded on a transparent marketplace

J

Total securities traded on all transparent marketplaces

t

A Trade executed on a transparent marketplace

n

Total trades executed on a transparent marketplace

T

Total trades executed on all transparent marketplaces

d

A trading day

D

All trading days for the period under review

a. Pre-Trade Metrics

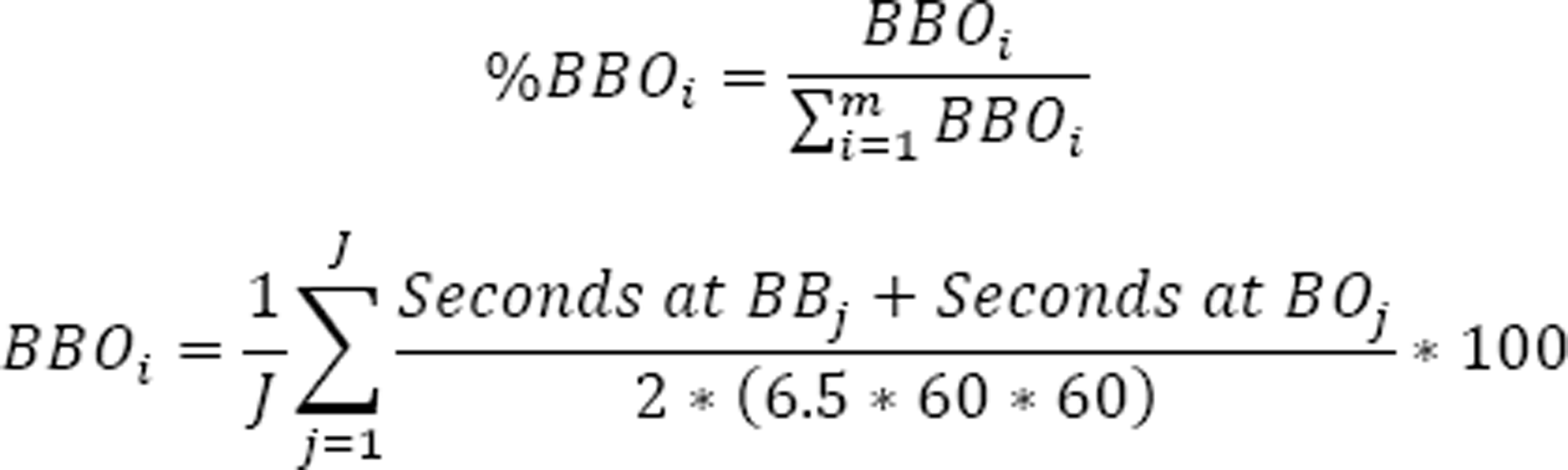

1. Percent of Best Bid and Offer (BBO){3} -- means the percent of the day for which a marketplace had a quote at the national best bid (BB) or best offer (BO) for security j. This metric is scaled to sum to one.

This metric rewards marketplaces for being at the BBO for a longer period during the day. This metric is constructed from standard quote data. In order to ensure that the addition of each marketplace sums to one, the individual metrics for each marketplace are summed to come up with a market-wide daily percent at the BBO, and each individual marketplace's percentage is then divided by this total to scale the metric to one.

