OSC Staff Notice: 52-719 - Going Concern Disclosure Review

OSC Staff Notice: 52-719 - Going Concern Disclosure Review

OSC STAFF NOTICE 52-719 Going Concern Disclosure Review

Staff of the Ontario Securities Commission conducted a review to assess the timeliness and adequacy of disclosures in financial statements and management's discussion and analysis related to the going concern assumption. The purpose of this Notice is to summarize our findings and to provide guidance to issuers on going concern disclosures to assist them in improving the disclosures and in providing robust information to investors. Smaller issuers and start-up operations often face more going concern uncertainties, and may therefore find this Notice of particular interest.

|

|

Importance of going concern disclosure to investors

|

|

|

|

|

The going concern assumption is a fundamental principle in the preparation of financial statements. Under the going concern assumption it is presumed that an issuer will continue in operation and that there will be no need to liquidate or cease operating. Going concern disclosures are important to investors as they provide warnings about significant risks that the issuer is facing and may help investors avoid or minimize negative consequences when making investment decisions. It is important that the assessment issuers make with respect to the going concern assumption is rigorous and that the corresponding disclosure provides a balanced and transparent view of material uncertainties that may cast significant doubt on the issuer's ability to continue as a going concern.

|

Going concern disclosures are important to investors as they provide warnings about significant risks that the issuer is facing and may help investors avoid or minimize negative consequences when making investment decisions. Each of an issuer's management, audit committee and auditors has a part to play in ensuring that investors are provided with timely and accurate information related to going concern risks.

|

Canadian Generally Accepted Accounting Principles (CGAAP) require management to assess the issuer's ability to continue as a going concern. If management's assessment identifies material uncertainties related to events or conditions that may cast significant doubt upon the entity's ability to continue as a going concern (for ease of reference, we will refer to these uncertainties in this Notice as a going concern risk), the financial statements should disclose such risk. Disclosure in the management's discussion and analysis (MD&A) should complement and expand upon the financial statement disclosure to provide a complete discussion of the uncertainties and the effect that they have on the issuers' operations, liquidity and capital.

Overall, we found that there is need for improvement in both the timeliness and robustness of the going concern disclosures, particularly in the MD&A. As a result of our review, certain issuers were required to make prospective improvements in their disclosure, and in some cases were required to file material change reports. Disclosure of going concern risks will continue to be an area of focus in our continuous disclosure and prospectus reviews, and issuers should be aware that we will require refilings of documents where appropriate.

|

Management's responsibility

|

Audit committee's responsibility

|

|

The assessment of an issuer's ability to continue as a going concern is the responsibility of its management. Management should satisfy themselves that it is reasonable for them to conclude that it is appropriate to prepare the financial statements on a going concern basis. If a material going concern risk exists, management should ensure that adequate disclosures are included in the issuer's continuous disclosure filings so that these filings fairly present the issuers financial condition, results of operations and cash flows.

|

The audit committee of an issuer must review the issuer's financial statements, MD&A and earnings press releases before the information is publicly disclosed. An audit committee should ensure that management has made an appropriate assessment of the issuer's ability to continue as a going concern and has made the necessary disclosures in its continuous disclosure filings. An audit committee must also be satisfied that adequate procedures are in place for the review of the issuer's other financial information disclosure.

|

Findings

We reviewed a total of 105 issuers. These issuers comprised the following three main groups:

1. issuers with indications of financial difficulty that had no going concern disclosure (28);

2. issuers with indications of financial difficulty that had some going concern disclosure (48); and

3. issuers that had recently ceased operations (29).

1. Issuers with indications of financial difficulty that had no going concern disclosure

For the group of 28 issuers that had indicators suggesting financial difficulty where no going concern risk was disclosed, our review focused on the appropriateness of management's assessment to determine if a going concern risk should have been disclosed. Overall we were satisfied with management's assessment. The issuers reviewed provided sufficient evidence supporting management's belief that there were no material uncertainties creating a going concern risk. Generally, management's assessment of the issuer's ability to continue as a going concern included consideration of unusual or one-time charges, forecasts, and improvements in operations or changes in circumstances. A follow up review of these issuers found that all continue to operate, with only one issuer now disclosing a going concern risk in its financial statements.

