CSA Staff Notice 51-354 Report on Climate change-related Disclosure Project

CSA Staff Notice 51-354 Report on Climate change-related Disclosure Project

CSA Staff Notice 51-354

Report on Climate change-related Disclosure Project

April 5, 2018

Table of Contents

|

|

|

|

|

|

|

Part 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 3 |

|

|

|

|

|

|

3.1 Review of International Disclosure Requirements and Voluntary Frameworks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4.5 Current Disclosure Requirements and Frameworks and Potential Future Trends |

|

|

|

|

Part 5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Introduction

Staff (staff or we) of the Canadian Securities Administrators (CSA) are publishing this notice to report on the findings of our project to review the disclosure by reporting issuers (issuers) of risks and financial impacts associated with climate change. The project included research, consultations and review of mandatory continuous disclosure (CD) documents, sustainability reports and other voluntary disclosures in relation to climate change-related risks, financial impacts and related governance.

Executive Summary

On March 21, 2017, the CSA announced a project to review the disclosure of risks and financial impacts to issuers associated with climate change, and the governance processes related to them (the Project). The objectives of the Project were:

• to assess whether current securities legislation in Canada and guidance are sufficient for issuers to determine what climate change-related disclosures they should provide,

• to better understand what climate change-related information investors need in order to make informed voting and investment decisions, and

• to see whether or not issuers are providing appropriate disclosures in this regard.

In connection with the Project, we conducted:

• research in respect of the current or proposed climate change-related regulatory disclosure requirements in selected jurisdictions outside of Canada as well as disclosure standards contained in certain voluntary frameworks related to climate change,

• a targeted review of current public disclosure practices of selected large Canadian issuers in a number of industries with respect to climate change-related information (the Disclosure Review),

• a voluntary and anonymous on-line survey designed to solicit feedback from a wider range of TSX-listed issuers (the Issuer Survey), and

• focused consultations with issuers, users and other stakeholders (the Consultations).

The work conducted in connection with the Project is discussed in greater detail in Part 3 of this notice.

We identified a number of key themes arising out of our work on the Project, which are discussed at length in Part 4 of this notice:

• We developed a better understanding of Canadian issuers' current disclosure practices in relation to climate change-related information. These are discussed in section 4.1 of this notice.

• We gained insight into users'{1} and issuers' perspectives on the materiality of climate change-related risks and opportunities and the associated financial impacts. A discussion of this issue is presented in section 4.2 of this notice.

• We consulted extensively with users during the Project. We sought to understand their disclosure needs, whether those needs were being met by issuers, and their suggestions for improvement. The insights gained from our Consultations with users are discussed in section 4.3 of this notice.

• We also consulted with issuers with respect to their interactions with users of climate change-related information, as well as the challenges involved in identifying climate change-related risks and opportunities, quantifying impacts, and preparing meaningful disclosure of material information. The issuer perspectives we obtained from the Disclosure Review, the Issuer Survey and the Consultations are discussed in section 4.4 of this notice.

• Finally, section 4.5 of this notice discusses current disclosure requirements and voluntary disclosure frameworks in relation to climate change-related risks, opportunities and impacts, as well as possible future trends in their development.

Part 5 of this notice provides a brief overview of our plans for future work in this area, both in the near-term and on an ongoing basis. Briefly, we anticipate such work to include the following:

• developing guidance and educational initiatives which are useful to issuers across a wide range of industries with respect to the business risks and opportunities and potential financial impacts of climate change,

• considering new disclosure requirements regarding corporate governance in relation to business risks, including climate change-related risks, and risk oversight and management,

• monitoring the quality of issuers' disclosure and the evolution of best disclosure practices in this area, to assess whether further work needs to be done to ensure that Canadian issuers' disclosure continues to develop and improve, and whether investors require additional types of climate change-related disclosure to make investment and voting decisions, and

• monitoring developments in reporting frameworks, evolving disclosure practices and investors' need for additional types of climate change-related disclosure to make investment and voting decisions, including whether disclosure requirements in relation to Scope 1 and Scope 2 greenhouse gas (GHG) emissions are warranted in the future.

Appendix "A" contains a glossary of defined terms and abbreviations which appear throughout this notice.

The focus on climate change-related issues in Canada and internationally has grown rapidly in recent years. Various stakeholders are seeking improved disclosure on the material risks, opportunities, financial impacts and governance processes related to climate change. There has also been a proliferation of voluntary disclosure frameworks that focus on climate change-related issues, including the Final Report -- Recommendations of the Financial Stability Board's Task Force on Climate-related Financial Disclosures (TCFD Recommendations) in June 2017. Lastly, the regulatory environment is changing, as evidenced by the pan-Canadian framework on clean growth and climate change and the Canadian federal government's commitment under the Paris Agreement to reduce GHG emissions, including by 30 per cent below 2005 levels by 2030.

As a result of the growing interest and concern in this area, the CSA announced the Project on March 21, 2017.{2} The Project was focused on climate change-related risks and opportunities that impact an issuer and its business, as opposed to the impact an issuer has or may have on climate change. As a result, climate change-related risks and opportunities are not viewed as an industry-specific issue, but rather as a category of risks and opportunities affecting issuers across a wide range of industries.

The objectives of the Project were:

• to assess whether current securities legislation in Canada and guidance are sufficient for issuers to determine what climate change-related disclosures they should provide,

• to better understand what climate change-related information investors need in order to make informed voting and investment decisions, and

• to see whether or not issuers are providing appropriate disclosures in this regard.

This notice provides an overview of the findings of the Project and also sets out the CSA's plans for further work in this area.

This notice is structured as follows:

In Part 2, we provide an overview of the current disclosure requirements under securities legislation in Canada and previously issued guidance.

In Part 3, we discuss the work that has been completed in connection with the Project.

In Part 4, we set out the key themes that we have identified from the Project.

In Part 5, we outline the proposed direction of future CSA work in this area.

2. Overview of Disclosure Requirements

Current securities legislation in Canada requires disclosure of certain climate change-related information in an issuer's regulatory filings, if such information is material. As discussed in CSA Staff Notice 51-333 Environmental Reporting Guidance (SN 51-333), which was published on October 27, 2010, a number of disclosure requirements relating to environmental matters are found in the principal rules governing CD, including National Instrument 51-102 Continuous Disclosure Obligations (NI 51-102), National Instrument 58-101 Disclosure of Corporate Governance Practices (NI 58-101), National Instrument 52-110 Audit Committees (NI 52-110) and National Instrument 52-109 Certification of Disclosure in Issuers' Annual and Interim Filings (NI 52-109). Furthermore, guidance on corporate governance practices is provided in National Policy 58-201 Corporate Governance Guidelines (NP 58-201).

The following is a brief summary of requirements pertaining to the disclosure of climate change-related risks and risk management and oversight, as well as guidance on materiality as a determining factor for whether a particular climate change-related matter requires disclosure.

This summary is primarily derived from existing guidance in SN 51-333. It is not intended to provide legal advice and is not an exhaustive overview of issuers' disclosure obligations in relation to climate change-related information. Issuers are encouraged to review SN 51-333, and should refer to applicable securities legislation to assess their respective climate change-related disclosure obligations.