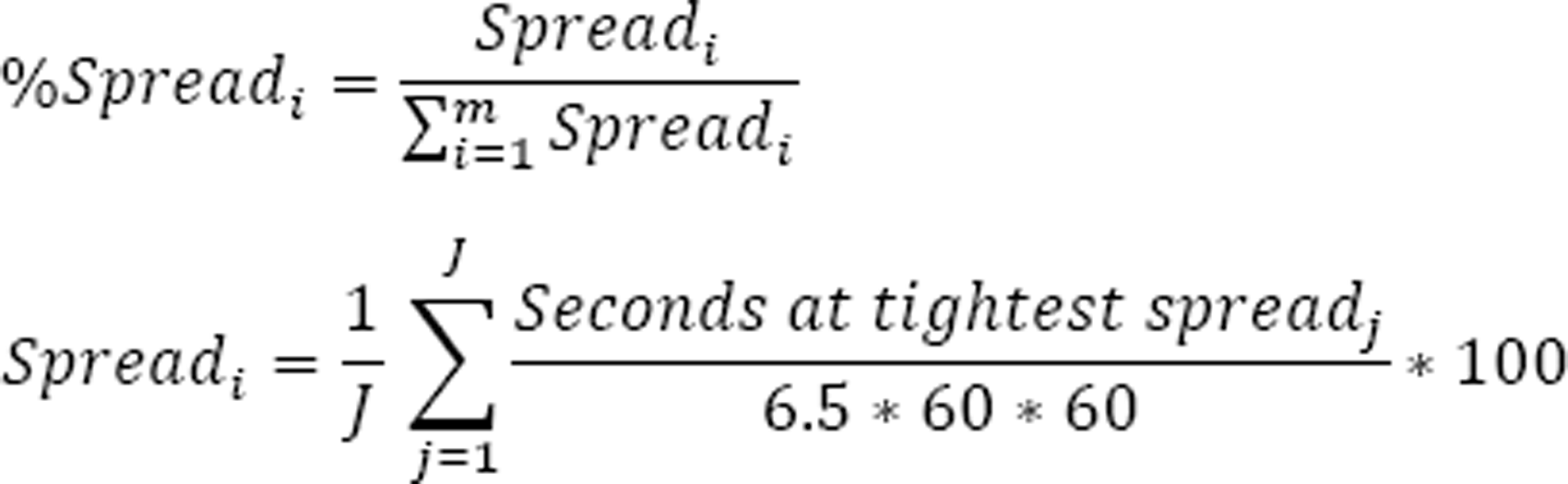

2. Percent of Best Spread -- means the percent of the day that a marketplace was quoting the narrowest spread for security j. This metric is scaled to sum to one.

This metric tends to reward marketplaces for providing liquidity at both the BB and BO, by establishing the narrowest spread on the market. This metric is also constructed from quote level data. In order to ensure that the addition of each marketplace sums to one, the individual metrics for each marketplace are summed to come up with a market-wide daily percent at the narrowest spread, and each individual marketplace's percentage is then divided by this total to scale the metric to one.