--------------------

Evidence supporting management's assessment

If events or conditions have been identified that may cast significant doubt on the entity's ability to continue as a going concern (such as the incidence of serious financial difficulty), sufficient appropriate evidence is required to demonstrate that a material uncertainty does not exist so that additional disclosures are not required. The following are two examples of situations where additional going concern disclosure was not required.

Examples:

Non-recurring charges

An issuer incurred a significant net loss in its most recent financial year. The issuer cited an unusual event -- foreign currency restrictions in one of the primary markets in which the issuer operates -- as the primary cause of the loss. The government restrictions had since been lifted and were not expected to recur in the foreseeable future. Absent such restrictions, the issuer was expected to return to profitability. This supported management's assessment that disclosure of a going concern risk was not necessary.

Amended financing arrangements and improvement in operations

An issuer had a significant working capital deficiency as a result of a violation of certain debt covenants. Subsequent to the year end, the issuer entered into an amended financing agreement with amended terms such that the risk of covenant violation was substantially reduced. In addition, the issuer obtained a new customer contract, and a revised forecast incorporating this new contract showed significant improvement in the issuer's results. This supported management's assessment that disclosure of a going concern risk was not necessary.

--------------------

2. Issuers with going concern disclosure

For the group of 48 issuers with indications of financial difficulty where there was some going concern disclosure, we focused our review on assessing the quality and sufficiency of the going concern disclosure in both the financial statements and MD&A.

|

Financial statement going concern disclosure

|

Auditors' responsibility

|

|

|

|

|

CGAAP requires financial statements to disclose the material uncertainties related to events or conditions identified by management's assessment that may cast significant doubt upon an issuer's ability to continue as a going concern. In assessing whether the going concern assumption is appropriate, management should take into account all available information about the future, which is at least, but is not limited to, twelve months from the balance sheet date{1}.

|

We remind auditors of their responsibilities under Canadian generally accepted auditing standards to obtain sufficient appropriate audit evidence about the appropriateness of management's use of the going concern assumption in the preparation and presentation of the financial statements and to conclude whether there is a material uncertainty about the entity's ability to continue as a going concern. We also remind auditors that if a material uncertainty exists, they are responsible for determining whether the financial statements adequately disclose and describe the going concern risk, and, therefore, that the issuer may be unable to realize its assets and discharge its liabilities in the normal course of business. Beginning for audits of financial statements for periods ending on or after December 14, 2010, an auditor's report is required to include a paragraph that highlights the existence of the material going concern risk even when adequate disclosure is made in the financial statements.

|

Overall, we found that issuers disclosed material uncertainties in the notes to their financial statements. However, 41% did not explicitly state that the disclosed uncertainties may cast significant doubt upon the entity's ability to continue as a going concern. This omission is significant because, absent such linking disclosure, the going concern risk is not highlighted for readers to assess the likelihood and impact of the uncertainties disclosed on the issuers' financial condition. During our review, we often found it difficult, based on the entity's public disclosures alone, to differentiate uncertainties that cast significant doubt on an entity's ability to continue as a going concern from uncertainties that do not cast such doubt, and had to request additional information from the issuer for clarification. Investors do not have the ability to request this additional information and rely on the public disclosure record to make investment decisions. That is why clear robust disclosure is important. In order for the going concern disclosures to be useful to investors, the going concern disclosures should explicitly identify that the disclosed uncertainties may cast significant doubt upon the entity's ability to continue as a going concern.

