Notice of Amendment Approval - Provisions Respecting a "Basis Order"

April 8, 2005

NOTICE OF AMENDMENT APPROVAL

PROVISIONS RESPECTING A "BASIS ORDER"

Summary

Effective April 8, 2005, the Alberta Securities Commission, British Columbia Securities Commission, Manitoba Securities Commission, Ontario Securities Commission and, in Quebec, the Autorité des marchés financiers (the "Recognizing Regulators") approved amendments to the Universal Market Integrity Rules ("UMIR") to incorporate a definition of a "Basis Order" and to provide that the execution of a Basis Order should not establish the "last sale price" and that the execution would be exempt from the requirements of:

• Rule 3.1 -- Restrictions on Short Selling;

• Rule 5.2 -- Best Price Obligation;

• Rule 6.3 -- Exposure of Client Orders; and

• Rule 8.1 -- Client Principal Trading.

Summary of the Amendments as Approved

Definition of a "Basis Order"

The definition of "Basis Order" has the following four components:

• the order involves the purchase or sale of listed securities or quoted securities;

• notice is provided to a Market Regulator prior to the entry of the order on a marketplace;

• the price of the resulting trade is determined in a manner acceptable to a Market Regulator based on the price achieved through the execution on that trading day of one or more transactions in a derivative instrument that is listed on an Exchange or quoted on a QTRS; and

• the securities included in the order comprise at least 80% of the component security weighting of the underlying interest of the derivative instruments used in the determination of the price.

In order to preclude abuse of a Basis Order merely to bypass better-priced orders for a particular security on a marketplace, notice of the order must be given to a Market Regulator prior to entry on a marketplace and the Market Regulator must be satisfied as to the calculation of the price for the trade. In assessing whether the difference between the price at which the derivative transactions were executed and the price at which trades in the listed security or quoted security will be reported as a Basis Order is "acceptable", the Market Regulator will consider principally the historical "price spreads" for transactions of a similar size and number of securities.

Effective January 31, 2005, the rules of the Bourse de Montréal Inc. ("Bourse") were amended to permit approved participants of the Bourse to arrange block trades of derivative contracts at price that is different from prevailing market prices provided that trade is at a price which the Bourse would consider "fair and reasonable" in light of a number of factors including:

• the size of the block trade;

• current prices in the same derivative contract or other contract months or option series;

• current prices in "other relevant markets, including without limitation the underlying markets";

• the volatility and liquidity of the market; and

• general market conditions.

Presently, the ability to execute on the Bourse a block trade at a price that is different from the prevailing market will be limited to interest rate futures contacts and options on interest rate future contracts. If the ambit of the rule of the Bourse is expanded to include other types of derivatives for which the underlying interest is a listed security or a quoted security, the Market Regulator will have to be satisfied that the price of any derivative trade on the Bourse has not been made outside of the prevailing market for that derivative merely to permit the Basis Order for the underlying listed security or quoted security to bypass better-priced orders for the underlying security on a marketplace.

Definition of "Last Sale Price"

A Basis Order will be executed at the average price of the accumulation or distribution of the underlying derivative position. As such, the price of the trade of a Basis Order may be above the best ask price or below the best bid price of a particular component security that is part of the Basis Order. It is therefore appropriate that the execution of a Basis Order not establish the "last sale price" of a security. Similarly, to the extent that a trade of Volume-Weighted Average Price Order is reported to a consolidated market display during regular trading hours (since the order will use only part of the trading day to establish the price) such an order should not establish the "last sale price". The amendments therefore exclude trades resulting from a Basis Order and a Volume-Weighted Average Price Order from the definition of the last sale price.

Provision for Exemptions from UMIR Provisions

Given that the price at which a Basis Order is executed is dependent on the average price of accumulation or distribution of the underlying derivative position, the execution of a Basis Order is exempt from certain requirements under UMIR including:

|

Rule |

Description |

Justification for Exemption from Requirement |

|

|

|

|||

|

3.1 |

Restrictions on Short Selling |

The exemption from the requirement that the price not be less than the last sale price is supported by the fact that the Market Regulator must be satisfied that the price reflects trades in the derivative markets. |