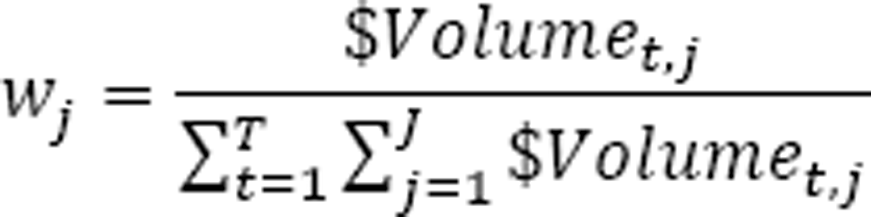

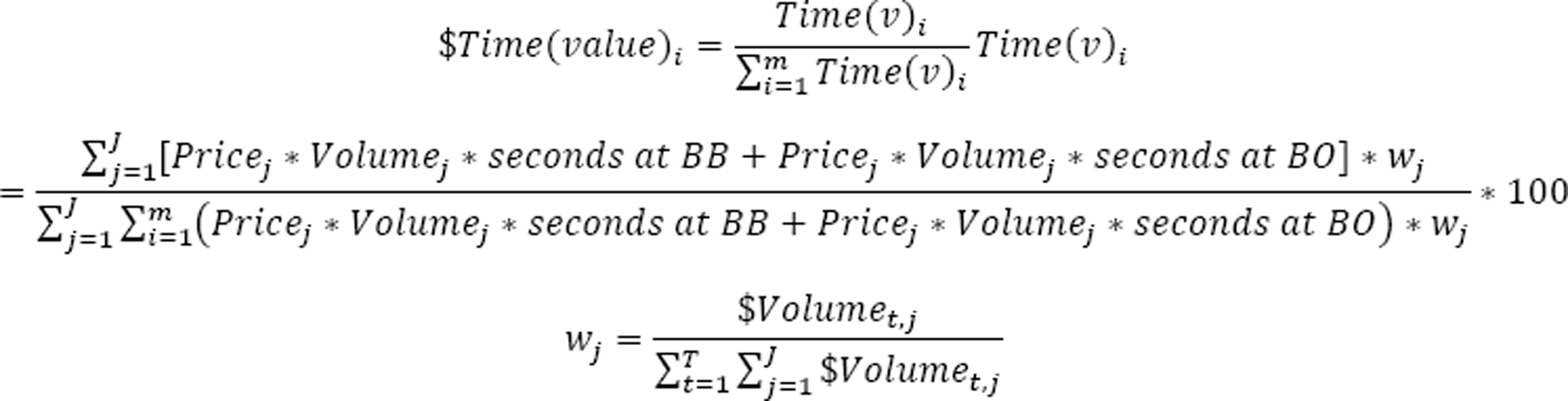

3. $Time(value) -- means the percent of quoted-time-dollar-volume for a marketplace, out of the total time-dollar-volume for the entire market for the period, when only the BB and BO are considered. Each stock is weighted by the value traded in the period of consideration, as described in the weighting "w" below.

The use of the value weighting places more emphasis on those stocks that trade heavily and less emphasis on stocks that do not trade frequently. At the extreme, a stock that does not trade at all will not be allocated any weight under this metric.

b. Post-Trade Metrics

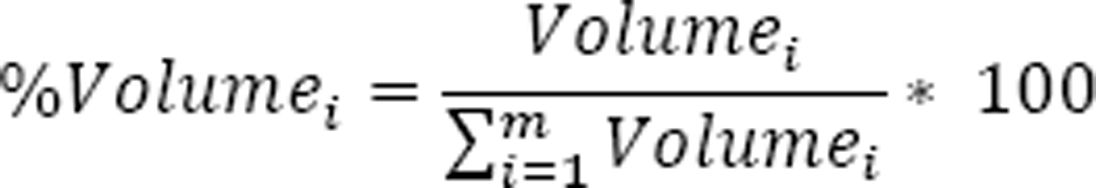

1. Percent of each marketplace's volume -- means the volume traded on each marketplace divided by the total volume traded on all marketplaces in the period.

This metric rewards traded volume and tends to favour those marketplaces that trade in relatively low-priced shares, as it considers only the number of shares traded, not their value. In an extreme scenario, if a marketplace traded only low-priced stocks, this metric would inflate their overall share of the entire market.

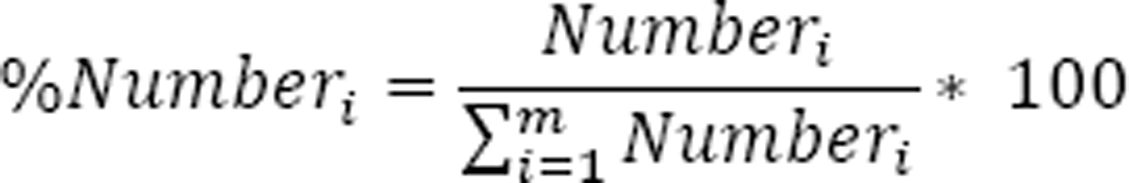

2. Percent of each marketplace's number of trades -- means the number of trades executed on each marketplace divided by the total number of trades on all marketplaces in the period.

This metric rewards those marketplaces that have a larger number of trades. This metric could be manipulated by encouraging traders to break their orders up into smaller pieces. If this were done, neither the volume nor the dollar volume traded would change, but the number of trades would increase significantly.

