Notice and Request for Comment - Application for Exemption from Recognition and Registration as an Exchange - ICE Futures Canada, Inc.

A. INTRODUCTION

ICE Futures Canada, Inc. ("ICE Futures Canada"), formerly known as the Winnipeg Commodity Exchange Inc., is currently carrying on business as a recognized commodity futures exchange in Ontario pursuant to the following orders:

(a) an order dated August 24, 1979 recognizing the Winnipeg Commodity Exchange Inc., as a commodity futures exchange (the "Commission's Previous Order");

(b) an order (the "Director's Exemption Order") dated August 24, 1979 exempting:

(i) the Winnipeg Commodity Exchange Inc. from the requirement to make available copies of all current contract terms and conditions to registrants through an agent, and

(ii) registered dealers and advisers from the requirement of furnishing a client with a copy of all current terms and conditions of any contract traded on the Winnipeg Commodity Exchange Inc.; and

(c) an order (the "Director's Acceptance Order") dated August 24, 1979 accepting the form of the commodity futures contracts and commodity futures options traded on the Winnipeg Commodity Exchange Inc.;

ICE Futures Canada has applied (the "Application") to the Commission requesting that the Commission issue orders to:

(a) revoke the Commission's Previous Order;

(b) revoke the Director's Exemption Order;

(c) revoke the Director's Acceptance Order;

(d) exempt ICE Futures Canada from the requirement to be recognized as an exchange under section 21 of the OSA;

(e) exempt ICE Futures Canada from the requirement to be registered as a commodity futures exchange under section 15 of the CFA;

(f) exempt trades in contracts on ICE Futures Canada by registered futures commissions merchants ("FCMs"), and any person or company who trades in a contract solely through an agent who is an FCM, from the requirements of section 33 of the CFA; and

(g) exempt trades in contracts on ICE Futures Canada by "hedgers" from the registration requirement under section 22 of the CFA; (collectively, "Draft Exemption Order").

The oversight of ICE Futures Canada will continue to follow the current regulatory process for the oversight of exchanges within Canada as set out in the Memorandum of Understanding about the Oversight of Exchanges and Quotation and Trade Reporting Systems entered into by the Commission, the Manitoba Securities Commission ("MSC"), the Alberta Securities Commission, the Autorité des marchés financiers, the British Columbia Securities Commission, and the Saskatchewan Financial Services Commission (the "MOU").

The MSC will continue to act as the lead regulator for ICE Futures Canada since ICE Futures Canada is registered as a commodity futures exchange and is recognized as a self-regulatory organization by the MSC.

B. DRAFT EXEMPTION ORDER

In its Application, ICE Futures Canada has addressed the criteria for exemption from recognition of a derivatives exchange recognized in another jurisdiction of the Canadian Securities Administrators. Subject to comments received, staff will recommend that the Commission grant an exemption order with terms and conditions to ICE Futures Canada based on the proposed Draft Exemption Order attached as Appendix "A" to the Application.

The Draft Exemption Order requires ICE Futures Canada to comply with terms and conditions relating to:

1. Regulation of ICE Futures Canada,

2. Access,

3. Filing Requirements,

4. Rule and Product Review,

5. Financial Viability,

6. Information Sharing; and

7. Submission to Jurisdiction and Agent for Service.

C. COMMENT PROCESS

The Commission is publishing for public comment the Application and Draft Exemption Order. We are seeking comment on all aspects of the Application and Draft Exemption Order.

Please provide your comments in writing, via e-mail, on or before July 30, 2012, to the attention of the Secretary of the Commission, Ontario Securities Commission, 20 Queen Street West, Toronto, Ontario M5H 3S8, e-mail: [email protected].

Confidentiality of submissions will not be maintained and a summary of written comments received during the comment period will be published.

Questions may be referred to:

ICE Future Canada Inc. -- Application

May 25, 2012

Attention: Ms. Emily Sutlic, Senior Legal Counsel, Market Regulation

Dear Sirs and Mesdames:

ICE Futures Canada, Inc. -- Application

ICE Futures Canada, Inc. (the "Exchange" or "ICE Futures Canada") formerly known as Winnipeg Commodity Exchange Inc., is currently carrying on business as a recognized commodity futures exchange in Ontario pursuant to the following orders:

(a) an order (the "Recognition Order") dated August 24, 1979 recognizing Winnipeg Commodity Exchange Inc., as a commodity futures exchange pursuant to section 34 of The Commodity Futures Act (Ontario) (the "CFA");

(b) an order (the "Director's Exemption Order") dated August 24, 1979 pursuant to clause 37(I)(b) and subsection 40(2) of the CFA exempting:

(i) Winnipeg Commodity Exchange Inc. from the requirement to make available copies of all current contract terms and conditions to registrants through an agent, and

(ii) registered dealers and advisers from the requirement of furnishing a client with a copy of all current terms and conditions of any contract traded on Winnipeg Commodity Exchange Inc.; and

(c) an order (the "Director's Acceptance Order") dated August 24, 1979 pursuant to section 36 of the CFA accepting the form of the commodity futures contracts and commodity futures options traded on Winnipeg Commodity Exchange Inc. (collectively, the "Previous Orders").

ICE Futures Canada hereby applies to the Ontario Securities Commission (the "OSC" or the "Commission") for the following orders:

(i) an order, pursuant to section 78 of the CFA, revoking the Recognition Order;

(ii) an order revoking the Director's Exemption Order;

(iii) an order, pursuant to section 60 of the CFA, revoking the Director's Acceptance Order;

(iv) an order pursuant to section 147 of The Securities Act (Ontario) (the "OSA") exempting ICE Futures Canada from the requirement to be recognized as an exchange under section 21 of the OSA;

(v) an order pursuant to section 80 of the CFA exempting ICE Futures Canada from the requirement to be registered as a commodity futures exchange under section 15 of the CFA;

(vi) an order pursuant to section 38 of the CFA exempting trades in contracts on ICE Futures Canada by registered Futures Commission Merchants ("FCMs"), and any person or company who trades in a contract solely through an agent who is an FCM, from the prohibition from trading on a commodity futures exchange unless recognized by the Commission under section 33 of the CFA ("FCM Relief"); and

(vii) an order pursuant to section 38 of the CFA exempting trades in contracts on ICE Futures Canada by "hedgers" from the registration requirement under section 22 of the CFA ("Hedger Relief").

(Collectively, the "Exemption Order")

The OSA, CFA and all regulations, rules, policies and notices of the OSC made there under are collectively referred to as the "Legislation".

Approval Criteria

OSC Staff has prescribed criteria that it will apply when considering applications by commodity futures exchanges recognized in another Canadian Securities Administrators (the "CSA") jurisdiction for exemption from registration and recognition. These criteria are similar to those prescribed in OSC Staff Notice 21-702 Regulatory Approach for Foreign Based Stock Exchanges ("Staff Notice 21-702") in relation to applications for recognition (or exemption from recognition) by foreign stock exchanges. For convenience, this Application is divided into the following Parts;

Part I Background

Part II Application of Approval Criteria to the Exchange

1. Regulation of the Exchange

2. Governance

3. Regulation of Products

4. Access

5. Regulation of Participants on the Exchange

6. Rulemaking

7. Due Process

8. Clearing and Settlement

9. Systems and Technology

10. Financial Viability

11. Transparency

12. Record Keeping

13. Outsourcing

14. Fees

15. Information Sharing and Regulatory Cooperation

Part III Submissions

Part I -- Background

The Exchange is a Manitoba corporation, which has been continually in operation since it was founded in 1887. The Exchange facilitates trades in futures contracts and options on futures contracts in canola, western barley, milling wheat, durum wheat and barley (collectively, "ICE Futures Canada Contracts"). Historically the Exchange offered trading of futures contracts and options on futures contracts via open outcry floor trading. In December 2004, the Exchange became the first commodity futures exchange in North America to convert fully to an electronic trading system. That trading system, which was hosted by a major North American futures exchange, was transitioned to the electronic trading system (the "ICE Platform") owned and operated by IntercontinentalExchange, Inc. ("ICE") over the weekend of December 4 to 6, 2007.