2.1 Climate change-related risks

Item 5.2 of Form 51-102F2 Annual Information Form (Form 51-102F2) requires an issuer to disclose, in its AIF, risk factors relating to it and its business that would be most likely to influence an investor's decision to purchase the issuer's securities. Accordingly, any climate change-related risks that are determined to be material to the issuer must be disclosed pursuant to this item. Moreover, item 1.4(g) of Form 51-102F1 Management's Discussion & Analysis (Form 51-102F1) requires an issuer to discuss, in its MD&A, its analysis of its operations for the most recently completed financial year, including commitments, events, risks or uncertainties that it reasonably believes will materially affect its future performance.

The following chart highlights some of the potential climate change-related risks and impacts (including examples of specific financial impacts that may result from climate change-related risks), the materiality of which should be considered by an issuer:

Risks

Impact

Financial Impact

Physical

•

Changing weather patterns

•

Asset damage

•

Asset write-offs

•

Water availability and quality

•

Health and safety

•

Capital expenditures

•

Operational disruptions

•

Increased costs

•

Transportation interruptions

•

Reduced revenues

•

Restriction of licenses, availability and use

Regulatory

•

Current/changing regulations

•

Compliance

•

Increased costs

•

Impact on market demand

•

Capital expenditures

•

Restriction of licenses, availability and use

•

Reduced revenues

•

Market restrictions

•

Asset valuations

•

Early retirement or write-offs

Reputational

•

Employees' and investors' attitudes

•

Reduced availability of capital

•

Asset write-offs

•

Regulatory violations

•

Litigation/penalties

•

Increased costs

•

Reduced demand for goods/services

•

Reduced revenues

Business Model

•

Changes in demands for products/services

•

Lower demand

•

Lower revenues

•

Renewable energy

•

Higher costs for transition

•

Increased costs

•

Energy efficient products

•

Higher cost of capital/limited access to capital

•

Asset write-offs

2.2 Risk management and oversight

NP 58-201 and NI 52-110 establish guidelines and requirements which are intended to assist issuers in the implementation of policies and practices required for effective corporate governance and oversight over their business, including the identification and management of business risks. SN 51-333 discusses two sets of disclosure requirements that provide insight into how issuers are managing material risks: (i) disclosure of environmental policies fundamental to operations, and (ii) disclosure of board mandate and committees. SN 51-333 also highlights the three levels of oversight that issuers' disclosure is subject to.

i) Environmental policies fundamental to operations

Item 5.1(4) of Form 51-102F2 requires issuers to describe environmental policies that are fundamental to their operations and the steps taken to implement them. This requirement is an opportunity for issuers to establish appropriate policies to manage material environmental risks and is also useful to investors in providing insight into how such risks are managed.

The term "policy" should be read broadly and may include policies for climate-change related issues, sustainable development or the reduction of GHG emissions. When discussing its environmental policies, an issuer should evaluate and describe the impact that such policies may have on its operations. This discussion may include a quantification of the costs associated with these policies, where such information is reasonably available and would provide meaningful information to investors.

ii) Board mandate and committees

Section 3.4 of NP 58-201 states that an issuer's board should adopt a written mandate that explicitly acknowledges responsibility for, among other things: (i) adopting a strategic process and approving, at least annually, a strategic plan that takes into account the opportunities and risks of the business; and (ii) the identification of the principal risks of the issuer's business and ensuring the implementation of appropriate systems to manage these risks.

Pursuant to Form 58-101F1 Corporate Governance Disclosure, non-venture issuers are required to disclose the text of their board mandate, or if the board does not have a written mandate, to explain how they delineate roles and responsibilities. In addition, both venture and non-venture issuers are required to identify and describe the function of any standing committees (other than audit, compensation and nominating committees), which would include environmental or other committees responsible for managing climate change-related issues, and to disclose the text of the audit committee's charter. For some issuers, the audit committee may have responsibility for, among other things, environmental risk management.

Such disclosure should provide insight into:

• the development and periodic review of the issuer's risk profile,

• the integration of risk oversight and management into the issuer's strategic plan,

• the identification of significant elements of risk management, including policies and procedures to manage risk, and

• the board's assessment of the effectiveness of risk management policies and procedures, where applicable.

iii) Oversight of disclosure

Oversight systems, processes and controls are necessary to ensure that an issuer provides a meaningful discussion of material climate change-related matters in their CD documents. NI 52-110 requires an issuer's audit committee to review its financial statements and MD&A, and NI 51-102 requires the approval of same by the board of directors, although the approval of interim filings may be delegated to the audit committee. NI 52-109 requires an issuer's Chief Executive Officer and Chief Financial Officer to certify certain matters in relation to the financial statements, MD&A and, if applicable, AIF.

In fulfilling their oversight functions, audit committees, boards and certifying officers should consider, among other things, the assessment management has made regarding the materiality of climate change-related matters, and whether the disclosure made in securities regulatory filings is consistent with this assessment.

To support the review, approval and certification process discussed above, an issuer must have adequate controls and procedures in place for its disclosure of material information, including climate change-related information. The audit committee and certifying officers have key responsibilities in establishing these controls and procedures. In particular, the audit committee has responsibilities under NI 52-110 in respect of procedures in place for the review of the issuer's public disclosure of financial information extracted or derived from financial statements.

As a general rule, materiality is the determining factor in considering whether information is required to be disclosed.{3} As provided in Form 51-102F1 and Form 51-102F2, information is likely material where a reasonable investor's decision whether or not to buy, sell or hold securities of the issuer would likely be influenced or changed if the information was omitted or misstated. Section 2.1 of SN 51-333 provides a number of guiding principles for issuers seeking to make materiality determinations, which can be briefly summarized as follows:

• there is no bright line test for materiality,

• materiality must be considered in light of all the facts available,

• the determination of materiality is a dynamic process that depends on the prevailing relevant conditions at the time of reporting,

• the time horizon of a known trend, demand, commitment, event or uncertainty may be relevant to an assessment of materiality, and

• where doubt exists as to the materiality of particular information, issuers are encouraged to disclose such information.

Among the various risks and opportunities considered by issuers, those related to climate change should also be assessed to determine whether they meet the materiality threshold as risks and opportunities must be disclosed in issuers' regulatory filings.

The work we have completed in connection with the Project includes:

• research in respect of the current or proposed climate change-related regulatory disclosure requirements in selected jurisdictions outside of Canada as well as disclosure standards contained in certain voluntary frameworks related to climate change,

• the Disclosure Review,

• the Issuer Survey, and

• the Consultations.

We were able to obtain valuable feedback through the Disclosure Review, Issuer Survey and Consultations. Key findings from the above-noted work are discussed in Part 4 of this notice.

3.1 Review of international disclosure requirements and voluntary frameworks

We reviewed climate change-related disclosure requirements in the securities laws of the United States, the United Kingdom and Australia. We also conducted a review and analysis in respect of the following four voluntary frameworks for sustainability reports or the voluntary disclosure of climate change-related risks and financial impacts:

• the TCFD Recommendations,

• the International Integrated Reporting Framework published by the International Integrated Reporting Council (the IR Framework){4},

• the Global Standards for Sustainability Reporting published by the Global Reporting Initiative (the GRI Framework), and

• the Climate Risk Technical Bulletin (the SASB Framework) published by the Sustainability Accounting Standards Board (SASB).