--------------------

Impact of transition to IFRS

The disclosure requirements for going concern under CGAAP are fully converged with the requirements in paragraph 25 of International Accounting Standards 1 Presentation of Financial Statements (IAS 1). The IFRS Interpretations Committee (the Committee) recently considered the need for further guidance on the going concern disclosure requirements in IAS 1. While the Committee decided not to add the issue to its agenda as they believe IAS 1 provides sufficient guidance, the Committee indicated that for the going concern disclosure required by IAS 1 to be useful, that disclosure must also identify that the uncertainties may cast significant doubt upon the entity's ability to continue as a going concern.

--------------------

Below is an example of a financial statement disclosure that does not explicitly link the disclosed uncertainties to the fact that they may cast significant doubt upon the entity's ability to continue as a going concern:

--------------------

At year-end the Company had cash of $1,000,000 and a working capital deficiency of $2,000,000. The Company's ability to continue operations and fund its expenditures is dependent on management's ability to secure additional financing. Management is actively pursuing such additional sources of financing, and while it has been successful in doing so in the past, there can be no assurance it will be able to do so in the future.

--------------------

The example below provides the link between the uncertainties and going concern that would be meaningful to investors:

--------------------

The financial statements were prepared on a going concern basis. The going concern basis assumes that the Company will continue in operation for the foreseeable future and will be able to realize its assets and discharge its liabilities and commitments in the normal course of business.

The Company has incurred significant operating losses and negative cash flows from operations in recent years, and has a working capital deficiency. Whether and when the Company can attain profitability and positive cash flows is uncertain. These uncertainties cast significant doubt upon the Company's ability to continue as a going concern.

The Company will need to raise capital in order to fund its operations. This need may be adversely impacted by: a lack of normally available financing, the ongoing lawsuit, an accelerating loss of customers, and falling sales per customer. To address its financing requirements, the Company will seek financing through joint venture agreements, debt and equity financings, asset sales, and rights offerings to existing shareholders. The outcome of these matters cannot be predicted at this time.

--------------------

MD&A going concern disclosure

MD&A should clearly communicate, through the eyes of management, an issuer's financial condition and future prospects. Various disclosure requirements for MD&A are applicable to an issuer with a going concern risk{2}.

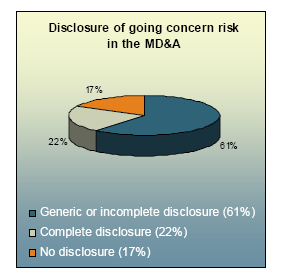

Generally, we found that issuers' discussion in MD&A related to their going concern risk needed improvement. 17% of the MD&A reviewed contained no discussion of going concern risk, and 61% of the going concern disclosures that were included were generic or incomplete.

Most commonly, we noted deficiencies in the following areas of disclosure:

• the risks and uncertainties resulting from the doubt that an issuer would be able to continue as a going concern;

• the impact of the going concern risk on the issuer's financial condition; and

• the impact of the going concern risk on the issuer's liquidity requirements, including mitigating factors and plans.

A complete MD&A discussion of going concern risk should address:

• the financial position (as shown on the balance sheet) and other factors that may affect the issuer's liquidity, capital resources and solvency;

• trends or expected fluctuations in liquidity, taking into account demands, commitments, events or uncertainties;

• risks or uncertainties that management reasonably believes will materially affect the issuer's future performance, including the possibility of discontinuance of operations;

• mitigating factors, and management's evaluation of the impact of such factors on the issuer's going concern risk; and

• management's plans to mitigate the events and uncertainties, and management's evaluation of the effectiveness and likelihood of successful implementation of these plans.

Below is an example of an incomplete MD&A disclosure.

--------------------

The Company is focusing on developing its technology and building its business. The Company has started to generate sales but has incurred significant losses to date. The Company's ability to continue is dependent on its ability to obtain sufficient funding to sustain operations, promote its products and achieve profitable operations.

--------------------

Below is an example of a more robust MD&A discussion that addresses an issuer's going concern risk.