The Exchange is ultimately owned by ICE, pursuant to a court approved acquisition of shares. The acquisition was completed on August 27, 2007. ICE is a public company governed by the laws of the State of Delaware and listed on the New York Stock Exchange. ICE and its affiliates are collectively referred to in this application as the "ICE Group".

The Exchange is the sole shareholder of ICE Clear Canada, Inc. ("ICE Clear Canada" or the "Clearinghouse"), which was formerly known as WCE Clearing Corporation. ICE Clear Canada is a Manitoba corporation and is designated as a recognized clearinghouse under Section 16(1) of The Commodity Futures Act (Manitoba) (the "CFA MB") pursuant to Order No. 5719 of The Manitoba Securities Commission (the "MSC"). In addition to being registered as a commodity futures exchange in Manitoba, ICE Futures Canada has received no-action relief from staff of the U.S. Commodity Futures Trading Commission (the "CFTC") and is regulated by the Autorité des marchés financiers Quebec (the "AMF") pursuant to an exemption order.

The Exchange proposes to offer direct electronic access to trading in ICE Futures Canada Contracts through the ICE Platform to participants in Ontario ("Ontario Participants"), who meet the eligibility criteria in the ICE Futures Canada Rules and who are either (i) entities registered as FCMs under the provisions of the CFA; or (ii) entities that seek to rely on the Hedger Relief ("Hedgers") as defined in Section 1(1) of the CFA.

ICE Futures Canada is currently carrying on business in Ontario pursuant to the Recognition Order and has registered Direct Access Trading Participants ("DATPs") which are FCMs and which are regulated in Ontario by the OSC. ICE Futures Canada wishes to be able to continue to do business with Ontario based entities which are registered as FCMs under the provisions of the CFA and would like to be able to grant DATP status to Ontario resident entities that meet the definition of a "Hedger" as defined in section 1(1) of the CFA. Hedgers are non-market intermediary commercial enterprises such as grain companies, producers, or processors that are exposed to the risks attendant upon fluctuations in the price of commodities. ICE Futures Canada also has Ontario residents registered in other categories, namely, Trading Participants, Merchant Participants and Ancillary Participants. Additional information on participants can be found in Part 5.1 Fair Access.

Part II -- Application of Approval Criteria to ICE Futures Canada

1. REGULATION OF THE EXCHANGE

The exchange is recognized or authorized by another securities commission or similar regulatory authority in Canada and, where applicable, is in compliance with National Instrument 21-101 -- Marketplace Operation and National Instrument 23-101 -- Trading Rules, each as amended from time to time.

Pursuant to an order issued by the MSC on June 16, 2008 ("Order No. 5718") the Exchange is recognized as a self-regulatory organization by the MSC pursuant to subsection 14(1) of the CFA MB and registered as a commodity futures exchange pursuant to subsection 15(1) of the CFA MB.

The MSC imposes numerous reporting obligations on ICE Futures Canada including advising of disciplinary actions taken against any ICE Futures Canada Participant, investigations of business transacted on the ICE Platform, and defaults by ICE Futures Canada Participants. The MSC has access to all trade information, compliance data, and other operational information as it relates to the Exchange's operations. The MSC conducts operational reviews as it deems necessary and makes recommendations concerning matters relative to the enforcement of rules, preventing market manipulation and customer and market abuses, and ensuring the recording and safe storage of trade information. The MSC also has access, upon request, to all records maintained by ICE Futures Canada.

Rule amendments are provided to the MSC which reviews and determines whether to grant non-disapproval. In the majority of situations, non-disapproval is obtained prior to the implementation of the said rule amendments. In unique circumstances, the Exchange has utilized the provisions of section 17 of the CFA MB to implement a rule and then give notice of same to the MSC.

On an annual basis the Special Regulatory Committee (the "SRC") provides a report to the MSC on all matters of regulatory importance pursuant to the requirement of Recognition Order No. 5718. The SRC also provides an annual financial report of the operations of the Regulatory Division to the MSC. Further details on the SRC and its reporting obligations are set out in Section 6 of this application.

ICE Futures Canada has reporting obligations to the AMF pursuant to Decision No. 2010-PDG-0034 issued on February 23, 2010. The AMF is an Exempting Regulator pursuant to the Memorandum of Understanding Respecting the Oversight of Exchanges and Quotations and Trade Reporting Systems.

ICE Futures Canada has reporting obligations to the CFTC, Division of Market Oversight and Division of Clearing and Intermediary Oversight, pursuant to the requirements of a No-Action Letter and a Part 30.10 Order, respectively. On December 5, 2011 the CFTC voted unanimously to approve rules which require foreign exchanges (FBOTs) to register with the CFTC. The FBOT registration processes will replace the No-Action letter regime.

ICE Futures Canada also has reporting obligations to FINMA, the statutory regulatory authority for Switzerland, pursuant to an Order issued by FINMA on September 2, 2010.

ICE Futures Canada also has the ability to offer its products for trading on screens in other jurisdictions around the world. A Jurisdictions document is published and maintained on the website.

2. GOVERNANCE

2.1 The governance structure and governance arrangements of the exchange ensure:

(a) effective oversight of the exchange;

(b) that business and regulatory decisions are in keeping with its public interest mandate;

(c) fair, meaningful and diverse representation on the board of directors (Board) and any committees of the Board, including:

(i) appropriate representation of independent directors, and

(ii) a proper balance among the interests of the different persons or companies using the services and facilities of the exchange;

(d) the exchange has policies and procedures to appropriately identify and manage conflicts of interest; and

(e) there are appropriate qualifications, remuneration, limitation of liability and indemnity provisions for directors, officers, and employees of the exchange.

2.2 Fitness

The exchange has policies and procedures under which it will take reasonable steps, and has taken such reasonable steps, to ensure that each director and officer is a fit and proper person.

The Exchange is headed by a board of directors (the "Board") whose organization and constitution is governed by the provisions of The Corporations Act (Manitoba). As part of its recognition review process, the MSC reviewed the organization and structure of the Exchange, including the By-laws and Rules establishing the corporate governance and the composition of the Board, to ensure that the Exchange is in compliance with statutory requirements.

The By-laws and Rules of the Exchange, in conjunction with the corporate law of the Province of Manitoba, establish the responsibilities of the Board and its officers. In general, the day-to-day management activities are the responsibility of the officers of the Exchange, who are directly accountable to the Board and appointed by the Board.

The Board is able to provide effective governance through its President and senior management. Pursuant to By-law Article 4, the Board has control and management of the business of the Exchange, with all required powers. The Board may, and has, delegated authority to the officers of the Exchange pursuant to the By-law Article 6.

Board meetings take place, on average, 6 to 8 times per year. A simple majority decides an issue on the Board agenda. If there is a tie, there is no right to a casting vote, and accordingly the motion would not pass. The cases in which more than a simple majority of the votes are required include emergency action matters and suspension of trading (Article 13 of the By-law). Between meetings, the Board may authorize actions by way of written resolutions, provided all members of the Board respond to the resolution and agree on the action to be taken (By-laws, Article 4.09).

There are seven (7) individuals on the Board of Directors of ICE Futures Canada, three (3) of whom are independent directors. Independent means individual persons who are not registered Participants and/or shareholders or employees, officers or directors of Participants and/or shareholders of ICE Futures Canada. Order No. 5718 requires that only two (2) Board members be independent. The MSC has reviewed the board size to ensure it is large enough to deal with conflicts and has the ability to act independently. The ICE Futures Canada Rules and By-laws are available on the website. The Board delegates certain matters to committees, as set out in the By-laws and Rule 3. Committee members are drawn from a wide group of Participant categories and other persons with expertise. Committee sizes are sufficient to ensure representation from a wide range of interested persons.