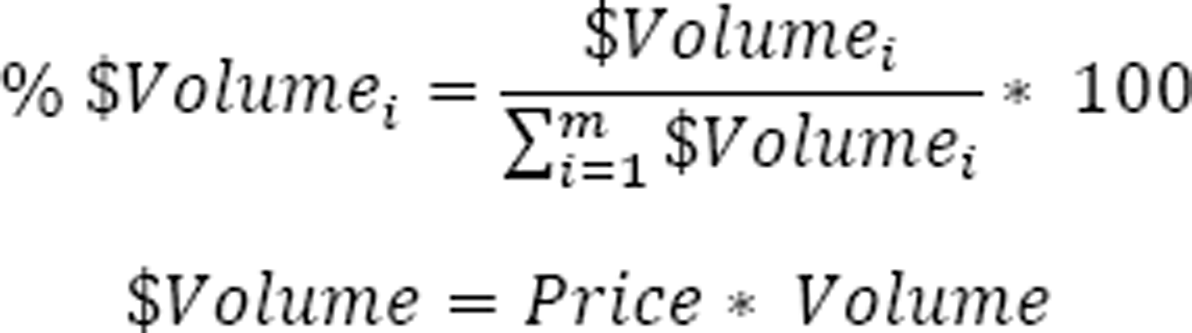

3. Percent of each marketplace's dollar volume (value) -- means the dollar volume traded on each marketplace divided by the total dollar volume traded on all marketplaces in the period. Dollar volume is the product of the price and volume of each trade.

This metric takes the value of the transactions into account.

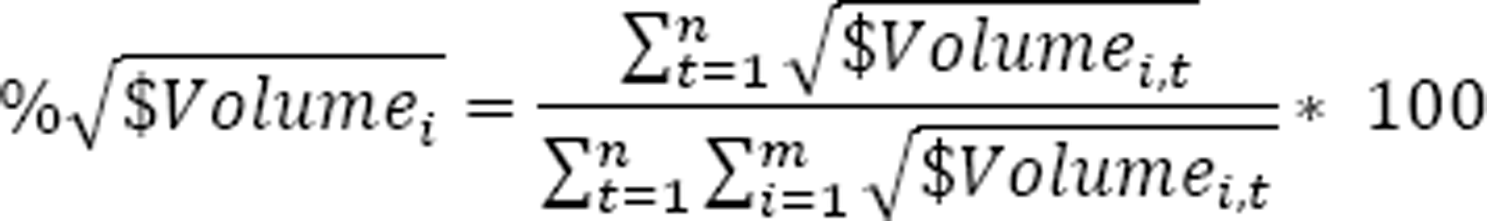

4. Percent of square-root dollar volume for each trade -- means the square root of the $Volume of each trade t executed on each marketplace divided by the sum of the square-root of the $Volume traded on all marketplaces in the period.

The square-root of dollar volume is individually constructed for each transaction. This metric reduces the importance of larger trades in relation to smaller trades.

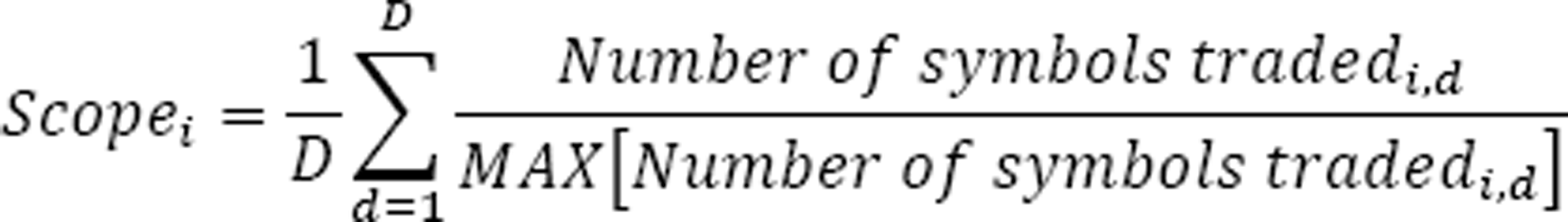

5. Scope of trading on each marketplace -- means the average over the period of the number of symbols with greater than 1 traded on each marketplace on day d, divided by the number of symbols traded on all marketplaces for that day.