|

|

|

|||

|

5.2 |

Best Price Obligation |

The exemption from the requirement that a Participant take reasonable efforts to ensure that a sale is at the best bid price and a purchase is at the best ask price is justified since the Market Regulator must be satisfied as to the manner of the determination of the price and the client has consented to their order being executed at a price determined by transactions in the derivatives market. |

|

|

|

|||

|

6.3 |

Exposure of Client Orders |

The requirement that client orders for 50 standard trading units or less be exposed on a marketplace ensures that the client receives timely execution at the best available price. The execution of a Basis Order has been agreed to based on transactions in the derivatives markets. As the client must consent to or direct that their order be treated as a Basis Order, it is not appropriate that their orders for the listed or quoted securities be exposed on a marketplace. |

|

|

|

|||

|

8.1 |

Client Principal Trading |

If a principal or non-client account is trading the Basis Order with a client, the price will be determined in a manner satisfactory to a Market Regulator based on transactions in the derivative markets. It is therefore not possible to determine in advance if the execution price will in fact be a "better" price. |

|

Procedures for Providing Notice of a Basis Order

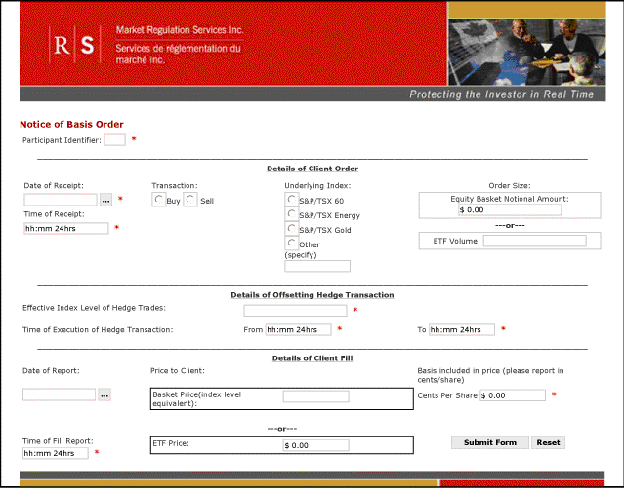

One of the requirements of the definition of a "Basis Order" is that notice must be provided to a Market Regulator prior to the entry of the order on a marketplace. A sample of the notice form is set out as Appendix "C" to this Market Integrity Notice. The notice may be completed and submitted on-line by accessing the "Notice of a Basis Order" form available on the Market Regulation Services Inc. ("RS") website at www.rs.ca. Upon receipt of the notice by RS, an e-mail response will be automatically generated to acknowledge receipt of the notice.

If an electronic submission can not be provided, the completed notice may be faxed to RS: Market Regulation Eastern Region -- 416.646.7261; or Market Regulation Western Region -- 604.602.6986.

Appendices

The amendments to the Rules respecting a "Basis Order" are effective as of April 8, 2005. The text of the amendments is set out in Appendix "A".

Appendix "B" contains the text of the relevant provisions of the Rules as they read following the adoption of the amendments. Appendix "B" also contains a marked version of the current provisions highlighting the changes introduced by the amendments.

Appendix "C" is the form of notice to be provided to RS prior to the entry of a Basis Order.

Questions

Questions concerning this notice may be directed to:

James E. Twiss,

Chief Policy Counsel,

Market Policy and General Counsel's Office,

Market Regulation Services Inc.,

Suite 900,

P.O. Box 939,

145 King Street West,

Toronto, Ontario. M5H 1J8

Telephone: 416.646.7277

Fax: 416.646.7265

e-mail: [email protected]

ROSEMARY CHAN,

VICE PRESIDENT, MARKET POLICY AND GENERAL COUNSEL

Appendix "A"

Universal Market Integrity Rules

Amendments Respecting Basis Orders

The Universal Market Integrity Rules are amended by:

1. Amending Rule 1.1 to:

(a) Add the following definition of "Basis Order":

"Basis Order" means an order for the purchase or sale of listed securities or quoted securities:

(a) where the intention to enter the order has been reported by the Participant or Access Person to a Market Regulator prior to the entry of the order;

(b) that will be executed at a price which is determined in a manner acceptable to a Market Regulator based on the price achieved through the execution on that trading day of one or more transactions in a derivative instrument that is listed on an Exchange or quoted on a QTRS; and

(c) that comprise at least 80% of the component security weighting of the underlying interest of the derivative instruments subject to the transaction or transactions described in clause (b).