The Board is required, pursuant to Order No. 5718, to empower the SRC and a Regulatory Division responsible for all matters concerning compliance and regulation for the Exchange. The SRC has been established to promote the protection of the public interest and protection of the integrity of the markets.

The SRC is a committee appointed by the Board, however it reports directly to the MSC on all matters affecting regulation and compliance, and effectively has board-like powers with respect to all matters pertaining to regulation and compliance.

The remuneration of directors and officers of ICE Futures Canada is reviewed on an annual basis by the Compensation Committee of ICE which is comprised entirely of directors that are independent of ICE and of ICE Futures Canada.

The ICE Group's global insurance program provides professional indemnity and directors and officers coverage to all directors and executive officers of ICE Futures Canada.

As set out above, ICE Futures Canada is ultimately a wholly owned subsidiary of ICE. ICE, as a publicly traded company, has a Nominating and Corporate Governance Committee. That committee would review any new proposed director for the Board. The ICE Nominating and Corporate Governance Committee has ratified a Policy regarding the Qualification and Nomination of Director Candidate (the "Policy"). The Committee would utilize the principles of the Policy in reviewing any new board applicants for ICE's subsidiary companies, including ICE Futures Canada.

The Policy includes direction on;

The necessary qualifications of board candidates, which includes: persons who possess personal attributes of leadership, an ethical nature, a contributing nature, independence, interpersonal skills, and effectiveness. In addition, the experience attributes include financial acumen, general business experience, industry knowledge, diversity of views and special or unique business expertise. With respect to independent directors, the committee seeks to ensure a cross section of candidates with unique expertise in areas that the relevant board requires strength in, examples include legal & regulatory, financial & accounting expertise, business development and similar.

The process to be utilized by the Committee in identifying and evaluating director candidates, which process includes input from committee members, other directors of the Company, management of the company and shareholders of the company. Where appropriate, outside consultants and search firms are utilized. Once identified, the candidates are interviewed by the Chairman of the board, the Chief Executive Officer and one committee member. The full board is advised and kept updated.

The evaluation of existing directors, which is performed by the committee on an annual basis.

At the time of the acquisition of the Exchange in August 2007, the MSC was required to review and approve the transaction, which included a review of ICE, the Board, and the officers and employees, and its ability to operate a regulated exchange and clearinghouse. The Board members have been the same since the date of acquisition on August 27, 2007. Three members of the seven person Board are senior ICE executives, including the Chairman, Chief Financial Officer, and Senior V.P. Business Development, and each of these individuals has unique expertise and knowledge in the operation of global marketplaces, including regulated exchanges and clearinghouses, as set out in their biographies.

The three independent board members on the Board are Canadian residents with extensive expertise in the areas of banking and finance, law and regulation, and business and corporate governance, respectively.

All employees and officers of the Exchange are subject to detailed pre-employment screening which is conducted by an external, independent agency and includes credit review, verification of academic qualifications and employment history, and a review of the information supplied in support of the individual's application (including references). In addition, senior management appointees are subject to further checks on their professional memberships, qualifications, and directorships.

Article 4.18 of the General By-law deals with Conflict of Interests and applies to the Board and all committees of ICE Futures Canada. These conflicts of interest provisions require that disclosure of the conflict be made, and prohibit a Board or committee member from participating in such body's deliberations, or voting in any manner, in a matter in which they have a conflict of interest. The possibility of a significant and/or direct financial position in a matter constitutes a conflict of interest and where a conflict exists, Board and committee members must recuse themselves and not be involved in the deliberation and/or voting on the issue. If the number of withdrawals or recusals prevents a quorum then there is a process for dealing with the matter, including, where necessary, delegation to an ad hoc committee made up of persons who do not have conflicts with the matter under consideration. The minutes of all meetings must document the procedures followed to show compliance with the Article 4.18 of the By-law provisions.

3. REGULATION OF PRODUCTS

3.1 Review and Approval of Products

The products traded on the exchange and any changes thereto are reviewed by the appropriate securities commission or similar regulatory authority, and are either approved by the appropriate authority or are subject to requirements established by the authority that must be met before implementation of a product or of changes to a product.

3.2 Product Specifications

The terms and conditions of trading the products are in conformity with the usual commercial customs and practices for the trading of such products.

3.3 Risks Associated with Trading Products

The exchange maintains adequate provisions to measure, manage and mitigate the risks associated with trading products on the exchange including, but not limited to, margin requirements, intra-day margin calls, daily trading limits, price limits, position limits and internal controls.

Prior to listing any new derivatives product, the Exchange conducts a substantial market review to confirm that there will be a proper market for the product. This includes a consultation process with all stakeholders that may have an interest in the contracts including end-users, grain companies, grain brokers, FCMs, academics, speculators, and Exchange staff. Critical to the introduction of a new contract is that the Exchange ensure the ongoing integrity of the cash market data underlying the contract at issue. Extensive consultation with industry participants, academics, trade groups, lobbying entities, consultants and others is instrumental in the development of a new contract. ICE Futures Canada reviews and adheres to the principles of contract design for physically settled commodity contracts as articulated in the "Principles for the Regulation and Supervision of Commodity Derivatives Markets" published by the International Organization of Securities Commissions ("IOSCO"), in September 2011, as they pertain to contract design (Chapter 3). Any new product must be approved by the MSC and must meet the regulatory requirements set out in Part 6 of the CFA MB.

Part 6 requires that prior to listing a new derivatives product, the Exchange must provide evidence to the MSC that;

a) more than occasional use is reasonably to be expected to be made of the contract for hedge trading;

b) each term or condition in the contract conforms to normal commercial practices; and

c) that the contract includes satisfactory levels of margin, daily price limits, daily trading limits, and speculative position limits.

In addition to requiring the pre-approval of the MSC, the Exchange must receive pre-approval from the CFTC pursuant to the provisions of the No Action Letter.

The terms and conditions of the ICE Futures Canada Contracts including speculative position limits, conform to the requirements of agricultural contracts traded on North America's derivative exchanges.

The extensive market consultation and Board approval processes to which all ICE Futures Canada Contracts are subject ensures that the terms and conditions of ICE Futures Canada Contracts are in conformity with normal business practices for trade in such products, that they meet the needs of the relevant commodity sector, and have widely acceptable specifications. ICE Futures Canada appoints a Contract Committee, an Electronic Trading Committee, and an Options Committee to ensure that there is ongoing dialogue with the users of the contracts to maintain relevance to the underlying cash markets.

ICE Futures Canada is responsible for all trading rules, for the surveillance of the market, and for ensuring the orderly trading and liquidation of contracts. Daily trading limits, price limits, and speculative position limits are set by the Exchange and compliance of same by market participants is monitored by the Regulatory Division.

All ICE Futures Canada Contracts are cleared and settled by ICE Clear Canada. ICE Clear Canada acts as a counterparty and financial guarantor to each transaction executed on ICE Futures Canada. ICE Futures Canada and ICE Clear Canada cooperate with respect to the development and maintenance of all ICE Futures Canada Contracts to ensure that all potential risks are evaluated and can be managed.

ICE Clear Canada sets margin requirements and makes margins calls, including intra-day margin calls from Clearing Participants. ICE Clear Canada undertakes Clearing Participant Surveillance to ensure the financial soundness of Clearing Participants. Risk and capital-based position limits are established for each Clearing Participant.

4. ACCESS

4.1 Fair Access

(a) The exchange has established appropriate written standards for access to its services including requirements to ensure

(i) participants are appropriately registered as applicable under Ontario securities laws or Ontario commodity futures laws, or exempted from these requirements,

(ii) the competence, integrity and authority of systems users, and

(iii) systems users are adequately supervised.

(b) The access standards and the process for obtaining, limiting and denying access are fair, transparent and applied reasonably.

(c) The exchange does not

(i) permit unreasonable discrimination among participants, or

(ii) impose any burden on competition that is not reasonably necessary and appropriate.