Our research focused on the identification of areas in which current securities disclosure requirements in Canada are consistent with the requirements of these other jurisdictions and frameworks, as well as areas in which these requirements differ.

The following table outlines the attributes of the Disclosure Review, including the criteria for the sample of issuers selected, the documents reviewed and the topics and questions that were considered. The purpose of the Disclosure Review was to assess the extent to which material climate change-related risks, financial impacts and related governance disclosure is being provided in CD filings and voluntary reports.

In addition, we reviewed voluntary disclosure provided by the selected issuers to gain a better understanding of additional climate change-related disclosure being provided, and to assess whether potentially material information had been omitted from issuers' CD filings.

|

Attributes of the Disclosure Review |

|||

|

|

|||

|

Who was selected? |

• |

78 issuers from the S&P/TSX Composite Index. |

|

|

|

• |

Wide range of industries, including: finance and insurance, communications, consumer products, industrial, investment companies, mining, oil and gas, oil and gas services, pipelines, real estate, technology, transportation, environmental services and utilities. |

|

|

|

• |

Market Capitalization ranged from $650 million to nearly $140 billion, with the largest proportion of issuers (38%) within the $1 billion to $5 billion range. |

|

|

|

|||

|

Which documents were reviewed? |

• |

CD filings: |

|

|

|

|

• |

financial statements, MD&As, AIFs, and information circulars. |

|

|

• |

Voluntary disclosures: |

|

|

|

|

• |

issuers' websites, sustainability reports and other voluntary reports/presentations, public surveys, etc. |

|

|

|||

|

What types of topics/questions were considered? |

• |

Nature and extent of climate change-related disclosure: |

|

|

|

|

• |

What types of information did issuers include in CD filings? |

|

|

|

• |

What information did issuers include in voluntary disclosure? |

|

|

|

• |

Did issuers disclose their governance and risk management processes related to climate change-related risks and impacts? |

|

|

• |

Current disclosure practices: |

|

|

|

|

• |

We reviewed issuers' climate change-related disclosure in relation to existing disclosure requirements under securities legislation in Canada. |

|

|

|

• |

We reviewed issuers' voluntary disclosure for potentially material climate change-related information which was omitted from their CD filings. |

|

|

|||

|

Comment Letters |

• |

Two jurisdictions issued comment letters to issuers seeking clarification on specific issues in relation to the topics and questions listed above. |

|

i) Issuer Survey

All TSX-listed issuers were invited to complete the Issuer Survey. The Issuer Survey was an anonymous survey intended to solicit candid responses from a broad population of issuers. We received responses from 97 TSX-listed issuers representing a cross-section of sizes and industries. The following table highlights the key features of the Issuer Survey:

Key Features of the Issuer Survey

Market Capitalization

•

Ranged from under $25 million to over $1 billion.

•

Largest group of respondents (45%) was over $1 billion.

Industry

•

13 industries (plus "other") represented.

•

Top four industries by number of respondents: mining (24%), oil and gas (19%), and finance/insurance and industrial (each, 8%).

Topics Covered

•

Issuers' current climate change-related disclosure practices.

•

Costs and challenges associated with climate change-related disclosure.

•

Governance and risk oversight in respect of climate change-related risks.

•

Investor demand for climate change-related disclosure.

ii) Consultations

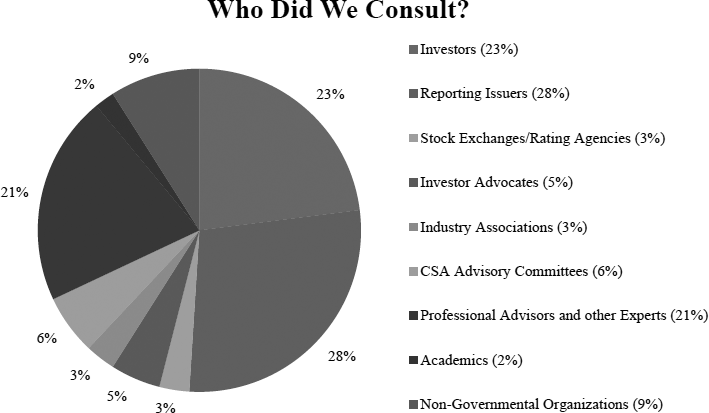

CSA staff held 50 Consultations, comprising both one-on-one and focus group consultations with a wide range of stakeholders, a significant portion being issuers and users of disclosure, as illustrated below:

The Consultations were intended to allow staff to obtain information from stakeholders on a wide range of topics such as the following:

Topics Addressed in the Consultations

Users

•

We discussed users' current and future demands for climate change-related disclosure.

•

We sought users' views with respect to the adequacy of current climate change-related disclosure for their investment and voting decisions.

•

Users provided insight into which types of climate change-related disclosure are material to them and decision-useful and which are not.

•

We solicited users' views regarding the adequacy of current Canadian disclosure requirements and guidance in relation to the disclosure of climate change-related risks and impacts.

Issuers

•

We canvassed issuers regarding current practices in relation to the voluntary and involuntary disclosure of climate change-related information in Canada and elsewhere.

•

Issuers identified challenges they had encountered in seeking to satisfy user demand for climate change-related disclosure.

•

Issuers provided insight into their governance and risk management processes in relation to climate change-related risks, and how they go about assessing the materiality of climate change-related information.

•

We discussed the current and anticipated costs and other regulatory burdens to issuers associated with the preparation and disclosure of climate change-related information.

Others

•

We sought the views of legal, accounting and engineering advisors with respect to the collection and presentation of climate change-related disclosure, including the disclosure of scenario analysis and other forward-looking information.

•

We gained insight into current trends in relation to the disclosure of climate change-related risks and impacts from academics, consultants and others with expertise in this area.

Based on the work we have completed in connection with the Project, we have identified a number of key themes, which are discussed in more detail below.

4.1 Current disclosure practices

The following is a summary of our findings regarding the current disclosure practices of issuers with respect to climate change-related information:

- - - - - - - - - - - - - - - - - - - -

Key Points

• Our Disclosure Review, which examined CD filings against existing securities disclosure requirements in Canada, did not result in any re-filings, restatements or other corrective actions being requested; however, we noted variations in disclosure practices and room for improvement in the disclosure of several issuers.

• 56% of the issuers whose disclosure we reviewed provided specific climate change-related disclosure in their MD&A and/or AIF, with the remaining issuers either providing boilerplate disclosure, or no disclosure at all. 28% of respondents to the Issuer Survey indicated that they provided climate-change related disclosure in their regulatory filings.

• More issuers provided climate change-related disclosure in their voluntary reports, with 85% of the issuers reviewed in our Disclosure Review and 32% of the respondents to the Issuer Survey providing this information in voluntary reports.

• The climate change-related risk most discussed was regulatory risk. Few of the issuers we reviewed disclosed their governance and risk management practices respecting climate change.

• To the extent that climate change-related risk was not provided in CD documents, the principal reason given by issuers was that such disclosure was not material from a Canadian securities law perspective.