(b) Amend the definition of "last sale price" by deleting the phrase "Call Market Order" and substituting "Basis Order, Call Market Order or Volume-Weighted Average Price Order".

2. Amending clause (f) of subsection (2) of Rule 3.1 by:

(a) deleting the word "or" at the end of subclause (ii);

(b) inserting the phrase ", or" after the word "Order" in subclause (iii); and

(c) adding the following as subclause (iv):

(iv) a Basis Order.

3. Amending clause (c) of subsection (2) of Rule 5.2 by:

(a) deleting the word "or" at the end of subclause (iii);

(b) inserting the phrase ", or" after the word "Order" in subclause (iv); and

(c) adding the following as subclause (v):

(v) a Basis Order.

4. Amending clause (b) of subsection (1) of Rule 6.2 by adding the following as subclause (v.1):

(v.1) a Basis Order.

5. Amending clause (h) of subsection (1) of Rule 6.3 by:

(a) deleting the word "or" at the end of subclause (iv);

(b) inserting the phrase ", or" after the word "Order" in subclause (v); and

(c) adding the following as subclause (vi):

(vi) a Basis Order.

6. Amending subsection (2) of Rule 8.1 by:

(a) deleting the word "or" at the end of clause (c);

(b) inserting the phrase "; or" after the word "Order" in clause (d); and

(c) adding the following as clause (e):

(e) a Basis Order.

Appendix "B"

Universal Market Integrity Rules

Text of Rule to Reflect Amendments

Respecting Basis Orders

|

Text of Provisions Following Adoption of Amendments Effective April 8, 2005 |

|

Text of Current Provisions Marked to Reflect Adoption of Amendments Effective April 8, 2005 |

||||||||

|

|

||||||||||

|

1.1 |

Definitions |

|

1.1 |

Definitions |

||||||

|

|

||||||||||

|

|

"Basis Order" means an order for the purchase or sale of listed securities or quoted securities: |

|

|

"Basis Order" means an order for the purchase or sale of listed securities or quoted securities: |

||||||

|

|

||||||||||

|

|

(a) |

where the intention to enter the order has been reported by the Participant or Access Person to a Market Regulator prior to the entry of the order; |

|

|

(a) |

where the intention to enter the order has been reported by the Participant or Access Person to a Market Regulator prior to the entry of the order; |

||||

|

|

||||||||||

|

|

(b) |

that will be executed at a price which is determined in a manner acceptable to a Market Regulator based on the price achieved through the execution on that trading day of one or more transactions in a derivative instrument that is listed on an Exchange or quoted on a QTRS; and |

|

|

(b) |

that will be executed at a price which is determined in a manner acceptable to a Market Regulator based on the price achieved through the execution on that trading day of one or more transactions in a derivative instrument that is listed on an Exchange or quoted on a QTRS; and |

||||

|

|

||||||||||

|

|

(c) |

that comprise at least 80% of the component security weighting of the underlying interest of the derivative instruments subject to the transaction or transactions described in clause (b). |

|

|

(c) |

that comprise at least 80% of the component security weighting of the underlying interest of the derivative instruments subject to the transaction or transactions described in clause (b). |

||||

|

|

||||||||||

|

"last sale price" means the price of the last sale of at least one standard trading unit of a particular security displayed in a consolidated market display but does not include the price of a sale resulting from an order that is a Basis Order, Call Market Order or Volume-Weighted Average Price Order. |

|

"last sale price" means the price of the last sale of at least one standard trading unit of a particular security displayed in a consolidated market display but does not include the price of a sale resulting from an order that is a Basis Order, Call Market Order or Volume-Weighted Average Price Order. |

||||||||

|

|

||||||||||

|

3.1 |

Restriction on Short Selling |

|

3.1 |

Restriction on Short Selling |

||||||

|

|

||||||||||

|

|

(2) |

A short sale of a security may be made on a marketplace at a price below the last sale price if the sale is: |

|

|

(2) |

A short sale of a security may be made on a marketplace at a price below the last sale price if the sale is: |