Pursuant to Order No. 5718, the Exchange must comply with the following;

The requirements of the Exchange shall permit all registered dealers that satisfy the criteria of the Exchange, including a requirement for recognition by another organization, if applicable, to access the trading facilities;

The Exchange will maintain written rules and application forms for granting access to trading on its facilities;

The Exchange will not unreasonably prohibit or limit access by a person or company to the regulated services offered by it.

The Exchange will keep detailed records relating to all applications for access to the facilities of the Exchange that have been granted as well as requests for access that have been refused, including the reasons for denying or limiting access to any applicant.

Part 4D of Rule 4 sets out the application processes. There are standard forms of application/agreements for each category of participant status which are required to be completed by each potential participant. All forms are available on the Exchange website. The forms of application/agreements have been reviewed by the MSC.

ICE Futures Canada maintains criteria that is applied in an objective and non-discriminatory manner in determining who can register as a participant of the Exchange and access its facilities. Pursuant to Rule 4, entities are entitled to register with the Exchange in one of four categories, depending on their business operations and desired activities. The categories are; DATP, Trading Participant, Merchant Participant, and Ancillary Participant, and there are sub-categories within each category. A brief description of each of the categories follows;

DATP is the only category that is entitled to directly access the ICE Platform. Participants in this category are entitled to connect directly to the ICE Platform through their own conformance-tested front end systems, called Direct Access Interfaces ("DAI") or through an Independent Software Vendor ("ISV") which is a third party provider which licenses its conformance tested front-end system to DATPs.

DATPs can be either companies or individuals. They are classified as one of: FCM, Merchant, Liquidity Provider, or Market Maker. Only FCMs may trade for the accounts of others. Hedgers who register in the category of DATP are entitled to trade only for their own account.

All DATPs access the ICE Platform by being permissioned by a Clearing Participant. In order to access the ICE Platform, a DATP must a) be a Clearing Participant of ICE Clear Canada; or b) have a properly executed Clearing Authorization and Guaranty Form with a Clearing Participant of ICE Clear Canada; or c) be issued a Systems Managed Account ("SMA") by a Clearing Participant.

Trading Participants are companies or individuals who trade through DATP FCMs. This registration provides most sub-categories with reduced exchange and clearing transaction fees.

Merchant Participants are companies that participate in the physical delivery system. They are entitled to register delivery space (elevators) and may choose to make delivery by issuing warrants. There are strict requirements pertaining to elevator registration, and myriad financial and operational obligations that must be met, all as set out in the Rules. Merchant Participants can trade as a client of a FCM. The FCM must be a dealer properly registered in the jurisdiction of the Merchant Participant.

Ancillary Participants do not have any trading or delivery rights. This is a legacy category and includes companies and individuals with an interest in the Exchange. Ancillary Participants are entitled to sit on committees of the Exchange. Ancillary Participants can trade as a client of a FCM. The FCM must be a dealer properly registered in the jurisdiction of the Ancillary Participant.

The Exchange reviews financial filings from all Merchant Participants and all Clearing Participants both at the time they apply for Participant status (Rule 7A.03 and Clearing Rule A-305) and on a regular basis (quarterly and annual for Merchants, per Rule 7A.03 and Clearing Rule A-305).

Entities that wish to register as participants are required to complete a written application/agreement which is standardized for each category. The application/agreement forms are designed to ensure that applicants are appropriately identified, are qualified to trade in commodity futures in their jurisdiction, have adequate financial resources, have a client relationship with a registered Clearing Participant, and have exhibited proper conduct in other capital markets activities. The Exchange reviews constating documentation and financial statements (if applicable to the category of registration), and confirms legal and regulatory compliance in the home jurisdiction (including any registration or licensing requirements for trading in commodity futures for clients). Staff of the legal department review all written applications for participant status. In the event that an application was refused, or was granted under conditions, an applicant has a right of appeal to the SRC pursuant to ICE Futures Canada Rule 4D.04.

Any applicant that is denied participant status with ICE Futures Canada and/or any ICE Futures Canada registered participant whose participant status and/or access to the ICE Platform is suspended is entitled to the opportunity to make representations and be heard, an explanation/reasons for the decision, and the right to appeal the decision. The Exchange maintains records of its participant application reviews and any resulting hearings or appeals.

Only DATPs have direct access to the Trading Platform and only with the approval and permission of a registered Clearing Participant in the category of FCM. All direct access to the ICE Platform is provided by ICE Futures Canada; it cannot be provided by another participant. ICE Futures Canada requires the following documentation in order for it to approve an entity as a DATP and then connect that registered DATP to the ICE Platform:

a) An Application/Agreement -- Form 1-C2010;

b) Proof that the entity will be set up to access the ICE Platform on a conformance tested and approved front end system. There are three options:

i) The DATP enters into a contract with an ISV (which has its own written agreement with ICE Futures Canada and ICE); or

ii) The entity itself has developed its own conformance tested front end system and has entered into a tri-party agreement DAI Agreement with ICE Futures Canada and ICE; or

iii) The DATP utilizes WebICE, which is the front end system owned and operated by ICE.

c) The DATP must be a registered Clearing Participant with ICE Clear Canada, Inc., or have a written Clearing Authorization and Guaranty with a registered Clearing Participant of ICE Clear Canada (in the category of FCM), or be issued a SMA by a Clearing Participant of ICE Clear Canada (in the category of FCM). By providing either a Guaranty or a SMA{1}, the Clearing Participant is agreeing that it will guarantee all of the financial obligations of the DATP(and its employees and customers, as applicable). This is important because the Exchange looks to two categories of registered Participants to ensure all financial obligations are met; a) Clearing Participants (with respect to all transactions effected) and b) Merchant Participants (with respect to the physical delivery aspect of the contracts).

Only DATPs which are registered in the category of FCM are entitled to have customers. These customers, which may be registered as Trading Participants, Merchant Participants, or Ancillary Participants do not have direct trading access to the ICE Platform; they are "order-routed" through the FCMs. Customers trade through the registered FCM (DATP). The FCM (DATP) is responsible for setting up the risk management processes and procedures for each customer. All trading conducted by the customers of an FCM (DATP) must go through (order-routed), and be approved by, that FCM (DATP).

ICE Futures Canada Rules require registered participants to ensure that the users of the Trading System are competent and utilize the ICE Platform appropriately.

Rule 8B.01d (3) and (5) requires registered Participants to:

(3) implement suitable security measures such that only those individuals explicitly authorized to trade by the Direct Access Trading Participant may gain access to Trading System;

(5) ensure that any access to the Trading System granted to a User by the Direct Access Trading Participant is:

i) Adequately controlled and supervised, including that the Direct Access Trading Participant must have the ability to make appropriate risk management and other checks before any orders are submitted to the Trading System, and

ii) Uniquely identified in accordance with the Rules on User Identification, and the Procedure attached to Rule 8 as "C Procedure Requirements for Unique User Information."

ICE Futures Canada Rules require that DATPs register a minimum of two "Responsible Individuals" that are responsible for all business conducted through their systems and registered accounts. These individuals must have the authority to bind the company.

Rule 4 prescribes that FCMs must be properly registered with the regulatory authorities in their home jurisdiction and in any other jurisdictions required by law. (Rule 4B.02 (l) (i)).

Rule 4C.02 prescribes that registered Participants must meet and maintain any qualifications required by the Rules or the self-regulatory organization(s) they are members of.

Rule 4C.04 requires all registered Participants to adopt written supervision policies and procedures to be followed by their directors, officers, partners and employees that are adequate, taking into account the nature, scope and complexity of the business, to ensure compliance with the Rules and the CFA MB.

Rule 4C.06 provides that all registered Participants entering orders must comply with all applicable regulatory standards with respect to the review and approval of orders.

Rule 11B.02 provides that companies are vicariously responsible for the actions of their employees, partners, directors and officers.