• The prevalence of climate change-related disclosure increased with the size of the issuer.

• We found that climate change-related disclosure was also more common among issuers in certain industries, notably those in the oil and gas industry. Some issuers in other industries provided significantly less disclosure in respect of the implications of climate change for their business and operations, or no disclosure at all.

• Of the various voluntary disclosure frameworks used, most issuers applied the GRI Framework. The main reason cited for choosing a particular framework was that it is commonly used in the issuer's industry.

- - - - - - - - - - - - - - - - - - - -

i) Climate change-related disclosure in regulatory filings and voluntary reports

Our Disclosure Review, which examined CD filings against existing securities disclosure requirements in Canada, did not result in any re-filings, restatements or other corrective actions being requested; however, we noted variations in disclosure practices and room for improvement in the disclosure of several issuers.

Based on our Disclosure Review, the majority of issuers reviewed provided climate change-related disclosure in their regulatory filings. Specifically, 56% provided specific disclosure in their MD&A and/or their AIF, 22% provided boilerplate disclosure and 22% provided no disclosure at all. Climate change-related information disclosed in issuers' regulatory filings was lower for Issuer Survey respondents, as 28% indicated that they currently disclose climate change-related information in their regulatory filings.

Voluntary reporting of climate change-related information was higher, as 85% of the issuers reviewed in our Disclosure Review provided voluntary climate change-related disclosure. Similarly, respondents to the Issuer Survey also indicated a higher percentage of voluntary climate change-related information relative to their regulatory filings, with 32% of respondents indicating that they provide this information in voluntary filings. Specifically, 61% of issuers reviewed identified climate change-related risks in their voluntary disclosures; 90% of those issuers also disclosed how they were managing those risks.

ii) Types of climate change-related information disclosed

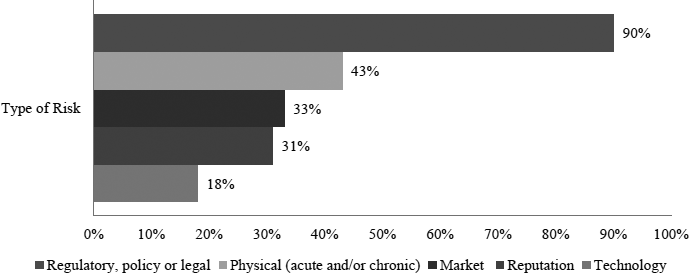

The following table outlines the types of climate change-related risk disclosure provided by Issuers in the Disclosure Review:

As indicated in the table above, the most prevalent risk noted was regulatory risk. The findings from our Disclosure Review were generally consistent with the results of the Issuer Survey, which identified regulatory risk as being the most commonly disclosed climate-change related risk (64%).

We also noted that the extent of disclosure was most significant in respect of regulatory risk. For example, issuers were more likely to discuss the historical or potential impact of regulatory change and policies and/or strategies to address this risk. This is consistent with the feedback from our Consultations, in which issuers advised that they considered this risk to be the most immediate (in terms of current impact) and tangible (as to actual costs and rates that issuers are incurring or expect to occur).

Based on our Disclosure Review, for those climate change-related risks that were discussed in issuers' AIFs, 41% of the risk disclosures did not address the financial impact of those risks, 34% disclosed that the impact cannot be determined at this time, 18% disclosed that the impact is not expected to be material and 7% provided specific disclosure regarding the financial impact.

Relatively few issuers explicitly disclosed climate change-related considerations in their governance disclosure. Based on our Consultations and the Issuer Survey, we understand that this responsibility generally falls under an issuer's health, safety and environment (or comparable) committee or other risk committee; however, this information was seldom articulated in regulatory filings. We noted through the Disclosure Review that a majority of issuers (55%) disclosed the existence of a board committee charged with responsibility for environmental or sustainability-related matters.

iii) Reasons for non-disclosure of climate change-related risks

Based on the results of the Disclosure Review, two jurisdictions issued comment letters to some issuers to gain insight into their reasons for not disclosing certain climate change-related risks.

The key takeaways noted from our inquiries were as follows:

• In many cases, the issuers confirmed that they had considered climate change-related risks and concluded that they did not rise to the level of materiality from a securities law perspective.

• With respect to physical climate change-related risks, some issuers concluded that based on a consideration of both quantitative and qualitative factors (the relevant conditions at the time of reporting, the probability of an event or trend occurring, and the magnitude of the impact on their business) such risks are not material. In some other responses, issuers indicated that they had addressed climate change-related risks through disclosure of broader physical or environmental risks in their CD documents. They adopted this approach because they were of the view that uncertainty exists with respect to the specific effects of climate change which prevents a reliable assessment of how, or to what extent, climate change, considered in isolation, would affect previously identified physical risks affecting the issuer's operations.

• When asked about the quantification of regulatory climate change-related risks, some issuers indicated that the current impact of existing regulations does not rise to the level of materiality from a securities law perspective. Further, they viewed changes in policy and regulatory frameworks to be uncertain, which presented challenges for issuers to predict the financial impact of these risks.

Similarly, for the 58% of respondents to the Issuer Survey that indicated they do not disclose climate change-related information, the top three reasons cited were:

1) their conclusion that climate change-related risks are not material to the issuer at this time,

2) the lack of a common framework for measuring the impacts of climate change at this time, and

3) a lack of interest on the part of stakeholders.

The materiality of climate change-related risks and opportunities was a central and reoccurring theme that arose in our Project. This is discussed further in section 4.2 of this notice.

iv) Climate change-related disclosure by issuer size and industry

In general, we found that the breadth and quality of disclosure increased as an issuer's market capitalization increased. We also found that as market capitalization increased, so did the proportion of issuers that provided climate change-related disclosure. For example, while 58% of the Issuer Survey participants did not disclose any climate change-related information in their regulatory or voluntary disclosures, issuers with a market capitalization greater than $1 billion were more likely than not to disclose (53% reported that they disclose) versus issuers under $1 billion (of whom only 34% reported that they disclose). All of the issuers with market capitalizations greater than $25 billion, whose disclosure we reviewed as part of our Disclosure Review, provided voluntary climate change-related disclosure.

The results of our Disclosure Review also indicated that issuers in the oil and gas industry were generally more likely to include climate change-related disclosure in their regulatory filings compared to other industries, especially with respect to regulatory risks (e.g., relating to carbon taxes and cap and trade programs). Oil and gas was also the only industry{5} in which a majority of the respondents to the Issuer Survey indicated that they currently disclose climate change-related information.

v) Frameworks and GHG calculation methods

While we noted some issuers that disclosed their GHG emissions in their CD filings, we found that 73% of issuers in our Disclosure Review only disclosed emissions-related metrics in their voluntary disclosures. Similarly, the majority of issuers that participated in the Issuer Survey (86%) indicated that they disclose GHG emissions in their voluntary disclosure. This was the most common type of voluntary disclosure provided by those respondents to the Issuer Survey.