--------------------

The Company has financed its operations through debt and equity issuances. During the period, sales funded 60% of operating costs (40% in the prior period).

The Company has a working capital deficiency of $9,000,000 and an accumulated deficit of $40,000,000. After adjusting working capital for the current related party debt of $10,000,000, the Company expects it will have sufficient liquidity to finance its operations for no more than twelve months. The working capital deficiency limits the Company's ability to fund capital expenditures and operations. The Company is in breach of the minimum working capital and earnings covenants of its credit agreement, which resulted in the lender having the right to demand full repayment.

As a result there is significant doubt about the Company's ability to continue as a going concern. The continuation of the Company as a going concern is dependent on completing a short-term financing to make a $1,000,000 payment to the Company's lender, raising sufficient working capital to maintain operations, reducing operating expenses, and increasing revenues. Subsequent to the year end, the Company has engaged a financial advisor to assist in seeking short-term financing to maintain operations and to work towards a long-term financial restructuring. The Company has also initiated an internal restructuring to sell redundant assets and reduce operating expenses. These plans are expected to be completed within nine months, and are expected to generate sufficient liquidity to finance operations until the launch of the Company's New Product. While management believes that the likelihood of completing these plans is high given the economic recovery and the rebound of the industry, a new financing has not yet been completed and there is no assurance that it will be. Without this financing the Company may be forced to cease operations.

--------------------

3. Issuers that had recently ceased operations

|

|

Timely disclosure of material change

|

|

|

|

|

For the 29 issuers that had ceased operations (i.e., filed for bankruptcy, entered receivership, became dormant) we reviewed the disclosure filed before they ceased operations to assess whether the financial statements and MD&A adequately disclosed their going concern risk. A significant number of these issuers did not draw attention to their going concern risk in the disclosure leading up to their ceasing operations. In some cases, the disclosure was boilerplate and did not clearly communicate the severity of the risk; in others, the disclosure was absent.

|

Securities legislation generally requires a reporting issuer to issue and file a news release and a material change report on a timely basis where a material change occurs in the affairs of the reporting issuer. Sufficient disclosure must be provided to enable a reader to appreciate the significance and impact of the material change. Issuers are reminded to consider whether the occurrence of a going concern risk constitutes a material change.

|

The following is a summary of the findings from a review of the continuous disclosure filings made by these issuers in the period immediately before they ceased operations:

• 28% had no financial statement disclosure related to their going concern risk. An additional 20% had incomplete disclosure and did not explain that there was significant doubt about the issuer's ability to continue as a going concern.

• 21% had no MD&A discussion related to their going concern risk. An additional 52% provided incomplete or generic disclosure.

Given that CGAAP requires management to take into account all available information about the future, which is at least, but not limited to, twelve months from the balance sheet date, in assessing whether the going concern assumption is appropriate, it is important for issuers to consider all available information and assess the need for going concern disclosure on a timely basis. In addition to the financial statements and MD&A requirements, issuers should assess whether they have met their timely disclosure obligation under securities law, including the disclosure of a material fact and the reporting of a material change. We may require refiling of documents or may take additional actions in situations where issuers have not met their disclosure requirements or reporting obligations.

Going Concerns and Prospectus Offerings: Additional Concerns

Further attention to an issuer's going concern risk is necessary when the issuer undertakes to distribute securities under a prospectus.

Subsection 61(2)(c) of the Securities Act (Ontario) prohibits the Director from issuing a receipt for a prospectus if it appears that the proceeds from the prospectus offering, along with the issuer's other resources, will be insufficient to accomplish the purpose of the issue stated in its prospectus. A principal purpose of this provision is to protect the integrity of the capital markets, which would be harmed if an issuer ceased operations on account of insufficient funds shortly after completing a public securities offering.

The proceeds raised under a prospectus may be insufficient if they are raised:

• for a specific purpose but do not address the issuer's short-term liquidity requirements,

• through a best efforts offering without a minimum subscription, or a minimum subscription that does not appear to be sufficient to satisfy the issuer's short-term liquidity requirements, or

• through a shelf prospectus offering that can be drawn down in small increments that may not be sufficient to satisfy the issuer's short-term liquidity requirements.