DATPs and Trading Participants as well as any other customer of a DATP, including Merchant Participants and Ancillary Participants, can have trading access terminated immediately if their Clearing Participant requests, or if they breach certain Rules of the Exchange. Termination could result inter alia, due to a breach of established capital or risk parameters, providing passwords or trading terminal access to persons not entitled to trade, failing to pay margin calls as and when required, and any other conduct that would be considered harmful to the Trading System.

All Participants are subject to disciplinary action in the event they fail to comply with ICE Futures Canada Rules or with any provision of the CFA MB. Disciplinary action may result in suspension, expulsion or fines. Participants are accountable and vicariously liable for the actions of their Responsible Individuals and employees. Information setting out the obligations of the Participants including information on the inspections, investigations and hearing procedures of ICE Futures Canada and the violations and penalties that may be imposed is included in Rules 10 and 11.

The ICE Platform maintains significant order data that must be populated by all entities submitting orders to the Trading System. This order information is populated via the traders' front-end trading systems, whether those systems are an ISV/DAI, or the proprietary WebICE system. Population of these data fields is a necessary requirement of each order, and furthermore is an element of the conformance testing that all ISVs and DAIs must pass before connecting to the ICE Platform. Order data, in turn, is used by the ICE Platform to automatically generate trade records for those orders that result in trade execution.

The order and trade information is retained within the trading systems, and is also loaded daily into ICE's proprietary compliance surveillance systems. Regulatory Division staff utilized this information in the daily review of exception reports and queries to flag potential trading violations.

Rule 8B.14 stipulates requirements for order recording and retention. The Rules of ICE Futures Canada, and in particular Rule 10, also provide for the jurisdiction of the Exchange to request, and the obligation of the participant to provide, any additional order or trade information that the Regulatory Division deems necessary.

Firms that cease to be ICE Futures Canada Participants, Responsible Individuals who are de-registered, and the employees of registrant firms remain subject to ICE Futures Canada's disciplinary jurisdiction for a period of one (1) year after the deregistration becomes effective or for as long as disciplinary proceedings continue.

Access for Ontario Persons

ICE Futures Canada is seeking Relief which would enable the following Ontario residents to trade ICE Futures Canada Contracts as DATPs;

1) Entities registered as FCMs under the provisions of the CFA;

2) Entities that meet the definition of a "Hedger" as defined in Section 1 (1) of the CFA.

All other Ontario residents would be required to become clients of an Ontario-registered FCM and trade ICE Futures Canada contracts through that FCM.

It is our expectation that most Ontario market participants interested in registering as DATP with ICE Futures Canada would be engaged in the business of trading commodity futures either as an FCM or as a Hedger. Hedgers are non-market intermediary commercial enterprises such as grain companies, producers, or processors that are exposed to the risks attendant upon fluctuations in the price of commodities.

5 REGULATION OF PARTICIPANTS ON THE EXCHANGE

5.1 Regulation

The exchange has the authority, resources, capabilities, systems and processes to allow it to perform its regulation functions, whether directly or indirectly through a regulation service provider including setting requirements governing the conduct of its participants, monitoring their conduct, and appropriately disciplining them for violations of exchange requirements.

ICE Futures Canada Rule 9 provides for the establishment of the Regulatory Division and the SRC, and mandates the SRC with duties and jurisdiction. In fulfillment of the requirements of Recognition Order No. 5718, the Board, by resolution, ceded powers under ICE Futures Canada Rules to the SRC, which direct that the SRC shall:

1) Ensure that the Regulatory Division has the resources it needs to carry out is duties. In the event the Special Regulatory Committee determines that the Regulatory Division has insufficient resources it shall make a recommendation(s) to the Board to resolve the matter.

2) Ensure that the Regulatory Division carries out its duties and responsibilities and that it does so in a manner that is fair, objective and without conflict of interest.

3) Evaluate the performance of the Regulatory Division and report thereon to the Commission on or before May 31st of each year. A copy of the report will be provided to the Board.

4) Report to the Commission, as required, on all matters of regulatory importance.

5) Recommend rules, policies and rule amendments of a matter other than administrative or operational in nature, to the Board on matters relating to:

i. Applications for Participant status.

ii. The operations and standards of practice and business conduct applicable to Participants.

iii. Investigations and disciplinary matter

iv. Market surveillance matters

v. Suspensions for failure to provide information pursuant to Rule 10D.06.

a. To hear and decide on hearings at first instance where the Rules so require.

b. To hear and decide appeals from decisions of the Discipline Committee.

The Rules further provide that the Regulatory Division has responsibility for investigation and market surveillance matters (Rule 9.08).

The Regulatory Division is responsible for monitoring and investigating trading in ICE Futures Canada Contracts to detect abusive and improper trading practices, and for prosecuting rule violators. The Regulatory Division includes investigators who monitor the market and conduct investigations and inspections relating to suspicious trades or suspicious patterns of trading. ICE utilizes proprietary software programmes that permit numerous sophisticated software queries to detect trade abusers. These programmes are able to generate reports which monitor for trading ahead, accommodation trading, large cross trades, direct and indirect cross trading opposite customer accounts, and wash trading among other improper trading practices.

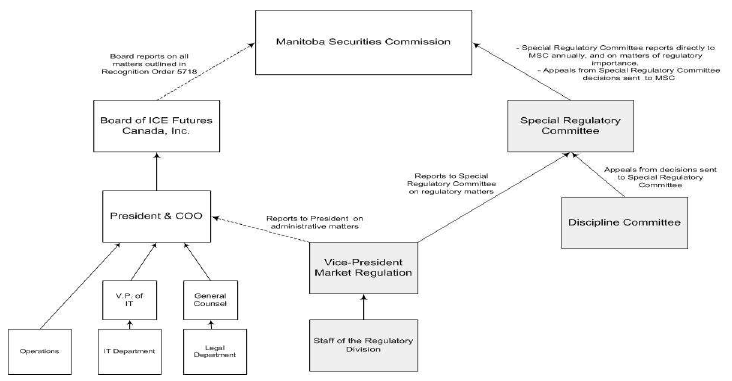

The diagram below sets out the internal reporting structure and the position of the Regulatory Division and the SRC in the Exchange's organization, all of which the MSC has accepted as conforming to the requirements of Order No. 5718. What is important to fulfillment of the conditions of Order No. 5718 is the separation of jurisdiction between the regulatory and the business functions. Part of this was achieved by setting up the organization such that the staff of the Regulatory Division report directly to the SRC on all matters of a regulatory importance and to the President (and thereafter the Board of Directors) on administrative matters. The SRC, in turn, reports directly to the MSC.

As noted earlier, Order No. 5718 at section 24 to Appendix "A" states:

The Exchange shall, through the Regulatory Division and otherwise, establish such rules, regulations, policies, procedures, practices or other similar instruments as are necessary or appropriate to govern and regulate all aspects of its business and internal affairs and shall in so doing specifically govern and regulate so as to:

a. Seek to ensure compliance with the Act;

b. Seek compliance with the terms and conditions of this order as well as any regulations, rules, policies or orders issued by the Commission;

c. Seek to prevent fraudulent and manipulative acts and practices;

d. Seek to promote just and equitable principles of trade;

e. Seek to foster cooperation and coordination with persons or companies engaged in regulating, clearing, settlement, processing information with respect to, and facilitating transactions in, trades in future and options contracts; and

f. Seek to provide for appropriate discipline.

Staffing of the Regulatory Division consists of a Vice-President, Market Regulation, a Manager of the Regulatory Division, a Senior Regulatory Officer, and an Investigator/Analyst. The Department has the ability to obtain administrative support assistance as required. Staff of the Regulatory Division is responsible for ensuring compliance with ICE Futures Canada Rules by all participants of the Exchange, conducting investigations and inspections into all matters, whether brought forward by a client or a participant complaint or whether on its own initiative and for ensuring that all matters of regulatory importance are brought forward to the SRC.

The Regulatory Division is also responsible for trade surveillance and market surveillance.