Based on the Disclosure Review, 41% of issuers did not reference a third-party framework for their voluntary climate change-related disclosure. Of the issuers that did reference a specific voluntary disclosure framework, 82% applied the GRI Framework, however, several other frameworks were also used. Consistent with the Disclosure Review, our Issuer Survey results indicated that the GRI Framework was the most widely used of the voluntary reporting frameworks (being used by 79% of the respondents that indicated that they provide voluntary disclosure). The main reason cited for choosing a particular framework was that it was commonly used in the issuer's industry. While issuers emphasized that "one size does not fit all," many issuers within the same industry tended to adopt the same framework.

We also noted that, based on our Disclosure Review, 74% of the issuers that provided voluntary climate change-related disclosure had responded to the CDP survey, of which 90% had made their response available to the public. A review of the publicly available CDP survey responses for issuers in the oil and gas industry, for example, showed that most issuers that disclose their GHG emissions used a combination of multiple calculation standards and guidance to determine their emissions. There did not appear to be a single, consistently-used standard, even within industries.

4.2 Materiality of climate change-related risk

- - - - - - - - - - - - - - - - - - - -

Key Points

• As a general rule, information is required to be disclosed under securities laws in Canada if it is material. As such, the topic of materiality assumed a central role in our Consultations and the other work performed in connection with the Project.

• Users and issuers offered a wide range of perspectives on the materiality of climate change-related risks and opportunities.

• Most of the users consulted considered climate change-related risks to be a conventional business issue affecting issuers in a wide range of industries, and not solely a sustainability or environmental issue. In their view, the significance of these risks is not adequately reflected in the CD documents of Canadian issuers.

• Most of the issuers consulted acknowledged the materiality of some climate change-related information, such as risk factors and regulatory considerations, while noting that other climate change-related information is either not material, or is currently so uncertain or remote that its ultimate materiality and financial impact cannot be assessed or quantified at the present time.

• Certain users were of the view that issuers should be required to disclose whether they specifically considered climate change-related risks and opportunities in their materiality assessments.

• Uncertainty surrounding the timing and measurement of climate change-related risks presented a particular challenge for issuers with respect to assessing their materiality and, consequently, their inclusion in, or omission from, regulatory filings.

- - - - - - - - - - - - - - - - - - - -

As a general rule, information is required to be disclosed under securities laws in Canada if it is material. Although securities laws in Canada do not impose specific requirements in relation to the disclosure of climate change-related information, the general requirement to disclose material information requires disclosure of the material climate change-related risks and impacts for an issuer's business in the same way that they require disclosure of other types of material information.

Through the Project, we received significant feedback from issuers, users and other stakeholders with respect to the materiality of climate change-related information. As discussed in section 4.1, when we questioned issuers about the omission of climate change-related information from disclosure, their principal explanation was that they only disclosed such information to the extent it had been determined to be material, and that other information was omitted because they concluded it was not material. On the other hand, most of the users consulted considered climate change-related risks to be a conventional business issue affecting issuers in a wide range of industries, and not solely a sustainability or environmental issue. In their view, the significance of these risks is not adequately reflected in the CD documents of Canadian issuers. This divergence of views on the materiality of climate change-related risks and opportunities was a central and recurring theme that arose throughout the Project.

During our Consultations, certain users emphasized the weight they placed on climate change-related risks in making investment and voting decisions. Some users indicated that when issuers do not disclose material climate change-related risks or a relevant discussion on the matter in their regulatory filings, they are often unsure as to whether the issuer has: (i) performed an informed analysis of the impacts of climate change and determined they are not material; or (ii) substantially overlooked climate change as a potential source of material risks to their business. As a result, these users were of the view that issuers should be required to disclose whether they specifically considered climate change-related risks and opportunities in their materiality assessments and if they concluded that such disclosure was not material, to provide disclosure to this effect. We note that a requirement to provide "negative assurance" of a specified risk would be a departure from current Canadian securities disclosure obligations, which only requires disclosure of material risks.

As noted above, based on the Issuer Survey, the most prevalent reason offered by issuers that do not disclose climate change-related information is that they are of the view that it is not material to them at this time. Through our Consultations, many issuers confirmed they have processes in place to identify and assess significant risks, including climate change-related risks. However, in their view, uncertainty with respect to the timing and measurement of climate change-related risks presented a particular challenge with respect to assessing their materiality and, consequently, their inclusion in or omission from regulatory filings. Further, many issuers stated that the extent of estimates and assumptions required to determine potential impacts associated with climate change-related risks can preclude them from having a reasonable basis for purposes of disclosure.

i) Uncertainty regarding the timing of climate change-related risks

Based on our Consultations, it is apparent that many issuers and users share the view that the timing of climate change-related risks and impacts presents a significant challenge for issuers in assessing materiality. Some users were of the view that issuers used a short-term outlook to identify and assess material climate change-related risks and opportunities, which resulted in a lack of climate change-related disclosure. Many users also viewed climate change-related risks as being likely to have a more imminent impact than some issuers currently acknowledge, citing recent examples of extreme weather events in Canada and abroad. We also noted that some issuers and their advisors tended to place greater emphasis upon risks which were expected to have a material impact on the issuer in the near term, as these impacts are more readily ascertainable and more easily quantified. Some issuers also advised that they emphasize more imminent risks in recognition of the priorities of their investor community, which may be focused on short-term rather than long-term considerations.

ii) Uncertainty regarding the measurement of climate change-related risks

Uncertainty associated with the measurement of climate change-related risks also impacted issuers' materiality assessments. For example, in the Disclosure Review, we found that while 43% of issuers specifically mentioned physical climate change-related risks in their regulatory filings, most issuers did not quantify the potential financial impact of those risks. Some issuers also noted that to the extent that they are able to identify specific potential physical and other effects of climate change, it was only possible to disclose the existence of the risk, but not to quantify it.

In our Disclosure Review, we also found that relatively few issuers quantified the impact of regulatory risks, although as noted in SN 51-333, Item 5.1(1)(k) of Form 51-102F2 requires an issuer to disclose the financial and operational effects of environmental protection requirements in the current financial year and the expected effect in future years. When questioned regarding the absence of quantified impact in their disclosures, the most common response issuers provided was that the current regulatory impact is generally not material at this point, and that there is too much uncertainty to reasonably estimate the potential impact of future regulations. This contrasted with the views of many users, who suggested that the impact could be measured, for example, with regard to national commitments under the Paris Agreement.

In certain instances, although issuers did not specifically refer to the term "climate change" in identifying risks, they nevertheless identified potential risks which may be influenced by climate change, such as extreme weather, natural disasters, and access to water, and discussed the implications of these risks for their business. When queried as to why these risks were not identified specifically as climate change-related risks, several issuers explained that these physical risks could occur (and had been identified as material risk factors) independent of any climate change-related impacts, and that attributing such risks to climate change to the exclusion of other factors was neither necessary, nor appropriate. In addition, some issuers noted that it is not yet possible to ascertain the incremental impact and materiality of risks specifically attributable to climate change, in isolation from other factors.

With respect to the other risk factors identified in relation to the issuer's market, reputation and regulations, several issuers noted that while many of these risks could be influenced or exacerbated by climate change, there are several other factors that also influence them, such as competition, market price fluctuations for inputs and outputs, and technological advancements. As many of these other factors posed more significant and immediate impacts, these issuers did not highlight climate change as a main contributor to such risks.