||||

|

|

||||||||||

|

|

|

... |

|

|

|

|

|

... |

|

|

|

|

||||||||||

|

|

|

(f) |

the result of: |

|

|

|

(f) |

the result of: |

||

|

|

||||||||||

|

|

|

|

(i) |

a Call Market Order, |

|

|

|

|

(i) |

a Call Market Order, |

|

|

||||||||||

|

|

|

|

(ii) |

a Market-on-Close Order, |

|

|

|

|

(ii) |

a Market-on-Close Order, |

|

|

||||||||||

|

|

|

|

(iii) |

a Volume-Weighted Average Price Order, or |

|

|

|

|

(iii) |

a Volume-Weighted Average Price Order, or |

|

|

||||||||||

|

|

|

|

(iv) |

a Basis Order. |

|

|

|

|

(iv) |

a Basis Order. |

|

|

||||||||||

|

5.2 |

Best Price Obligation |

|

5.2 |

Best Price Obligation |

||||||

|

|

||||||||||

|

|

(2) |

Subsection (1) does not apply to the execution of an order which is: |

|

|

(2) |

Subsection (1) does not apply to the execution of an order which is: |

||||

|

|

||||||||||

|

|

|

... |

|

|

|

|

|

... |

|

|

|

|

||||||||||

|

|

|

(c) |

directed or consented to by the client to be entered on a marketplace as: |

|

|

|

(c) |

directed or consented to by the client to be entered on a marketplace as: |

||

|

|

||||||||||

|

|

|

|

(i) |

a Call Market Order, |

|

|

|

|

(i) |

a Call Market Order, |

|

|

||||||||||

|

|

|

|

(ii) |

a Volume-Weighted Average Price Order, |

|

|

|

|

(ii) |

a Volume-Weighted Average Price Order, |

|

|

||||||||||

|

|

|

|

(iii) |

a Market-on-Close Order, |

|

|

|

|

(iii) |

a Market-on-Close Order, |

|

|

||||||||||

|

|

|

|

(iv) |

an Opening Order, or |

|

|

|

|

(iv) |

an Opening Order, or |

|

|

||||||||||

|

|

|

|

(v) |

a Basis Order. |

|

|

|

|

(v) |

a Basis Order. |

|

|

||||||||||

|

6.2 |

Designations and Identifiers |

|

6.2 |

Designations and Identifiers |

||||||

|

|

||||||||||

|

|

(1) |

Each order entered on a marketplace shall contain: |

|

|

(1) |

Each order entered on a marketplace shall contain: |

||||

|

|

||||||||||

|

|

|

... |

|

|

|

|

|

... |

|

|

|

|

||||||||||

|

|

|

(b) |

a designation acceptable to the Market Regulator for the marketplace on which the order is entered, if the order is: |

|

|

|

(b) |

a designation acceptable to the Market Regulator for the marketplace on which the order is entered, if the order is: |

||

|

|

||||||||||

|

|

|

|

(i) |

a Call Market Order, |

|

|

|

|

(i) |

a Call Market Order, |

|

|

||||||||||

|

|

|

|

(ii) |

an Opening Order, |

|

|

|

|

(ii) |

an Opening Order, |

|

|

||||||||||

|

|

|

|

(iii) |

a Market-on-Close Order, |

|

|

|

|

(iii) |

a Market-on-Close Order, |

|

|

||||||||||

|

|

|

|

(iv) |

a Special Terms Order, |

|

|

|

|

(iv) |

a Special Terms Order, |

|

|

||||||||||

|

|

|

|

(v) |

a Volume-Weighted Average Price Order, |

|

|

|

|

(v) |

a Volume-Weighted Average Price Order, |

|

|

||||||||||

|

|

|

|

(v.1) |

a Basis Order, |

|

|

|

|

(v.1) |

a Basis Order, |

|

|

||||||||||

|

|

|

|

(vi) |

part of a Program Trade, |

|

|

|

|

(vi) |

part of a Program Trade, |

|

|

||||||||||

|

|

|

|

(vii) |

part of an intentional cross or internal cross, |

|

|

|

|

(vii) |

part of an intentional cross or internal cross, |

|

|

||||||||||

|

|

|

|

(viii) |

a short sale which is subject to the price restriction under subsection (1) of Rule 3.1, |

|

|

|

|

(viii) |

a short sale which is subject to the price restriction under subsection (1) of Rule 3.1, |

|

|

||||||||||

|

|

|

|

(ix) |

a short sale which is exempt from the price restriction on a short sale in accordance with subsection (2) of Rule 3.1, |