Trade Surveillance is conducted daily, and focuses on detecting abusive and improper trading practices, such as wash trading, front-running and pre-execution communications. The Exchange utilizes various reports which flag potential violative conduct. Trade surveillance also includes spot checks which are conducted on EFP and EFR transactions. In addition, investigators review error trades, trade adjustments, and trade cancellations.

Market Surveillance includes all processes and procedures aimed at preventing, detecting, and protecting against market manipulation and other threats to market integrity. Staff of the Regulatory Division focuses on activities that could influence the validity of market prices and the proper functioning of the Exchange's contracts as price discovery and risk management tools. At least weekly, a meeting of all staff of the Regulatory Division is held to review market information with a particular focus on the nearby (expiring) contract months. All market participants are required to report their positions to the Regulatory Division in accordance with the requirements of the Rules. In addition the physical stocks information along with details on outstanding warrants and delivery certificates, as well as volume and open interest ("VOI") reports are analyzed and reviewed.

For any decision made by the Exchange that affects a Participant, including a decision in relation to acceptance of participant registration status, access to the Trading System or discipline matters, Rule 10 requires that all due process requirements of Canadian administrative law are met, including that parties are given full particulars of the case against them, an opportunity to be heard and make representations. Rule 10 provides that an independent, non-biased panel of three members of the Discipline Committee will hear the matter. The Panel keeps a record of the hearing and provides written reasons for its decision. There are appeal rights to the SRC and the MSC.

Participants are subject, under certain circumstances, to suspension or termination with regard to their access to the ICE Platform. Information setting out the obligations of the participants including information on the inspections, investigation and hearing procedures of ICE Canada and the violations and penalties that may be imposed is fully transparent and set out in Rules 10 and 11. All inspections and investigations follow procedures that provide for written notification of the allegations against a participant (the Originating Notice), the opportunity for filing an answer (the Reply), and all due process required by Canadian administrative law under the hearing process, which includes a hearing at first instance before the Discipline Committee, an appeal to the SRC and an appeal to the MSC. An appeal, with leave, is further permitted to the Manitoba Court of Appeal. The chart on the following page outlines the process in diagram form.

6. RULEMAKING

6.1 Purpose of Rules

(a) The exchange has rules, policies and other similar instruments (Rules) that are designed to appropriately govern the operations and activities of participants.

(b) The Rules are not contrary to the public interest and are designed to

(i) ensure compliance with securities legislation and derivatives legislation, as applicable;

(ii) prevent fraudulent and manipulative acts and practices;

(iii) promote just and equitable principles of trade;

(iv) foster co-operation and co-ordination with persons or companies engaged in regulating, clearing, settling, processing information with respect to, and facilitating transactions in securities or derivatives, as applicable;

(v) provide a framework for disciplinary and enforcement actions; and

(vi) ensure a fair and orderly market.

The Exchange and its Participants are required to comply with all provisions of the CFA MB. Each ICE Futures Canada Participant agrees to comply with the ICE Futures Canada Rules, which also provide for compliance with the CFA MB. ICE Futures Canada Rules require participants to keep and maintain records, file reports and comply with prescribed position limits and position accountability.

ICE Futures Canada and ICE Clear Canada maintain a set of written Rules and Annexes. ICE Clear Canada also publishes an Operations Manual. The ICE Futures Canada Rules and Annexures and ICE Clear Canada Rules and Operations Manual are designed to fulfill all of the requirements of Orders Nos. 5718 and 5719 and to provide for a fair and orderly market. Updated documents are available on the Exchange's website.

ICE Futures Canada works with companies and persons engaged in regulating, clearing, settling and processing information, and facilitating transactions in products by entering into information sharing agreements, holding meetings to share information and otherwise ensuring information is up to date and potential amendments to processes are discussed in advance.

All trading in ICE Futures Canada Contracts is conducted in accordance with ICE Futures Canada Rules (particularly Rule 8) and the related rules of ICE Clear Canada. ICE Futures Canada Rules are applicable to all ICE Futures Canada market participants without regard to jurisdictional boundaries as such obligations arise by virtue of the contractual relationship between ICE Futures Canada and all entities trading its markets. ICE Futures Canada Rules contain substantive provisions relating to participant requirements, risk management, trading procedures, speculative position limits, reporting and business conduct standards, contract specifications, procedural provisions relating to the discipline, arbitration, default rules and other provisions. Exchange participants are required to act in accordance with the spirit as well as the letter of ICE Futures Canada Rules.

The ICE Futures Canada Rules specifically reference the CFA MB at Rule 11B.01 d) and it is a violation of the Exchange Rules to contravene the CFA MB and the regulations and rules promulgated thereunder. Recent disciplinary proceedings have included violations of the CFA MB.

The ICE Futures Canada Rules prohibit a Participant from disseminating false or misleading or knowingly inaccurate information concerning contract, underlying commodity or market information or conditions; from manipulating or attempting to manipulate the market, from entering bids or offers not in good faith or for an improper purpose, from executing non-competitive transactions, from engaging in any conduct or practice that is inconsistent with just an equitable principles of trade, or otherwise from violating the Rules or procedures of ICE Futures Canada or ICE Clear Canada.

The Rules, including Rules 8, 11, and 12, are designed to promote fair processes and procedures and prevent fraudulent and manipulative acts and practices. Significant rules include;

Rule 8A.07 Prohibition against making false or fictitious transactions. Conducting or Reporting false / fictitious trades is prohibited by Rules 11B.01(r)(1) and 11B.01(r)(2). Rule 8A.10 requires that only good faith bids and offers may be entered into the Trading System.

Cross Trades -- Transactions in which the same trader is both buyer and seller are addressed in Rule 8A.08. With respect to two client orders, Rule 8A.08(b) requires a delay of five seconds for outright futures, or 15 seconds for strategies and options, between the entry of opposing buy and sell orders by the same trader. In situations where the opposing orders are independently initiated and immediately executable, no delay is required.

Cross trades in which a client order is opposite the trader's personal or proprietary account are separately addressed, in Rule 8A.08(a). If the trader is a Floor Broker, no such crossing is permitted. For traders other than Floor Brokers, crossing is permitted if the client order is entered first, and the personal/proprietary order is entered after a five second delay for outright futures, or a 15 second delay for strategies and options.

Crossing orders in the back-office and representing that they have been conducted on-exchange -- commonly known as "bucketing" -- is prohibited by Rule 11B.01(r)(6).

Wash Trading -- Wash trading is addressed, and prohibited, under Rules 8A.07(b), 8A.07(c), 11B.05(r)(3), and 11B.01(r)(5). Opposing orders for the same beneficial owner may not be executed across each other, either directly or indirectly. The only exemptions are when the orders are generated from different arms-length business units of the same company, and can be proven to have been for legitimate business purposes and not pre-arranged.

Rule 8A.08 which provides details on how and when a broker can trade against or across a customer order. There are also requirements on FCMs in covering separate client orders and a requirement on the FCM to wait a specified period of time before placing the other wide of the order into the Trading System.

Rule 8A.11(b) for bids front running. It provides that a market participant may not "...submit any order for a personal or proprietary account until all executable customers' orders in the same contract and at the same price or "at market" have been entered in their entirety." Rule 11B.01(r)(12) defines the following as a violation: "Failing to give priority to a customer order over an order for the trader's personal account or their employer's proprietary account."

Rule 8A.09 forbids pre-execution communications, pre-negotiated trades and non-competitive trades. Pre-execution communications are defined as "...communications between two market participants for the purpose of discerning interest in the execution of a transaction prior to the entry of an order on the Trading System." All of these types of trades have been found to hinder the transparent and competitive process, which results in reduced liquidity and lack of true price discovery. Pre-execution communications leads to inefficient markets and harm to the market users in the form of inaccurate price discovery information that is not indicative of a price discovered in the open market. In certain circumstances, pre-arranged trading will also fall under Rule 11B.01(r)(4), which prohibits the disclosure of stop-loss or limit orders.