While some issuers appeared to lack familiarity with the risks and impacts of climate change, and the expertise to assess them, it must also be acknowledged that the precise impacts of climate change, and their magnitude and timing, are not yet certain and, in some instances, unlikely to be known for some time. Consequently, some issuers noted that consideration of both quantitative and qualitative factors in determining materiality must, in some cases, be based upon extensive assumptions and estimates which may limit the usefulness and reliability of the resulting disclosure. They also noted that this uncertainty presents significant challenges given their need to ensure that disclosure is verifiable and has a reasonable basis in light of the potential for liability for such disclosure.

- - - - - - - - - - - - - - - - - - - -

Key Points

• Substantially all of the users we consulted were dissatisfied with the current state of climate change-related disclosure, and believe that improvements are needed.

• Users consulted with were not a homogenous group and as a result, informational needs varied.

• Substantially all users were also of the view that issuers in many industries will be affected by climate change-related risks, and should provide disclosure regarding their governance and oversight of such risks.

• Some users suggested that the current disclosure requirements, supplemented by additional guidance and education, may be adequate to provide better disclosure of climate change-related risks, opportunities and impacts, while others maintained that new disclosure requirements should be imposed.

• Users' views also differed on whether issuers should be required to disclose GHG emissions and/or scenario analyses in their regulatory filings.

• Several of the users we consulted acknowledged that it may be appropriate for new disclosure requirements to apply differently to issuers based on exchange listing, size or industry.

- - - - - - - - - - - - - - - - - - - -

As noted earlier, most of the users consulted considered climate change-related risks to be a conventional business issue, rather than a narrowly focused sustainability or environmental issue. We also found that substantially all users expressed general dissatisfaction with the current state of climate change-related disclosure being provided by issuers, noting that in many cases disclosure is not provided, while in other cases much of the disclosure provided is boilerplate, vague or viewed as incomplete. As a result, users were of the view that these deficiencies negatively impacted their ability to make investment and voting decisions. A number of users also found the climate change-related disclosure provided by issuers lacked clarity and consistency, which limited their ability to compare such disclosure between issuers. As a result, substantially all of the users we consulted were of the view that enhancements to improve the current state of climate change-related disclosure were needed.

We also found that the users consulted were not a homogenous group. Informational needs varied, in some cases, arising out of fiduciary duties or other obligations. For example, some investors employed long-term investment strategies and therefore required disclosure to address such needs, whereas other investors had shorter investment horizons. In other cases, users sought disclosure of GHG emissions based on commitments to measure, disclose and reduce the carbon footprint of their portfolio, whereas others noted that GHG emissions did not factor into their investment decision making. As a result, we found that while substantially all users agreed that improvements to the current state of climate change-related disclosure were needed and had generally agreed upon a number of areas of enhancements, there was also a lack of consensus in other areas, including with respect to the reporting of GHG emissions and scenario analysis.

i) Areas of consideration

Substantially all of the users consulted were of the view that climate change-related disclosure enhancements are needed. Specifically, the users consulted generally agreed that: (i) disclosure of issuers' governance and risk management of climate change-related risks are required; (ii) issuers' directors and officers should seek further education on the nature and extent of climate change-related risks; and (iii) it would be appropriate for any new disclosure requirements to apply differently to issuers of different sizes and in different industries. On the other hand, we also found that users disagreed in other areas, specifically with respect to how disclosure of climate change-related disclosure of risks, opportunities and impacts could be improved, and whether specific mandatory disclosure requirements regarding GHG emissions and scenario analysis should be imposed.

A) Governance and risk oversight

Substantially all of the users consulted agreed that issuers in many industries will be affected by climate change-related risks, and should provide disclosure regarding their governance and oversight of such risks. Many users supported the TCFD Recommendations in this regard, which recommend disclosure on: (i) the board of directors' oversight of climate change-related risks and opportunities; (ii) management's role in assessing and managing climate change-related risks and opportunities; (iii) the process used to identify and assess climate change-related risks; and (iv) how such processes are integrated into the issuer's overall risk management process. As discussed further in section 4.5, these elements of the TCFD Recommendations are not subject to an assessment of materiality.

Based on our Consultations, the primary reasons offered by users for seeking governance and risk oversight disclosure were that:

• issuers need reliable governance and risk oversight processes in order to identify material business risks, including material climate change-related risks,

• many users were not confident that issuers have reliable processes in place to identify and manage climate change-related risks,

• in the absence of this disclosure, many users questioned whether an issuer had made an informed analysis and had correctly concluded that climate change does not pose a material risk to it, or whether the issuer substantially overlooked this risk due to lack of expertise, due diligence or otherwise, and

• some larger institutional investors were hesitant to obtain this information through engagement with issuers, due to the risk of selective disclosure in violation of securities laws.

B) Further education on climate change-related risks

The users consulted strongly emphasized that issuers' directors and officers should understand the risks, opportunities and impacts associated with climate change. Users highlighted the importance of an issuer's board of directors having an appropriate level of expertise in this area in light of the risk that climate change may present to an issuer's business, and suggested that this may not currently be present. We note that, as previously discussed, feedback to the Issuer Survey also suggested that some issuers hold a narrow understanding of the nature and extent of climate change-related risks and impacts, implying that further education in this area may be necessary. As a result, users were of the view that issuers' boards of directors and management should seek to be better informed on climate change and its implications for the issuer's business in order to properly strategize, manage and oversee its associated risks.

Users also noted that further education would assist issuers in all industries in assessing the materiality of climate change-related risks and impacts, which could lead to improvements in their disclosure of such risks and impacts in their regulatory filings.

Regarding educational resources, many users indicated that guidance focused specifically on climate change would be beneficial to issuers across a wide range of industries and their advisors. This could include, for example, a "refresh" of the guidance in SN 51-333, which currently includes guidance on disclosure of environmental matters more broadly. We note that consideration of further guidance specifically focused on climate change is discussed under Part 5 of this notice. Many users also indicated that there are other useful resources that issuers can use to better understand how they may be impacted by climate change.

C) Tailoring reporting requirements

Most users acknowledged that if new mandatory reporting requirements are implemented, it may be appropriate for such requirements to apply differently to various subsets of issuers. Users offered a number of different options in this regard, including whether an issuer is or is not a "venture issuer" (as such term is defined under NI 51-102), the issuer's market capitalization and/or particular industry.

We recognize that Canada has a unique composition of issuers with the vast majority of issuers having a relatively modest market capitalization, as compared with other countries. As such, a focused application of new disclosure requirements to a subset of issuers would need to be best suited to our market. Users suggested that staff should consider, among other things: (i) the type of disclosure required; (ii) the resources of issuers in the subset to provide this disclosure; and (iii) the consistency of the application of requirements from one reporting period to another.

D) New prescriptive requirements vs. enhanced guidance

We also had significant discussions during our Consultations on whether the disclosure on the risks, opportunities and impacts of climate change required new prescriptive requirements or guidance based on existing requirements. Many users indicated that the existing disclosure requirements supplemented by additional guidance would not be sufficient to effect a significant change in the quality of this disclosure. In particular, these users suggested that new regulatory disclosure requirements would be necessary to create any meaningful improvements. Most of the users we consulted noted that environmental matters, including climate change, are increasingly being considered by investors in their investment and voting decisions and as such, specific and clear disclosure requirements are a key means to assisting issuers in providing decision-useful information to their investors.