Scope of trading provides a metric that measures the number of symbols a marketplace trades.

c. Ranking Models

In order to rank each marketplace's contribution to price discovery we constructed two models from the pre-- and post-trade metrics.

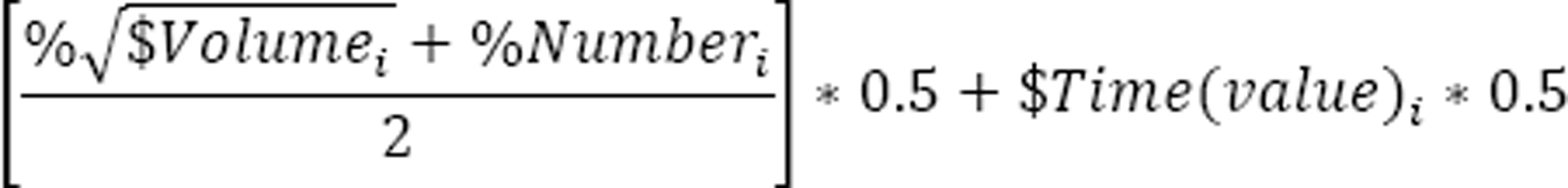

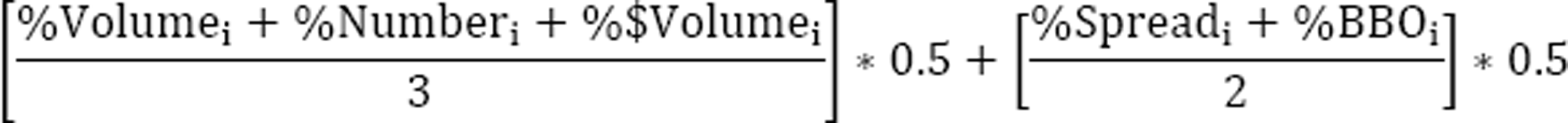

1. Model 1 (formerly SIP Value) -- is based on the revenue distribution model used by the U.S. SIP.

This model incorporates the metrics used by the U.S. SIP to distribute revenue amongst participating marketplaces. The post-trade metrics used are equally weighted, and are composed of each marketplace's share of square root dollar volume and number of trades. Both of these post-trade metrics together are assigned a weighting of 50% of the value of the model.

The pre-trade metric used is the value weighted percent of quoted dollar-time. This is also given a 50% weighting in the final model. The weighting of this model by the value traded in each security provides a greater emphasis on those stocks that are heavily traded, rewarding marketplaces more for providing liquidity where the majority is consumed.

2. Model 2 (formerly Model 3) -- differs significantly from the previous model. For the post-trade element, this model considers each marketplace's share of traded volume, share of trades and share of dollar-volume. These three elements are given equal weighting in this index. The pre-trade metrics considered are the percent of the day spent at the best spread and the percent of the day spent at the BBO. Each of these two pre-trade elements is equally weighted. The resulting pre-- and post-- trade metrics are then equally weighted to come up with the final index.

d. Assigning an estimated fee range

After calculating these ranking methods, we would use them to assess whether a marketplace's existing (or proposed) fee is related to its share of trading activity. We use the domestic reference that takes the data fees charged by each marketplace and aggregates them into a single "pool". The result is then considered to be the appropriate fee for the Canadian market, and this result is then re-distributed, based on the two ranking models, giving us four estimated fees for each marketplace.

{3} The time at BBO could be calculated in fractions of a second, given the rapidity of quoting.