Rule 8A.11 provides that brokers must submit orders received from clients in the Trading System in the sequence they are received. If a trader is dual trading, they must ensure that all executable customer orders are completely filled before entering their personal orders.

Market manipulation and deceptive trading practices are forbidden in the Rules at Rule 11B.01;

11B.01 Violations

r. Trading Violations -- The following are violations:

.....

(7) Directly or indirectly using or knowingly facilitating or participating in the use of any manipulative or deceptive method of trading in connection with any contract whereby the trade or trades could reasonably be expected to create a false or misleading appearance of trading activity or an artificial price for the contract, the underlying commodity , or any related contracts;

(8)

(i) Manipulating or attempting to manipulate the price of a contract or commodity that is capable of being delivered pursuant to a contract traded under these Rules;

(ii) Effecting, alone or in concert with others, a series of transactions (including any bids, offers, or trades) in a contract to create an impression of actual or apparent active trading in the contract or to raise or lower the price of the contract for the purpose of inducing the purchase or sale of the contract by others;

(9) Cornering or attempting to corner the market in any commodity that is capable of being delivered pursuant to a contract traded under these Rules;

(10) Acting or attempting to act in any fashion which might bring about or permit a potential corner or squeeze or an opportunity for the manipulation of prices of any commodity that is capable of being delivered pursuant to a contract traded under these Rules;

(11) Disseminating any false, misleading or knowingly inaccurate information, including a report concerning crop or market information or conditions that affect or tend to affect the price of any commodity that is capable of being delivered pursuant to a contract traded under these Rule;

......

s. Purchasing or selling or offering to purchase or sell commodities, futures contracts or options for future delivery in a manner which may have the effect of upsetting the equilibrium of the market, or of demoralizing the market, so that prices will not properly reflect reasonable commercial values. Any Participant or Market Participant who makes or assists in making such purchases or sales, or offers to purchase or sell with the knowledge of an intent or who with such knowledge is a party to or assists in carrying out any plan or scheme is in violation of the Rules

Rule 12 -- Speculative Trading Limits, is designed to protect the ICE Futures Canada marketplace from excessive speculation that can cause unreasonable or unwarranted price fluctuations. The rule with the attendant policies is based on the procedures established and enforced in other North American soft commodity markets utilizing the principles of spec position limits approved by the CFTC. ICE Futures Canada regularly reviews the position limits to ensure they continue to be set at levels which protects the markets.

The SRC is responsible for reviewing all ICE Futures Canada Rules to ensure they are compliant with the Exchange's legal and regulatory obligations. The Exchange has extensive disciplinary processes set out in Rules 10 and 11 with respect to disciplining or terminating ICE Futures Canada participants.

As per Rule 9.08 and 9.09, the Regulatory Division is responsible for ensuring compliance with ICE Futures Canada Rules by all entities trading on the Exchange. It performs this function by: monitoring trading to detect abusive and improper trading practices; conducting investigations and inspections, whether brought forward by an external complaint or on its own initiative; and ensuring that all matters of regulatory importance are brought forward to the SRC.

ICE Futures Canada utilizes proprietary and customized software programmes that permit numerous sophisticated software queries to detect trade abusers. These programmes are able to generate reports which monitor for trading ahead, accommodation trading, large cross trades, direct and indirect cross trading opposite customer accounts, and wash trading among other improper trading practices.

ICE Futures Canada Rules apply equally to all registered Participants and market participants and do not unreasonably discriminate against any category or class of registrant, and do not impose unnecessary or inappropriate burdens on competition.

ICE Futures Canada Rules apply equally to all participants; whether registered, or a customer of a registered participant. Each category is treated equally as to criteria and cost.

7. DUE PROCESS

7.1 For any decision made by the exchange that affects a participant, or an applicant to be a participant, including a decision in relation to access, exemptions, or discipline, the exchange ensures that:

(a) parties are given an opportunity to be heard or make representations, and

(b) it keeps a record of, gives reasons for, and provides for appeals or reviews of its decisions.

Decisions made by the Exchange that impact and affect participants, including decision in relation to access, exemption requests, or disciplinary matters provide for rights of due process and procedural fairness, in compliance with administrative law in Canada.

Access

With respect to access, the relevant provisions are set out in Part 4D of the Rules. Rule 4D.02 provides that applications will be reviewed at first instance by staff and that staff have the right to interview representatives of the prospective applicants, and seek additional records and documentation.

In the event that staff determine not to grant unconditional approval to a prospective applicant, and provide either conditional approval or refuse, an applicant has the right to appeal to the SRC. The rules detail the processes to be followed in the event of an appeal. The SRC will provide applicants with notice of the meeting to consider that appeal, and the right to be heard and make representations.

Disciplinary

Hearings (Non-Settlement)

Hearings are scheduled follow the accepted procedures of administrative tribunals in Canada. As such, the respondent(s) have rights at a hearing, including the right to appear and give evidence (Rule 10G.04), the right to legal representation (Rule 10G.05), and the right to bring forward witnesses (Rule 10G.06). Disclosure of information for a hearing, including witness statements and expert reports, has specific requirements as set out in Rule 10F.

The order of proceedings at a hearing is set out in Rule 10G.08, and the discipline panel may hear any evidence it deems relevant, whether within technical rules of evidence or not (Rule 10G.07). All oral evidence at a hearing is recorded, in writing or otherwise, and forms the official record of the hearing along with any items (documents, affidavits, etc) received into evidence (Rule 10G.12). The respondent has the right to review this record, including the transcript of oral evidence, at their cost (Rule 10G.20e).

After hearing all evidence and arguments at a hearing, the discipline panel deliberates in private (Rule 10G.17), and then returns its findings. If there is a finding of guilt on one or more of the alleged violations, the panel re-convenes to hear arguments on penalty (Rule 10G.17). Subsequent to this, the panel may impose any of the penalties set out in Rule 11C. In addition to any fines or other monetary sanctions assessed by the panel, the respondent may also be ordered to pay costs to the Exchange, in an amount determined by the panel (Rule 10G.18).

Whatever the decision of the discipline panel, within 90 days of the hearing they must provide a written decision, along with reasons for that decision (Rules 10G.20a and 10G.20d). These reasons are provided to all parties to the hearing, including the respondent(s) and the Regulatory Division (Rules 10G.20a and 10G.20b). Furthermore, the findings are published on the Exchange website, as described further below.

Settlements and Settlement Hearings

At any time prior to two (2) business days before a hearing, including an appeal hearing, the respondent or the Regulatory Division may submit an Offer of Settlement to the other party (Rule 10I.01). The Offer of Settlement must be in writing, and contain various information including violations admitted, facts admitted, and the proposed disposition (Rule 10I.02c). Offers of Settlement are non-binding unless accepted, and if accepted result in the waiver of all rights to a hearing or appeal should it be accepted (Rule 10I.02c).

Settlement agreements between the Regulatory Division and a respondent must be approved by a panel of the Discipline Committee (Rule 10I.05). A hearing must be held to present the Joint Settlement Proposal to the hearing panel. Both the Regulatory Division and the respondent may make submissions, with respect to the reasons the panel should approve the settlement. Upon deliberation, the panel may accept or reject the proposed settlement -- they may not alter or amend any portion of it (Rule 10I.06). Rejected settlements do not preclude a new re-negotiated settlement at a future time, but no member of the Discipline Committee panel that heard the first settlement may sit on the panel hearing the subsequent settlement (Rule 10I.09).

Appeals

Appeals of contested (non-settlement) hearing results from the Discipline Committee may be appealed by either the respondent(s) or the Regulatory Division, to the SRC (Rule 10H.01). Appeals must be filed within ten (10) business days of the service of the written decision of the Discipline Committee (Rule 10H.02), and must contain a brief statement of the appellant's reasons for the appeal, as well as indicate any new evidence intended to be introduced (Rule 10H.03).