On the other hand, some users felt that additional guidance on climate change-related reporting would encourage a more robust approach to this disclosure and that prescriptive requirements would lead to increased boilerplate disclosure. Some users were also of the view that imposing prescriptive requirements would not be appropriate at this time, as in their view, an ideal model for climate change-related disclosure has not been established. Rather, these users felt that efforts should be focused on encouraging issuers to improve their climate change-related disclosure practices through guidance, education and other methods of engagement.

As discussed above, many users indicated that one of their key challenges is determining whether an appropriate materiality assessment with respect to climate change-related risks has been conducted by issuers. In this regard, some users suggested that instead of prescriptive disclosure requirements in all cases, a "comply or explain" approach may be appropriate. For example, this would require that issuers either disclose specific climate change-related risks, or explain why climate change does not pose a material risk to their business. We acknowledge, however, that such a requirement would entail a departure from the general approach applied to securities-related disclosure in Canada, whereby issuers are generally not required to disclose information that is not material, and may omit negative answers.

E) GHG reporting and scenario analysis

Another area where users' views differed was whether issuers should be required to disclose GHG emissions and/or scenario analyses in their regulatory filings. In this respect, staff had asked users for their input on these particular disclosure items in light of the TCFD Recommendations. The following summarizes certain users' views with respect to both types of disclosure.

|

GHG Reporting |

||||

|

|

||||

|

Users' view for reporting |

Users' view against reporting |

|||

|

|

||||

|

|

• |

Quantitative data inherently avoids boilerplate disclosure. |

• |

Costly to conduct. |

|

|

• |

Provides a baseline, that over time, will identify broad trends, which is decision useful information. |

• |

Collecting GHG emissions data takes away resources that are better spent elsewhere. |

|

|

• |

Climate change-related risks associated with changes in regulations, the physical environment and technological developments have the potential to impact investment returns, resulting in some users making investment decisions based on the GHG efficiency of issuers. |

• |

Usefulness of such information is still unclear. |

|

|

• |

Particularly relevant for high-emitting issuers/industries, as regulatory costs associated with GHG emissions will become more material over time. |

• |

Not a financial risk metric for some users. |

|

|

• |

Requirement for some users to disclose total portfolio footprint. |

• |

Regulatory costs associated with GHG emissions are not material at this time. |

|

|

• |

GHG Protocol provides an established and widely accepted methodology to allow for aggregation and comparability. |

• |

Emissions data is a snapshot at a certain point of time; as such its usefulness is uncertain. |

|

|

|

|

• |

Data may be unreliable as information is generally not verified. |

|

|

|

|

• |

Scope 3 emissions, which are the most difficult to calculate and aggregate with certainty, account for a majority of all emissions. |

|

Scenario Analysis |

|||

|

|

|||

|

Users' view for reporting |

Users' view against reporting |

||

|

|

|||

|

• |

Useful across multiple sectors, especially for disclosing an issuer's strategy and its resiliency in a changing environment. |

• |

Difficult to conduct -- lack of experience by issuers and requires long term analysis. |

|

• |

Useful tool to assist issuers in identifying their material climate change-related risks. |

• |

Requires a significant number of assumptions and factors, and as such could allow issuers to present favourable outcomes, resulting in this disclosure being used for promotional purposes. |

|

• |

While difficult, development of standardized and relevant assumptions is possible, for example by industry organizations. |

• |

Generation of scenario analysis requires the application of assumptions and key factors that if undisclosed, could impact usefulness and reliability of analysis. On the other hand, disclosure of assumptions and key factors may divulge commercially sensitive information. |

|

|

|

• |

Standardized set of assumptions are required for comparability, however this inhibits incorporation of additional factors that may provide more insight into an issuer's business. |

- - - - - - - - - - - - - - - - - - - -

Key Points

• While some, principally larger, issuers are receiving requests from users for climate change-related information, a number of issuers are not being asked to provide this information at all.

• Issuers suggested it was more appropriate to report non-material climate change-related disclosure on a voluntary basis rather than in regulatory filings, and expressed concern that mandatory reporting could result in a disproportionate and potentially misleading emphasis on climate change-related risks relative to other equally or more significant risks.

• There is no consensus amongst issuers as to whether there should be a single prescribed framework for climate change-related disclosure. Many issuers are of the view that a single framework for climate change-related disclosure is inadequate to accommodate the specific circumstances of all industries and issuers, and that a "one size fits all" approach in this area will not meet the needs of issuers or investors. Several issuers expressed concerns that even if a single framework was mandated, requests by users for diverse, specific and non-material information in relation to climate change would continue.

• Many issuers identified their concerns about mandatory disclosure requirements in relation to climate change, including:

• potential increases in the cost of compliance and regulatory burden for issuers which are disproportionate to the benefits realized by investors,

• concerns that some of the demand for this information is driven by considerations other than investment considerations, such as mass divestment movements, and that the objectives of some users of this information may not be aligned with the interests of shareholders, and

• limitations of current frameworks and measurement standards which are not yet fully developed.

- - - - - - - - - - - - - - - - - - - -

i) Issuers have a range of perspectives on climate change-related disclosure

A) Demand for climate change-information is not consistent from issuer to issuer

It is clear that the current level of demand for climate change-related disclosure varies dramatically among issuers, often depending on the size of the issuer and the composition of its investor community. Generally speaking, the largest issuers in carbon-intensive business sectors are under significant pressure from investors and others to provide meaningful disclosure in relation to climate change-related risks and the associated financial impacts.

While some smaller issuers are also being asked to disclose this information, a substantial number of issuers in our Consultations reported little or no demand on the part of users for this information at the present time. This was consistent with the Issuer Survey responses, where 49% of issuers indicated no demand, and 31% indicated low demand (16% moderate, 0% significant, and 4% responded they "don't know"). In some cases, issuers noted during our Consultations that the perceived lack of demand may be due to the fact that they already provide climate change-related disclosure in their voluntary filings. Some issuers speculated that the limited demand for climate change-related information might be attributable to characteristics of their investor community, such as a limited number of institutional investors, or a large number of investors principally focused on short-term results.

B) Issuers favour flexibility, as opposed to prescriptive requirements

Few issuers consulted expressed enthusiasm for the prospect of additional mandatory disclosure requirements in relation to climate change-related risks and financial impacts. However, some issuers identified potential benefits of a single disclosure regime, whether voluntary, mandatory or some combination of the two, including greater certainty with respect to the disclosures required, a "level playing field" for all issuers from a disclosure standpoint, and increased rigour in the preparation and verification of disclosure presented in mandatory filings.

Many issuers acknowledged that inconsistency in climate change-related disclosures, and the inability to perform direct comparisons on common disclosures and metrics, is an issue. These issuers suggested that providing further guidance (pointing to established voluntary frameworks, commonly used standards, etc.) for those issuers that choose to voluntarily disclose additional climate change-related information would likely be helpful. Some issuers indicated that the disclosure in CD filings tends to converge among peers, which has resulted in boilerplate disclosure over time, and that voluntary disclosure tends to be less susceptible to this trend.