A prospectus should clearly disclose an issuer's going concern risk to allow its readers to make an informed investment decision. The Director may not issue a receipt for a prospectus if it appears that the prospectus inadequately discloses an issuer's going concern risk. Additional requirements aimed at the disclosure of going concern risk may be found in both NI 41-101 General Prospectus Requirements and NI 44-101 Short Form Prospectus Distributions.

Section 21.1 of Form 41-101F1 Information Required in a Prospectus and section 17.1 of 44-101F1 Short Form Prospectus require disclosure of risk factors relating to an issuer and its business, such as cash flow and liquidity problems. The accompanying instructions require the risks to be disclosed in order of seriousness. An issuer with a going concern risk should disclose this risk in the prospectus. This disclosure should explain the uncertainties that may create a going concern risk and how the issuer is addressing it.

|

|

|

Material fact disclosure requirements

|

|

|

||

|

In many circumstances an issuer with a going concern risk should also include the disclosure required by section 8.7 of Form 41-101F1 for junior issuers. This section requires disclosure of:

|

In addition to considering whether the occurrence of a going concern risk constitutes a material change, reporting issuers are reminded to also consider whether the presence of a going concern risk constitutes a material fact. If this is the case, to the extent that the issuer wishes to make a prospectus offering prior to general disclosure of this information, the issuer will be required to disclose the information in the prospectus in order to be able to certify that the prospectus contains full, true and plain disclosure of all material facts. Issuers should also note that persons in a "special relationship" with the reporting issuer with knowledge of a material fact will generally be prohibited from trading in securities of the issuer prior to disclosure of this information.

|

|

|

•

|

the period of time the proceeds raised under the prospectus are expected to fund operations,

|

|

|

•

|

the estimated total operating costs necessary for the issuer to achieve its stated business objectives during that period of time, and

|

|

|

•

|

the estimated amount of other material capital expenditures during that period of time.

|

|

Similarly, section 4.3 of Companion Policy 41-101CP and section 4.4 of Companion Policy 44-101CP explain that an issuer with negative operating cash flow in its most recently completed financial year for which financial statements have been included in the prospectus should:

• prominently disclose that fact in the use of proceeds section of the prospectus,

• disclose whether, and if so, to what extent, it will use the proceeds of the distribution to fund any anticipated negative operating cash flow in future periods, and

• disclose negative operating cash flow as a risk factor.

Below is an example of a Use or Proceeds disclosure that adequately addresses the two above disclosure requirements.

--------------------

USE OF PROCEEDS

At period end, the Company had negative operating cash flow of $1,500,000 and a working capital deficit of $1,000,000. The net proceeds of the Offering will be used by the Company as follows:

Proceeds of the Offering

The Company will use the proceeds to:

(i) ensure adequate working capital to fund operations for the next 9 months; and

(ii) complete the development phase of its product over the next 6 months.

If the product is successfully developed, the Company expects it will require an additional $2,000,000 to acquire regulatory approvals and implement a marketing plan.

--------------------

Future Action

Our reviews identified areas where going concern disclosures need improvement. While the economic environment for issuers has begun to improve, many issuers still face a going concern risk and will need to provide clear disclosure about this risk. We will continue to focus on going concern risk disclosure as part of our continuous disclosure and prospectus reviews, and require issuers to enhance their disclosure prospectively or to refile their continuous disclosure documents, depending on the severity of the deficiency.

Questions

--------------------

Questions may be referred to:

--------------------

{1} See CICA Handbook Section 1400 General Standards of Financial Statement Presentation, paragraphs 1400.08A and 1400.08B.

{2} See Form 51-102F1 -- MD&A, Part 1(a), sections 1.2, 1.4(g), 1.6, and 1.7.