The decision of the Discipline Committee, and any associated penalties, remain in effect pending an appeal, unless specifically ordered to be stayed (Rule 10H.12).

At its discretion, the SRC may order security for costs, in an amount and at a time of its choosing. Failure to post or remit the security of costs precludes the proceedings of an appeal, unless otherwise ordered by the SRC. (Rule 10H.04)

The procedures prior to, and during, an appeal hearing are set out in Rules 10H.05 through 10H.11. As noted previously, the member of the SRC who reviewed the Investigation Memo may not sit on the panel reviewing an appeal of the same file.

Upon hearing an appeal, the SRC may: affirm, quash, or vary the finding of the Discipline Committee; make a new finding or order (including an assessment of costs) as it deems appropriate; refer the matter back to the same Discipline Committee panel for further consideration (Rule 10H.13).

Appeals from a decision of the SRC, by either the respondent or the Regulatory Division, may be further appealed to the MSC (Rule 10H.14). A final appeal, with leave, may be taken to the Manitoba Court of Appeal, which is the highest court in the province.

8. CLEARING AND SETTLEMENT

8.1 Clearing Arrangements

The exchange has appropriate arrangements for the clearing and settlement of transactions through a clearing agency.

8.2 Regulation of the Clearing Agency

The clearing agency is subject to acceptable regulation.

8.3 Access to the Clearing Agency

(a) The clearing agency has established appropriate written standards for access to its services.

(b) The access standards for clearing members and the process for obtaining, limiting and denying access are fair, transparent and applied reasonably.

8.4 Sophistication of Technology of Clearing Agency

The exchange has assured itself that the information technology used by the clearing agency has been adequately reviewed and tested and provides at least the same level of safeguards as required of the exchange.

8.5 Risk Management of Clearing Agency

The exchange has assured itself that the clearing agency has established appropriate risk management policies and procedures, contingency plans, default procedures and internal controls.

All trades in ICE Futures Canada Contracts are settled and cleared through ICE Clear Canada. ICE Clear Canada is the designated clearinghouse for ICE Futures Canada pursuant to Rule 1.15. ICE Clear Canada acts as counterparty and financial guarantor to each transaction executed on the Exchange.

ICE Clear Canada is recognized as a clearinghouse under Section 16 (1) of the CFA MB pursuant to Order No. 5719 which was issued by the MSC on June 16, 2008. ICE Clear Canada was established as the designated clearinghouse for ICE Futures Canada in 1998.

ICE Clear Canada observes the current Recommendations for Central Counterparties (RCCP) issued jointly by the Committee on Payment and Settlement Systems and the Technical Committee of IOSCO, as updated. The RCCPs provide for recommendations on participation requirements, measurement and management of credit exposure, financial resources, custody and investment risks, operational risks efficiency, money settlements and supervision and oversight. ICE Clear Canada is committed to meeting any successor standards to the RCCPs, including the Principles for Financial Market Infrastructures published by IOSCO on April 16, 2012.

The self-assessment performed by ICE Clear Canada against the RCCPs provides ICE Futures Canada with assurance as to the sophistication of the clearinghouse technology, risk management processes and procedures, contingency plans, default preparedness, procedures and controls and legal certainty.

Clearing Participant status in ICE Clear Canada is open to any company, partnership or cooperative which is registered as a DATP of ICE Futures Canada and which meets the required clearinghouse criteria. The standards for Clearing Participant status are set out in the ICE Clear Canada Rules, at Part A-202. Some of the factors reviewed include; entities with qualities of financial responsibility, operational capacity, experience, business integrity, and reputation and competence. The status of the entity at other self-regulatory organizations, and statutory regulatory authorities is also a factor with is considered by the clearinghouse.

ICE Clear Canada does not discriminate or restrict access. All rules and requirements, as well as copies of the participant application/agreements, are available on the website. The application criteria is designed to ensure that Clearing Participants are sophisticated, well financed companies that evidence their ability to meet and maintain the financial and operational requirements necessary to support the integrity of the Clearinghouse. ICE Clear Canada reviews the admission requirements for time to time and may, if appropriate, modify them or adopt additional or alternative requirements with board approval.

The application/agreement forms incorporate by reference the By-laws, Rules and Operations Manual of the Clearinghouse.

The admission procedures are set out in the ICE Clear Canada Rules at Part A-2. All applications for clearing participant status are reviewed by staff and ultimately determined by the Board of Directors of ICE Clear Canada. All applicants are entitled to a hearing, the opportunity to make representations and be heard, and the right to a decision. ICE Clear Canada maintains records of its participant application reviews and any resulting hearings or appeals.

Since ICE Clear Canada was incorporated and designated as the clearinghouse for ICE Futures Canada in 1998, no entity which has properly completed the application/agreement forms and submitted same has been denied Clearing Participant status.

The technology employed by ICE Clear Canada is scrutinized by the MSC, as well as by the CFTC. The back office clearing systems are provided by Kansas City Board of Trade Clearing Corporation ("KCBTCC"), a Designated Clearing Organization (DCO) registered with the CFTC. Accordingly, the KCBTCC back office system is subject to DCO Core Principles which requires a DCO to demonstrate that it; (i) has established and will maintain a program of oversight and risk analysis to ensure that its automated systems function properly and have adequate capacity and security; and (ii) has established and will maintain emergency procedures and a plan for disaster recovery, and will periodically test its back-up facilities.

On an ongoing basis, each Clearing Participant's regulatory capital reports are reviewed in order to ensure that each Clearing Participant remains financially sound. All Clearing Participants must meet financial and operational standards and must file annual audited financial statements and monthly unaudited financial statements with ICE Clear Canada (see ICE Clear Canada Rule A-305).

If ICE Clear Canada were to determine that the financial or operational condition of a Clearing Participant makes it necessary or advisable (for the protection of the ICE Clear Canada, other Clearing Participants, or the market) to impose restrictions on a Clearing Participant, ICE Clear Canada has the authority to take any of the following steps, at its discretion. First, the clearing of opening transactions by the Clearing Participant may be limited or prohibited. Secondly, the Clearing Participant may be required to reduce or eliminate existing long positions or short positions in the Clearing Participant's accounts. Third, the Clearing Participant may be required to transfer any of its account to another Clearing Participant.

In addition, ICE Clear Canada has the authority, at its sole discretion, to suspend a Clearing Participant's clearing privileges for such time and under such terms and conditions as the board determines are necessary. Alternatively, if ICE Clear Canada deems that it is in the public interest or in the interest of the Exchange to allow the Clearing Participant to continue to clear transactions it has the authority to require that ICE Clear Canada's auditors regulate and generally supervise the Clearing Participant's activities as they relate to its performance as a Clearing Participant.

The Rules and Operations Manual of ICE Clear Canada operate to ensure that the Clearinghouse has the ability to complete settlements on a timely basis, to fulfil its financial guarantee, to protect Clearing Participants' funds, and to expeditiously resolve any Clearing Participant default. The risk management processes employed by ICE Clear Canada are comprehensive and specifically designed to prevent the accumulation of losses, ensure that sufficient resources are available to cover future obligations, promptly detect any financial or operational weakness of a Clearing Participant, allow for swift actions to rectify a problem and protect the clearinghouse's guarantee. ICE Clear Canada has never incurred any losses as a result of adverse credit events experienced by its Clearing Participants. The Rules of ICE Clear Canada ensure that clearing and settlement obligations of Clearing Participants are met in a timely manner.

The Exchange has assured itself that the Clearinghouse has established appropriate risk management policies and procedures, contingency plans, default procedures and internal controls. ICE Clear Canada operates under established risk management processes and procedures are designed to conform to the international standards for derivatives clearinghouses.

ICE Clear Canada applies a multi-layered risk management approach;

• Obligation for Clearing Participants to maintain well-defined capital adequacy standards;

• Settlement of all trades and marking all futures positions to market on a daily basis;

• Processing of all cash settlements through an irrevocable electronic payment processing system;