|

|

|

|

(ix) |

a short sale which is exempt from the price restriction on a short sale in accordance with subsection (2) of Rule 3.1, |

|

|

||||||||||

|

|

|

|

(x) |

a non-client order, |

|

|

|

|

(x) |

a non-client order, |

|

|

||||||||||

|

|

|

|

(xi) |

a principal order, |

|

|

|

|

(xi) |

a principal order, |

|

|

||||||||||

|

|

|

|

(xii) |

a jitney order, |

|

|

|

|

(xii) |

a jitney order, |

|

|

||||||||||

|

|

|

|

(xiii) |

for the account of a derivatives market maker, |

|

|

|

|

(xiii) |

for the account of a derivatives market maker, |

|

|

||||||||||

|

|

|

|

(xiv) |

for the account of a person who is an insider of the issuer of the security which is the subject of the order, |

|

|

|

|

(xiv) |

for the account of a person who is an insider of the issuer of the security which is the subject of the order, |

|

|

||||||||||

|

|

|

|

(xv) |

for the account of a person who is a significant shareholder of the issuer of the security which is the subject of the order, or |

|

|

|

|

(xv) |

for the account of a person who is a significant shareholder of the issuer of the security which is the subject of the order, or |

|

|

||||||||||

|

|

|

|

(xvi) |

of a type for which the Market Regulator may from time to time require a specific or particular designation. |

|

|

|

|

(xvi) |

of a type for which the Market Regulator may from time to time require a specific or particular designation. |

|

|

||||||||||

|

6.3 |

Exposure of Client Orders |

|

6.3 |

Exposure of Client Orders |

||||||

|

|

||||||||||

|

|

(1) |

A Participant shall immediately enter on a marketplace a client order to purchase or sell 50 standard trading units or less of a security unless: |

|

|

(1) |

A Participant shall immediately enter on a marketplace a client order to purchase or sell 50 standard trading units or less of a security unless: |

||||

|

|

||||||||||

|

|

|

... |

|

|

|

|

|

... |

|

|

|

|

||||||||||

|

|

|

(h) |

the client has directed or consented to the order being entered on a marketplace as: |

|

|

|

(h) |

the client has directed or consented to the order being entered on a marketplace as: |

||

|

|

||||||||||

|

|

|

|

(i) |

a Call Market Order, |

|

|

|

|

(i) |

a Call Market Order, |

|

|

||||||||||

|

|

|

|

(ii) |

an Opening Order, |

|

|

|

|

(ii) |

an Opening Order, |

|

|

||||||||||

|

|

|

|

(iii) |

a Special Terms Order, |

|

|

|

|

(iii) |

a Special Terms Order, |

|

|

||||||||||

|

|

|

|

(iv) |

a Volume-Weighted Average Price Order, |

|

|

|

|

(iv) |

a Volume-Weighted Average Price Order, |

|

|

||||||||||

|

|

|

|

(v) |

a Market-on-Close Order, or |

|

|

|

|

(v) |

a Market-on-Close Order, or |

|

|

||||||||||

|

|

|

|

(vi) |

a Basis Order. |

|

|

|

|

(vi) |

a Basis Order. |

|

|

||||||||||

|

8.1 |

Client-Principal Trading |

|

8.1 |

Client-Principal Trading |

||||||

|

|

||||||||||

|

|

(2) |

Subsection (1) does not apply if the client has directed or consented that the client order be: |

|

|

(2) |

Subsection (1) does not apply if the client has directed or consented that the client order be: |

||||

|

|

||||||||||

|

|

|

(a) |

a Call Market Order; |

|

|

|

(a) |

a Call Market Order; |

||

|

|

||||||||||

|

|

|

(b) |

an Opening Order; |

|

|

|

(b) |

an Opening Order; |

||

|

|

||||||||||

|

|

|

(c) |

a Market-on-Close Order; |

|

|

|

(c) |

a Market-on-Close Order; |

||

|

|

||||||||||

|

|

|

(d) |

a Volume-Weighted Average Price Order; or |

|

|

|

(d) |

a Volume-Weighted Average Price Order; or |

||

|

|

||||||||||

|

|

|

(e) |

a Basis Order. |

|

|

|

(e) |

a Basis Order. |

||

Appendix "C"

Universal Market Integrity Rules

Sample "Notice of Basis Order" Form