Issuers indicated a strong preference for the current disclosure requirements, where information determined to be material for purposes of securities laws in Canada must be disclosed in CD filings, while additional non-material information may generally be disclosed on a voluntary basis. Many of the issuers consulted expressed interest in updated guidance from the CSA with respect to disclosure in relation to climate change-related risks and financial impacts.

A number of issuers noted that the flexibility permitted in voluntary disclosure enables them to provide readers with additional information that might not typically be included in a CD document. These issuers emphasized that context is required to make the information requested understandable. For example, year-over-year changes in GHG emissions could have a number of causes, such as changes in production, improved emissions strategies or shifts in assets. Under those circumstances, metrics taken out of context could be misleading and/or lead to inappropriate investment decisions.

In addition, several issuers and other stakeholders indicated that full comparability between the disclosure of different issuers in different industries may be difficult to achieve, even with prescribed disclosures, since some variability in the underlying data and assumptions is inevitable. Emissions metrics are prepared for different purposes and often using various methodologies.{6} Further, a multitude of differing factors and assumptions are built into emissions calculation methodologies. Comparability, even within industries, may not be appropriate; for example, within the oil and gas industry, issuers have differing projects, outputs and reserves, each with varying timelines.

Other issuers indicated that they have been able to obtain a level of independent assurance over their reported GHG emissions. While this assurance does not necessarily validate the emission numbers, it highlights areas where emissions calculations are inconsistent (for example across the organization), thereby driving the issuer to work towards consistency in their calculations. One concern raised in relation to a requirement to provide assurance in respect of GHG emissions reports in CD filings is that it would be difficult to coordinate the preparation of such reports and assurance within the timelines imposed by securities filing deadlines.

Based on our consultations, some issuers were concerned that even if securities regulators recommended or imposed a single standard of measurement (for GHG emissions disclosures), issuers would still be required to report the same information, using other standards, to satisfy reporting requirements of other regulatory bodies depending on the scope and location of their operations (such as Environment Canada, provincial environmental regulators and the U.S. Environmental Protection Agency).

C) Some issuers questioned the materiality of climate change-related risks and financial impacts

Several issuers expressed doubts regarding the materiality of climate change-related risks and financial impacts to their businesses. A number of issuers advised us that they had considered climate change-related risks and financial impacts, and determined that while some of these impacts, such as the impact of carbon taxes and other carbon pricing schemes, were both known and quantifiable, they were simply not considered to be material to the issuer or its investors based on the standard of materiality prescribed by securities laws in Canada.

In a few instances, issuers indicated that they do not disclose climate change-related information because they are not significant emitters of GHG or otherwise contributing to the underlying causes of man-made climate change. This suggests an incomplete understanding on the part of some issuers and other stakeholders of the implications of climate change-related risks and financial impacts, which may affect issuers' businesses irrespective of the carbon intensity of their own operations. For example, retailers and service providers in communities which are heavily reliant on carbon intensive industries for employment may be significantly impacted by the gradual transition towards a lower carbon economy, even though their own operations do not produce significant emissions. In addition, issuers may be impacted by the physical effects of climate change, based simply on their geographic location, rather than their GHG emissions levels.

D) Undue emphasis on climate change may detract from other environmental risks and impacts

Several issuers we consulted advised us that they have established risk management processes that consider risks and impacts of climate change along with a wide range of other environmental risks and that the preparation of disclosure providing investors with insight into these processes would not be burdensome. Some of these issuers noted that the widespread public attention being paid to climate change may over-emphasize the risks and impacts of climate change as compared with other risks (environmental or otherwise), which may be more material to an issuer's business from a financial standpoint. These issuers also questioned whether an approach to disclosure that singled out climate change-related risks and impacts for disclosure, among many other environmental risks and impacts, could be reconciled with the general requirement under securities laws in Canada that risks be presented in order of their seriousness to the issuer, from the most serious to the least serious.

E) Issuers have concerns about the motivations underlying some stakeholder demands

Our Consultations revealed increasing issuer frustration with some of the demands of stakeholders for information on climate change-related topics. While some of the larger users seek information related to issuers' risk management and the resilience of their business strategy to the effects of climate change, a number of issuers reported that the climate change-related information they were being asked to provide was frequently "granular" in nature, and that in many cases, only a small fraction of the information requested was actually decision useful for investors in relation to investment and voting decisions. In other cases, results from our Consultations indicated that the issuer would like to better understand what climate change-related information investors are seeking and how it is used in their investment-decision making process.

Several issuers indicated that their responsiveness to demands for disclosure depended on their perception of the use to which the disclosure would be put (and its resulting value to the issuer and its investors). These issuers advised us that while they are very willing to accommodate requests for information from investors or analysts, they are less willing to expend resources on inquiries from stakeholders who appear to be pursuing an agenda that diverges from that of a reasonable investor focused on a financial return on investment. There is some concern among issuers that the motivations underlying some of these requests is not aligned with the interests of investors, and that the additional disclosure being requested will be used in litigation, resulting in negative impacts on the reputations of issuers or in furtherance of mass divestment campaigns directed at carbon-intensive industries.

ii) Challenges of providing climate change-related disclosure

A) Additional costs and regulatory burden of mandatory climate change-related disclosure

A number of issuers we consulted expressed an interest in additional regulatory guidance or educational opportunities with respect to climate change-related risks and financial impacts and expressed concerns about the potential costs and new regulatory burdens that would accompany new rules prescribing mandatory disclosure of climate change-related information. A number of larger issuers that currently produce sustainability reports on a voluntary basis noted the significant cost and personnel committed to their preparation, and suggested that a comparable commitment would represent a very significant new burden for many smaller issuers. Some issuers noted that the imposition of extensive mandatory climate change-related disclosures could result in a cost structure that would be impossible for some smaller issuers to sustain.

Specifically, with respect to disclosing metrics such as GHG emissions, issuers indicated that in their view there is currently a lack of consistency in their calculation, complexities inherent in their preparation and the potential need for outside assurance expertise. Issuers viewed these as factors that could significantly increase regulatory burden. As a result, several issuers doubted whether the benefits of providing this disclosure justified the costs of obtaining it.

Several issuers suggested that the imposition of new disclosure obligations would discourage issuers from entering, or continuing to participate in, the Canadian public markets. They noted that this may also lead to a decrease in the competitiveness of Canadian issuers compared to peers in jurisdictions without comparable mandatory requirements.

B) Continually shifting and uncertain regulatory landscape

Several issuers in carbon-intensive industries stated that, in their view, the current regulatory landscape in Canada with respect to GHG emissions is unsettled. Further, climate change more generally represents a significant challenge to issuers seeking to identify and disclose material climate change-related risks and financial impacts. We acknowledge the challenge presented by this issue. We note however, that issuers are frequently confronted by a complex array of uncertainties that they must take into account when formulating their business strategies and disclosing risk factors and other information.

C) Forward-looking information

Some of the issuers we consulted indicated that the additional climate change-related disclosures that are being requested (and recommended in certain voluntary frameworks) consist of forward-looking information (FLI). Further, some issuers noted that in some cases this FLI is of a nature and extent which would be difficult to accommodate under existing securities laws in Canada.